Leaner times for the fat cats

Shareholders have been exercising new powers to tell company bosses

what they think of their pay and pensions. No-one minds top executives getting

well paid for success. And they are - the annual pay and bonuses of a typical

Chief Executives in one of Britain’s biggest 100 companies passed the £1.5

million mark in 2002, That figures is up 10% compared with the 4% increase in

the state pension and wages. But people do object when pay seems unrelated to

performance – or indeed when company bosses fail in their job but still get

massive pay offs.

Now these concerns have got serious with a new law giving shareholders the right to vote on pay deals which came in this year. The protests have been led by the National Association of Pension Funds under its new Chief Executive Christine Farnish. The members of the NAPF are almost all the large pension schemes in the UK and they can exercise real power.

|

"We own more than 20% of UK shares – with the members of the Association of British Insurers it is more than half and if the US shareholders join us it is even more. We are not capricious, but it is important that shareholders express their views because they put up the capital on which the businesses depend. So our views are ignored at their peril. I don’t think they’re ignoring us any more!" |

Many companies have been shocked by the size of the vote against the pay deals – typically between a fifth and a third of shareholders. But in one celebrated case the objectors achieved a narrow majority, with 50.72% of shareholders voting against the estimated £22 million pay package of Jean-Pierre Garnier, Chief Executive of the drug company GlaxoSmithKline. Stuart Bell is Research Director at Pensions Investment Research Consultants which advises shareholders on corporate governance. "Five years ago all votes were carried by 99%. Now the effects of Glaxo are reverberating round boardrooms all over the country and we do expect to see major changes by the end of this year."

Although these votes are advisory and companies can ignore them, within a fortnight Glaxo company got rid of two of its Board members who had helped draw up the controversial deal – who themselves were paid a total of £189,000 in 2002 – and brought in consultants to review directors’ pay.

Christine Farnish is in no doubt of the effect.

"Glaxo was a watershed - the first time shareholders actually did vote down a resolution. It is a very clear signal and it will happen again if companies do not take notice. Companies are listening a lot more now they see the effect on their image of the headlines about these votes. We will see a big difference next year."

But can individual shareholders really make a difference when the big investors – like the NAPF – dominate the votes? After all there are nearly four billion GSK shares and each brings with it a vote. Stuart Bell says it is "The vote at Glaxo was won by a fraction of one percent. Who knows what difference a few hundred individual investors made to that?" That view is supported by Toby Keynes, National Secretary of the UK Shareholders’ Association, agrees "Private shareholders could be the ones who just tip a close vote. Apart from that we play an important role at AGMs where we can kick up a stink and directors have to confront people who express their concerns forcefully."

Shareholder power still has to be fought for. Nowadays, individuals are encouraged to buy shares through what is called a nominee account – although they still own the shares, they get no voting rights and cannot attend the AGM. Toby Keynes says that saves the company and the brokers money but should be resisted "It is disenfranchising private shareholders. Your vote needs to be exercised even if you lose. It is a democratic process and one of the benefits of ownership."

INDEX OF THE MONTH

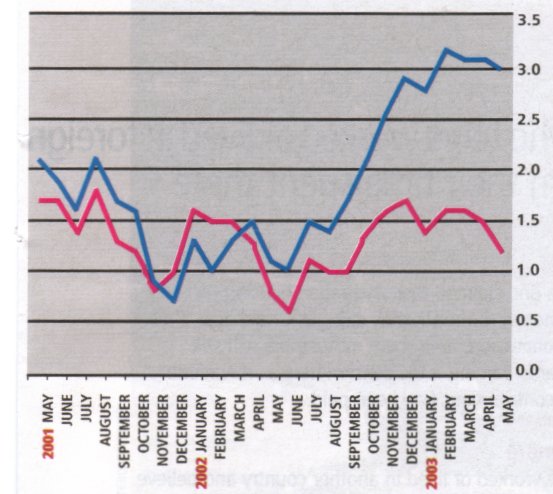

The Chancellor has halved the rate of inflation. He has decided that the

Bank of England will use a different measure of price rises when it sets

interest rates. Instead of the familiar Retail Prices Index – which has been

around since 1947 – it will use the Harmonised Index of Consumer Prices, common

in Europe and other countries. In May the HICP shows inflation was just 1.2% -

less than half the 3% rise in the RPI. Gordon Brown assured Parliament that

pensions and benefits as well as index-linked savings would all continue to rise

with the RPI. But there must a danger long term that they will be linked to the

HICP instead which has been lower in 20 of the last 24 months. The two indices

are different because the HICP excludes housing costs, puts the things we buy in

different categories, and crunches the numbers with a different formula.

STATUS SYMBOLS

What colour is your plastic? Forget gold or even platinum. If you

seriously want to impress then your card has to be black. The most expensive

card in the UK is American Express Centurion. This black plastic costs you £650

a year – and, as a charge card, you have to pay off the balance in full each

month. For the fee you get loads of free insurance and what Amex calls a

‘concierge service’ – basically a slave at the end of the phone who will arrange

anything for you from tickets to the cup final to a signed copy of the latest

Harry Potter book. But there is no point in rushing off to apply – Centurion is

by invitation only and there is a waiting list.

|

Meanwhile you could apply for the NatWest Black Mastercard – if your income is at least £70,000 a year. The first black credit card in the UK, NatWest Black costs £250 a year and offers free travel insurance and breakdown cover as well as entry to 300 airport lounges around the world. If you want a translator after a traffic accident or you lose your passport and wallet – relax, the personal assistant service will lend you €2000 and sort out all the boring paperwork. |

ALTERNATIVES

Although shares have bounced back a bit recently, many people still want

to look for an alternative investment for at least some of their money. If art

baffles you and wine is just too tempting, why not try autographs of the famous?

The price of celebrity signatures, especially on a photograph, has been growing

strongly. Fraser’s Autographs, a division of the world famous stamp dealer

Stanley Gibbons, says the value of the 100 most sought after autographs grew by

an average 19% a year from 1997 to 2002. For example, a signed photograph of

Paul McCartney was £125 in 1997, now it is £775. A signature of Oscar Wilde was

£850, now it would cost you £3000. A photograph signed by Elizabeth Taylor has

risen in value from £185 to £775 while one of Winston Churchill has moved from

£2500 to £4950. [Illus here provided by Fraser’s – ask me for contact]. Fraser’s

publish six sale catalogues and six postal auction catalogues each month and you

can often pick up autographs at local auctions or sales. Manager Kerry Watson

says you can also spot tomorrow’s starts and get their autographs free now.

"Finding the right person is important and undedicated signatures are worth more

than ones written specifically to you. We recently did a roadshow in Rochester

and got several Audrey Hepburn signatures – we sell those at £400 each now."

CHECK LIST

If you use a credit card to borrow money, remember that there are more than 30 cards that offer zero per cent to new customers. Why not take one out, transfer what you owe, and pay it off over six months with no interest to pay?

How much do you get on your current account? The main High Street banks pay a miserly 0.1%. But you can get 3.3 % with cahoot 3.3% or 3% with smile. Both are internet accounts. It is easy to switch– all your standing orders and direct debits will be moved free and it usually takes around 2-3 weeks.

Questions about tax? Why not call TaxAid a charity offering tax advice for people who can’t afford an accountant. Call 020 7803 4959 between 10am and 12 midday, Mondays to Thursdays. Or check out their website www.taxaid.org

BLINK AND YOU’LL MISS IT

Some deals are so good that they have to be gone for at once – or not at

all. And here is one from the Government – so you know it’s safe! National

Savings & Investments is offering a chance to share in the growth in the

stockmarket without risking your capital. The details of its sixth issue of its

Guaranteed Equity Bond are expected in August and you will then have around six

weeks to invest your money. The details are not yet public but the last issue,

which closed in June, offered a five year investment. At the end

If the stock market has fallen, you will get all your capital back in full

If the stock market has risen, you get the full growth in the index of our top 100 companies (FTSE 100) over the five years up to a maximum of 65% - equivalent to 10.53% per year.

Three things to note – you will need a minimum amount, probably around £2000 to invest. The interest is taxable. And you cannot get your money out until the end of the five years.

You can register now to be told as soon as the next issue is launched. Call 0845 964 5000. Blink – and you’ll miss it!

August 2003