This talk was given 22 November 2012

The text here may not be identical to the spoken text

STEP Thames Valley AGM 22 November 2012

ADVICE, MIS-ADVICE AND ADVISERS

Among other things I present Money Box on Radio 4. I also do regular slots on

BBC Breakfast and pop up in other places. I also write for Saga Magazine. And

the Oldie. A lot of the things I write about are very relevant to your work –

planning estates and setting up trusts.

Just to be a bit formal – I know you're lawyers and financial advisers – I have

to make my own disclosure notice – I am not here representing any of my clients

– Money Box, Breakfast, Saga, AgeUK, Reader’s Digest, the Oldie, or, God forbid,

the BBC. I am here as a freelance financial journalist. And thus personally

responsible for any nonsense I come out with.

Today I will talk about

ADVICE, MIS-ADVICE AND ADVISERS

ADVICE

There is a desperate hunger and a great need for financial advice among a large

proportion of the population.

Let

me give you a sample of the emails and tweets I get – taking out the ones that

follow up on a broadcast or twitter campaign I’ve been doing.

Here is a list of ten common financial topics I get asked about.

1.

Income tax

2.

Benefits

3.

National Insurance

4.

State pension

5.

Credit cards

6.

Current accounts

7.

Foreign currency

8.

Inheritance Tax

9.

Care home fees

10.

Fuel bills

Let

me be more specific with ten common questions I am asked.

1.

Income tax – is my tax code wrong?

2.

Benefits – what is happening to my incapacity benefit?

3.

National Insurance – I am 60 - do I need to pay it on my earnings?

4.

State pension – how much will my SERPS rise in April?

5.

Credit cards – how do I cancel a regular payment I agreed to?

6.

Current accounts – which is the cheapest bank for an overdraft

7.

Foreign currency – where will I get the best rate for euros?

8.

Inheritance Tax – What allowance will my heirs get?

9.

Care home fees – does my daughter have to help with the cost?

10.

Fuel bills – how can I reduce the cost?

Those are all financial questions that need advice. Who is a financial adviser

by profession here?

Now. Keep your hands up if you can answer two of those questions? Five? All of

them?

And

that is without mentioning debt, or budgeting, or student loans, or tax credits,

or cash savings, fraud, compensation…I could go on.

Can

any financial adviser here answer them with confidence? Or even tell people

where to go to get the answers? So in what sense are you financial advisers if

you can’t give advice on basic questions about financial matters?

All

the information given to customers when financial products are sold has to be

fair, clear and not misleading. In that way the term ‘financial adviser’ itself

fails the test of being fair, clear and not misleading.

Now

if I had put this up

1.

Pensions

2.

Investment

and

probably

3.

Insurance

4.

Mortgages

the

financial advisers’ hands would have stayed up. And what do these four areas all

have in common? At the moment they all earn you commission. So it is not

financial advice you give. But advice on pensions, investment, mortgages, and

insurance – perfectly understandable because that’s how earn your living. And in

the past most financial advisers earned a living through commission.

For

the last ten years I have been giving talks like this saying that commission was

the cancer at the heart of the financial services industry. I did discover that

was a bit of a false claim as the heart is the one organ in the human body that

is just about immune from cancer. But you get my drift. And over the years that

view has moved from being completely dismissed and derided – I’ve been jeered,

shouted at, abused, buttonholed, people have even walked out – but now they are

mainstream as the FSA has slowly come round to my view on this as on many other

things – such as regulating products not processes.

And

commission is wrong because when I sit opposite someone who is recommending me

to invest my money in a product I don’t really understand and which will cost me

money every year regardless of whether it does what it should do or not, I want

to know why is that person recommending that to me? Is it because it is best for

me? Or best for them?

And

that conflict of interest lies at the heart of the problems of the financial

services industry. A conflict of interest does not mean someone deliberately

sells a rubbish product just to earn the commission. Undoubtedly some have. But

most don’t.

My

uncle was an IFA and he is the kindest, fairest, and, if it matters, most

Christian man you could imagine. I don’t believe for one moment he sold me an

endowment mortgage just because of the commission he earned on it. He genuinely

believed it was a good idea. He had been told so by those clever people at

Standard Life who manufactured it and surely knew what they were talking about.

They had actuaries and everything. So it was win/win – by selling me the right

thing, he earned money.

The

insurers who made that crazy product promoted it through high rates of

commission because it was so profitable. It matched two incompatible things. The

mortgage was interest only – so the capital was not paid off. Parallel with that

was sold an investment – the endowment – and that was supposed to produce a

return big enough to pay off the mortgage and give a bit extra on top. And it

cost no more. Magic.

The

fact is endowment mortgages were always a mis-match – an uncertain investment to

meet a fixed and certain debt. And a debt which, if you did not repay it, could

leave you homeless. That was ignored. Not by good honest salesmen like my uncle.

But by the people who devised it and sold the idea to him and gave him a cash

incentive to sell it.

Mortgage endowments sold from the 1980s right up to the late 1990s left up to

five million people up to £40 billion short of the money they need to repay

their mortgage. Nearly £3 billion of compensation has been paid.

We’ll come back to mis-selling later.

But

let’s look now at advice on the important things – debt, benefits, tax,

budgeting, banking – where do people get that advice?

Apart from emailing or tweeting me of course.

You

may remember the Thoresen Review of generic Financial Advice which reported in

March 2008 and recommended a national scheme of what it wanted to call Money

Guidance. But which eventually became the Money Advice Service.

The

Money Advice Service is generally hated by financial advisers because they like

to have a monopoly on the word ‘advice’. In fact the only term that is legally

controlled is independent. Anyone can cal themselves a financial adviser – of

course if they sell regulated products then they have to follow FSA rules. But

if they only sell unregulated products they don’t.

But

the problem with the Money Advice Service – and I was one who was very happy

with its name – is that it doesn’t give advice. It has some online tools – as it

calls them – and useful comparison tables which it inherited from the FSA. And

it is taking over debt advice which it has contracted out to private and highly

profitable firm A4e in England and Wales rather than the CAB which will do it in

Scotland and NI.

But

generally what the Money Advice Service gives is not advice – it is information.

Perhaps Money Guidance wasn’t such a bad name after all – but advice – never.

When people ask for advice they don’t want information or facts they want

someone to hold their hand, take them through the options and say that is what I

would do.

Despite its budget – which is seen as large but at around £40 million is in fact

less than £1 a year for every adult – so perhaps I should say because of its

budget the MAS has not made much of an impact on most people. But I don’t want

to talk about the MAS here or its £20m PR budget or the fact its chief executive

was forced to resign in July because he was paid twice as much as the Prime

Minister and ran an organisation smaller than – at this point I was going to

name a very small country. But when I looked at Vatican City, Monaco, San

Marino, Liechtenstein they actually are wealthy countries. But the smallest in

money terms are even smaller than the MAS. Tuvalu, Montserrat and Nauru are

bottom of the list and have GDPs less than the turnover of the MAS – Nauru’s is

about the same as the annual income of MAS. If MAS was a country it would be

fourth from bottom of the UN list of nations. And with resignations and scandals

and allegations of mishandling money – not that different really.

My

interest in MAS is what constitutes advice. Advice is telling people what they

should do. That’s what they want from me. More examples

·

Ebay has closed my account what can I do

·

I

was missold PPI in 1997 but my claim has been refused

·

I

am getting cold calls about claiming PPI how can I stop them

·

My

mentally ill son has been lent £15,700 by NatWest – his income is £12,000, can

NatWest be held liable for the debt?

·

My

son is being pursued by CapQuest debt collection agency for a debt he does not

have with a company he has never dealt with…

·

I

run a charity and have £8000 to save what accounts are available

·

My

mother is 91 and went into hospital with a bladder infection she was taken into

a care home, will she have to sell her house?

·

I

am an elderly widow and my financial affairs are dealt with by an advisor

connected to a well know fund management company, is this a good idea?

·

I

am being fined by HMRC even though I owe no tax is that right?

·

I

have a guaranteed annuity, some are telling me to shop around what should I do?

·

How

do I stop PPI cold calls and texts?

·

Can

the state pension be paid to me if I move to Macedonia

Three days’ questions. So don’t tell me that people do not need advice. They do.

Yes, they need information. But not the sort that MAS gives. And at the end of

that information they need to have the question answered – what

can I do, what

should I do?

And

now the question is – why? Why do they need that advice?

People need advice because of the financial services industry. Not because it

omits to give them advice – though it clearly does on many important topics –

but because the industry itself engages in a deliberate process that 15 years

ago I called ‘complexification’. Meaningless and unintelligible jargon, rules

expressed in a language which at best is closely related to English, and obscure

rules buried in the Terms & Conditions at para 94 brackets 2 square brackets c

roman iv blobby point five which begins ‘notwithstanding’.

MISADVICE

Let’s look at misadvice. And where it began. Today’s industry has been around

for only 25 years or so.

A

quarter of a century ago the past was indeed a foreign country.

Some of you may not remember that Nigella’s Dad was then in charge of the

economy. Nigel Lawson, Chancellor of the Exchequer. Margaret Thatcher was Prime

Minister. And Norman Fowler, now Lord Fowler of Sutton Coldfield, was S of S for

Pensions.

And

in this foreign land called ‘the mid 1980s’ there were no personal pensions. And

there was no financial services industry as we understand it there was the man

from the Pru and there were stockbrokers, and that was about it.

The

Thatcher Government came up with the idea that we should cast off the chains of

Government dependency. Official adverts showed a chained man setting himself

free. And the first thing he did, as you would after a long time in chains, he

bought himself a pension. One of the new personal pensions.

And for those who took responsibility

for themselves there was, without any irony, a useful taxpayer subsidy. Around

8% of your pay.

But

Margaret Thatcher made an even more important change. Before 6 April 1988 if

there was a pension scheme at your job you had to join it – no choice. Margaret

Thatcher ended that. Three weeks later (28 April) the first personal pensions

went on sale.

That was the moment when the financial services industry could have grown and

developed into a popular, useful, worthwhile, and much loved business. Instead

it sent teams of poorly trained, commission driven sales staff to descend on a

hapless population who believed the adverts and newspaper stories which said

that for a few pounds a month everyone could buy political AND financial

independence.

Altogether the industry systematically mis-sold the new personal pensions to

millions of people keen to embrace the new world of freedom from the state and

personal responsibility. They were persuaded to leave good company schemes and

put their money at risk in personal pension plans. More than a decade later the

industry admitted its mistake and forked out £11.5bn in compensation plus

another £2bn to find and deliver the money to the two million people known to

have been mis-sold.

There were all sorts of things that contributed to that systematic mis-selling –

Government adverts, political interference, phrases like ‘personal

responsibility’, and articles by compliant newspaper columnists with little

understanding of risk or indeed of pensions– but the fuel which drove it to the

heights it achieved was commission.

It

is commission – not solutions to financial problems – which has driven the

growth in the financial services industry.

And

it is commission which led to every one of the mis-selling scandals of the last

25 years. Here are a few of them. Billions lost by millions.

◙

Personal pensions mis-sold to two

million people at a cost of £11.5bn in compensation and £2bn to administer the

scheme.

◙

Mortgage endowments sold from the

1980s right up to the late 1990s will leave three million people up to £40

billion short of the money they need to repay their mortgage. Only £3 billion of

compensation has been paid.

◙

Additional Voluntary Contributions –

between 1988 and 1994 at least 100,000 customers were sold the wrong sort of

AVCs to top up their company pension. More than £250 million in compensation has

been paid.

◙

Split capital investment trusts were

sold as safe investments mainly from 1998 to 2002. Up to 50,000 individuals have

lost at least £600 million. Compensation of £350 million was sought by the

regulator. The industry finally coughed up £144 million – on condition it

admitted nothing and got indemnity from further action.

◙

Precipice bonds were sold between 1997

and 2004 to 450,000 mainly older customers who wanted safety and a good return.

They put in £7.4 billion and may have lost more than £2 billion.

And

those are just five big ones. There were many others as pensions were unlocked

but the door led to poverty, people were encouraged to contract out of SERPS

only to find that it was their pension which had contracted.

No

lawful industry has been rocked by such a succession of scandals as financial

services.

One

of the key items that is not explained to people is risk.

Poor assessment of risk is endemic in financial services. In January 2011 the

FSA produced a report. It examined files across the financial services industry

between March 2008 and September 2010 – two and a half years. The advisers did

not do well. It assessed that half those files showed unsuitable advice was

given because the investment selection failed to meet the risk a customer was

willing and able to take.

Risk means you can lose your money. But many advisers don’t explain that

clearly.

And

for most people with modest amounts of money especially when they are saving it

over a short period cash savings are the place for their money. But financial

advisers not very good at recommending cash options – indeed when it comes to

pensions they often say you cant have a cash option. You can.

Now

I have been critical of independent financial advisers so let’s redress the

balance a bit and talk about the other category of person who is still allowed

to be called a financial adviser – but is not.

I

mean the people who work in banks. Technical they are what are currently called

‘tied agents’. In other words although they sell financial products they can

only sell you stuff from one or a few providers – normally their own bank or an

insurance company they have a deal with. For example Barclays used to be tied to

Aviva for investment products. So its advisers could only sell those products.

They cannot possibly give you good advice. They can only sell you products from

one provider out of hundreds. The best advice for most products will be – don’t

buy from me go down the road and buy from another company that offers a better

deal. But they not only do not do that they are not allowed to do that.

And

here’s what happens.

Barclays is one of our biggest banks, and one that more than a million people

trust to give them investment or pensions advice. In January 2011 the Financial

Services Authority fined Barclays Bank £7.7 million for mis-selling two funds

called ‘cautious’ and ‘balanced’ which were anything but. It sold them for more

than two years to more than 12,000 people who invested nearly £700mn. The FSA

found that Barclays failed:-

The

bank didn’t ensure the investment was suitable. Didn’t train its staff. And gave

out misleading sales brochures.

And

this mis-selling to more than 8,000 people was not just down to

over-enthusiastic sales people. Barclays put out training material that was

simply misleading to them as well.

People who thought they were being sold a cautious investment saw it fall 30%,

those with a balanced investment lost 50%. Many – afraid of what they saw – sold

at just the wrong time.

Why

did Barclays sell this fund? Because Aviva paid it 4.5% of the money invested

and then 1% a year thereafter – and where did that money come from? The

investors!

Within a fortnight of the bank being fined £7.7mn it decided to stop selling

investment advice in its branches.

it

now seems likely that no high street banks will be selling investments and they

have all begun to rejig their pay structures so that staff are rewarded for

customer service not for selling stuff.

And

that brings us to two major mis-selling scandals of the present. Both of which

have the banks’ fingerprints all over them.

Payment protection insurance.

Now I have stood

on platforms like this for some years saying that PPI was a waste of money and

was widely mis-sold. And as time has passed the response has changed from boos

to murmurs to silence to the rustling of paper to, now, sage nods. Oh yes it was

widely mis-sold and do you know we are making every effort to repay it.

Forgetting to mention that it was only two years ago that the major banks put

all claims on hold pending the court case which they hoped to win. Only when

they lost did they suddenly realise what the law said and what they had to do.

In

the last few weeks High Street banks and others have set aside billions of

pounds more to pay compensation for Payment Protection Insurance PPI mis-selling.

The total is now well over £12.5 billion – far more than the original £8 billion

predicted a year or so ago. At this rate it may overtake pensions mis-selling.

And this time it is the banks that are in the frame.

Individual amounts are significant. I had an email from a grateful listener who

had followed my advice to claim yourself without any claims management company

and he got almost £8000 from PPI on a Barclays loan he took out in 2005. The

average is thought to be around £2600 and these billions of pounds paid out to

far more than 2 million people this year. It really is the High Street bank

version of quantitative easing. Pumping new money into the economy.

The

FSA says that of the total set aside £7 billion has already been paid out.

Research by ING found that £1.4bn of that will be spent on the High Street.

Another £2.4 billion will go into savings accounts. And nearly £3 billion will

be used to pay down debt. Which will also release spending power. £500 million a

month this year going into the real economy.

I

tweet a lot nowadays @paullewismoney it’s a personal account, not a BBC account,

not ‘complied’ as they call it, so I say what I want within the bounds of libel

and usually commonsense. It has more than 43,000 followers.

I

do tweet often about mis-selling. And I get a surprising number of people who

tweet back saying ‘what is this mis-selling? Is it just you media protecting the

banks? Surely mis-selling is just a polite word for fraud?’

Fraud is committed if I lie to you and as a result you give me money.

But

the law goes a bit broader.

First – it is not only lying that is at the heart of fraud. Anything said which

the person saying it knows to be untrue or misleading which causes the person

who hears it suffer a loss or a risk of loss, is fraud.

Fraud is also committed by failing to disclose information which you have a

legal duty to disclose, and that causes you to profit or the other person to

make a loss.

And

there is also fraud by abuse of position. If you are in a position where you are

expected to safeguard or not to act against the financial interests of another

person and you abuse it by acting or failing to act and you gain or the other

loses.

That was from the Fraud Act 2006 and I recommend sections 2, 3, and 4 to you for

your bedtime reading. It’s one of the shorter simpler Acts of Parliament.

And

was this systematic mis-selling of insurance in fact fraud? Giving information

known to be untrue or misleading, omitting information that there is a legal

duty to disclose, being in a position where you should safeguard another’s

financial interests and failing to do so – any of those to make a profit is

fraud.

The

more I look into it the more I tend to agree with those tweeps. It goes beyond

mis-selling. There is a respectable legal argument that it was fraud. And on an

industrial scale.

And

just this week the banks were implicated in another insurance mis-selling

scandal. CPP is a firm that sells – or sold – What it called card protection

plans which were supposed to pay out if you had money stolen from your account –

but of course if you do the banks pay out in almost all circumstances so the

insurance was generally useless. The FSA revealed CPP charged around £35 a year

for it but the product cost it just 60p. The other was ID theft insurance. It

was more expensive at £84 a year but it cost CPP just £16. Both products were

mis-sold by sales staff who, to put it bluntly, lied. They used false

statistics, made misleading claims, exaggerated the value of the insurance –

which as I said would almost never pay out – and they gave advice after they had

been banned from doing so. Their contracts also contained unfair terms.

And

a week ago the FSA announced that it was fining CPP £10.5m and expected it to

pay £14.5m in compensation. That was seven years after it began investigating.

While those investigations were proceeding CPP sold more than £840m of new and

renewed business – 23 million new or renewed policies – to millions of people

between 2005 and 2011. But only about one tenth of its sales were direct to the

public. The bulk of them – about 4 million new policies – were sold as a result

of a partnership with four High Street banks – Barclays, RBS, Santander, and

HSBC. In some cases the bank put a phone number on newly issued cards with the

instruction to call it to ‘activate’ the card. In fact you got straight through

to a CPP sales person. So those banks colluded in this mis-selling useless and

overpriced insurance to 4 million people.

Those sales certainly involved untruths, misleading claims, false statistics and

unfair terms. And CPP and the banks made a lot of money out of them.

That sounds like fraud to me.

ADVISERS

Now, Advisers – who they are and what they should do

I

was asked recently to talk about ‘retirement solutions’. And I began by

quibbling over the phrase ‘retirement solutions’. A solution has to be the

answer to a problem. And what problem do people have about retirement?

Bill Deedes, at one time editor of The

Daily Telegraph and before that a Cabinet minister, born in 1913 who died at

the age of 94 in 2007 had a very neat solution to retirement – he didn’t do it.

During his final illness he wrote his Telegraph columns on his laptop in bed.

His final column was published just two weeks before he died – on Darfur being

as bad as Nazi Germany (he had been to both). His family reported that he was

writing another column as he died. And for myself that would be my wish – found

in bed with my laptop open and a half finished piece on the screen. To die doing

my job, earning my living. Not at the tedious end of a 30 year holiday paid for

by other people.

Retirement solutions is a small example of how the industry uses words not to

enlighten but deceive. By calling

it retirement solutions you beg the question is there a problem in the first

place? Maybe there isn’t. And you may say well yes the problem is that most

people don’t have enough income in retirement. Which is true. But many of them

won’t have had enough income in their lives generally. And there is no reason to

believe that saving for a pension will solve that problem for them. Not having

enough money is the default state at any age for most of us.

The

RDR – Retail Distribution Review begins of course soon. 2012 is the last year

that advisers will be able to earn commission from advising on pensions or

investments. They will have to charge fees for that advice. So is commission

being banned? Well sort of.

It

is not being banned for insurance and not, at the moment, for mortgages. Those

sales can still be driven by commission. And you will see that many financial

advisers are adding insurance to their portfolio of products to sell.

And

even with pensions and investments the change is not as clear as it might be.

Customers will not have to pay the fees up front. So you won’t have to get out

your debit or credit card and pay hundreds maybe low thousands of pounds.

No!

You can have the money taken out of your investment, often spread out over many

months or years. So you will still not see the money, still not realise just how

much the advice is costing you. It may have removed commission bias – but it

will not increase your engagement with the adviser.

And

fees may not be expressed in pounds. Barclays Wealth has announced it will be

charging its wealthy customers a percentage of their total assets under

management and a percentage of the assets they move or the deals they do. It is

considering a minimum of £37,500. For that people with at least £3 million will

get

“cutting edge behavioural finance and asset allocation techniques alongside

global expertise in research and investments”

And

the fear is that only the wealthy will be able to afford financial advice. The

mass market, as it is called, will not.

My

answer to that concern is ‘good.’ The mass market does not need expensive advice

about investment or pensions.

At

least half the population has debt – not mortgages though that is also present –

but personal debt – credit cards with a balance running, personal loans, money

borrowed for a car, a kitchen, a holiday, and nowadays perhaps a payday loan –

smaller short-term loans at APRs in the thousands. Or of course a persistent

overdraft – with an APR sometimes in the millions – I won’t go into that here.

The Bank of England puts the total at £157 billion of consumer credit. That is

down considerably. It was £211bn eighteen months ago. But it is still about

£5,730 per UK household. Except that probably around half of households do not

owe anything – those figures are a bit flaky. But if that is true it means that

each household in debt owes around £11,600. Suppose they are paying interest of

10% on that – very modest – that is £1,160 year, or nearly £100 out of every

monthly household pay packet – just on servicing that debt without repaying a

penny of it. And that is without the almost £1.25 trillion debt secured on our

homes through mortgages and second mortgages. That has not gone down.

So

if someone goes to an Independent Financial Adviser the first question should be

– do you have personal debt? And if the answer is ‘yes’ then the IFA should say

‘Thanks for coming to see me. But pay off your debt and then come back. There is

no point in having a debt that costs you 9% or 19% or 1900% a year and saving or

investing money that will earn you 3% or even 7% or 9% a year as some

investments aspire to. Spare money should be used to pay off debts first. The

only two possible exceptions are student loans (especially pre-2012 loans) where

interest rates are set at the rate of RPI inflation or in some cases at Bank

Rate plus 1% = 1.5%. And some mortgages which are very cheap at the moment. 2%

or 3%.

But

otherwise generally pay off debt rather than save.

But

that is advice that many financial advisers do not give.

And

most people do not need investment advice – they need advice about budgeting

and, if they have spare cash, about saving – and saving rates. Getting the best

certain return on your money. Financial advisers generally do not advise on

either of those. Indeed they confuse investing and saving using the terms

interchangeably when they are very different indeed.

If

you save, your money remains yours.

If you invest, your money belongs to

someone else.

It

is that simple.

So

if most people no longer go to a financial adviser there will be fewer people

who lose money.

And

I am not talking here about scams – though there will be a few who are fooled by

advisers into investments in property in Columbia, carbon credits, or forests in

Euador. The vast majority of financial advisers are like my uncle. Selling

products they genuinely believe are good. But which may not be suitable. If

financial advisers are guilty of anything it is, like my uncle, of believing the

industry’s propaganda.

Pensions are perhaps the best example. leaving aside the systematic mis-selling

of pensions – see above. Pension calculations are based on growth rates which

are fictitious – laid down by the FSA and which will finally be reduced in 2014.

The only certainty in pensions is that whatever you put into your pot the

company that sold it you has its own private tap at the bottom out of which your

money drips into its bank account. Charges of 1.5% a year will eat up a quarter

of the money you put into it. Pensions – and I believe in them – are an act of

faith and tax subsidy not of arithmetic. Low charges are the key to pensions –

that and a contribution from you employer.

But

let me move on to two areas that I am sure many you STEP people advise on. And

they are linked.

Inheritance tax and care costs

I

write a guide to Inheritance Tax – how it works, how to reduce it and so on. But

I always start by saying something like this –It is one of the most hated taxes.

And that puzzles me. Because when it is due when you are dead. Someone else pays

it. The ideal tax for me. And very few pay it anyway.

One

reason for that is because in October 2007 Alistair Darling made the Inheritance

Tax allowance portable from one married or civil partner to another. Couples

with assets of less than £650,000 need not worry about Inheritance Tax today.

And that roughly halved the number of estates paying IHT from its peak of 34,000

in 2006/07.

In

2010 about 550,000 people died in the UK. But in 2010/11 only 17,000 estates

paid Inheritance Tax. That is 3 about estates in 100. In fact out of 32 funerals

you see only one of those families in black will have to worry about Inheritance

Tax. It is a minority concern.

Of

course many people, particularly those living in the Southeast of England, fear

it. They see their home alone is worth more than the £650,000 threshold. And the

threshold is not going to rise to £1 million as promised in September 2007 by

George Osborne when in opposition.

And

those people are prime targets for what is often called wealth protection. But

where did this wealth come from?

If

you are 80 now and paid off your mortgage at 65 and bought that house at 50.

Suppose that home is now well into the IHT band. Suppose it is worth £500,000 –

now for most people who are or have been a couple no tax will be due on that.

But if you are single or haven’t arranged your affairs sensibly then tax may be

due. So let’s look at that example.

If

it is worth £500,000 (Nationwide Outer SE figures, Q3 2012) now and you bought

it 30 years ago it was then £67,600 (Outer SE Q3 1982 or £53,870 London). Now

you may have struggled to pay that mortgage off over the next 15 years – average

pay then was around £5,500 a year. So it was about 10 times average earnings.

But you managed it. Today that house is worth about 20 times average earnings -

£500,000. So you have a windfall gain of £432,400. Money you haven’t earned in

any sense of the word And even if you take account of the cost of borrowing most

of that money the windfall is still around £367,000.

Source: Mortgage calculator www.lcplc.co.uk; Nationwide house price calculator.

That has been created by inflation, by wage rises, by the economy of the

country, by the state you live in. But not by you.

People object to IHT on the grounds that the house was bought from taxed income.

So why should it be taxed again?

But

in fact from 1969 to 2000 there was tax relief on mortgage interest. There were

certain limits introduced over the years but for most people most of the

interest they paid on their loan was subsidised by other taxpayers. And until

1983 at their highest marginal rate. So at least a big chunk and possibly all of

the mortgage cost was subsidised by taxpayers.

So

where IHT is payable – those three in a hundred estates – the chances are that

the tax is levied on money that was subsidised when it was spent and the bulk of

which is a windfall payment which has not in any real sense been earned or still

less worked hard for.

That is not how many people see it. And of course a whole panoply of schemes to

avoid IHT have been drawn up.

Some insurance companies and financial consultants have made a lot of money

selling plans to reduce or avoid Inheritance Tax. Such schemes can be

complicated – involving juggling the ownership of money or making gifts into or

from trusts – and often involve taking out an insurance policy.

These schemes are often designed principally to generate commission for the

person who sells them. If the scheme does not work it is the heirs, not the

adviser, who will end up paying the bill. In 2005 the Government clamped down on

one kind of scheme leaving 30,000 people, who had paid good money for advice,

with a tax bill every year just to carry on living in their own home.

In

2006 major uncertainty was created when the Government announced plans to change

the way that trusts were taxed, without any consultation. Later it watered down

the proposals but the changes have made deals involving trusts much less

attractive.

The

Government has warned that it will take action against any scheme which is set

up just to avoid tax. The Government has announced it will pass a new General

Anti-Abuse Rule into law which will make it even harder to set up cunning

schemes to avoid tax. There will be more consultation in December. The new law

may begin in 2013 or 2014.

There are of course legitimate and intended ways to diminish IHT. I’m sure this

audience is well aware of most of them. But let me mention three that usually

surprise people.

If

a person’s death was due to active service in the armed forces – or was hastened

by it – then their whole estate is completely exempt from inheritance tax. Many

people can benefit from this little-known rule. It was used by the executors of

the fourth Duke of Westminster in 1967. His family, one of the wealthiest in

Britain, successfully claimed his death from cancer had been ‘hastened’ by a

stomach wound he suffered fighting in France in 1944 and paid no inheritance tax

at all.

But

many people of much more modest means can also benefit from this exemption which

has existed for more than 300 years. There is no time limit even when tax has

been paid it can be refunded – plus interest from when it was wrongly paid.

Since i have been writing about this I have had several examples of people

getting money back.

Two

other reliefs – money which is paid to someone out of surplus income is exempt

if the right records are kept. And gifts to your own children (but not

grandchildren or others) while in full time education to pay for their education

– for example student fees – is also exempt if paid before the end of the tax

year in which they leave education.

The

simplest method of course is just to make a gift and live seven years.

There are some ways often suggested to reduce IHT which don’t work. Some

advisers will suggest taking out an ‘equity release’ plan to reduce your

liability to Inheritance Tax. You borrow money against the value of your home.

While you are alive you pay no interest on the loan. When you die the loan and

all the accrued interest is paid from the value of your home which is therefore

less and the Inheritance Tax is reduced or disappears completely.

Equity release might be a perfectly sensible way of raising money for people who

need more income or capital in retirement. And it goes without saying that

taking out a loan against the value of your home will reduce the amount of your

estate and the tax due. But that is a side effect. If you do not need extra

capital or income then equity release should never be considered. It is better

for your heirs to have 60 per cent of something than 100 per cent of nothing.

And

the same is true generally of gifts to charity. Giving money to charity may be a

laudable thing to do. However, it should be done for its own sake not as a way

to avoid tax. New and complex rules allow IHT to be charged at a reduced rate of

36% if at least 10% of the estate is left to charity. Even with the new rules

heirs will be better off if you leave everything to them.

Care home fees

One

of the big areas of concern among older people is care home fees. And when the

Government came in they commissioned Andrew Dilnot – ex IFS an economist – to

find an answer to the problem. In July last year he produced his paper setting

out his plans. That paper came out in July last year and a year later this July

the Government produced its response

Caring for our

future:reforming care and support

The

announcement was surrounded by all the usual nonsense about 40,000 people being

forced to sell their homes to pay for care – which they are not – and that the

Dilnot plans would ensure no-one would have to pay more than £35,000 for their

care – which they wouldn’t.

So

I wrote a blog post to correct these misconceptions. But I called it

Paying for Care – Déjà Vu Vu Vu.

http://www.paullewismoney.blogspot.co.uk/2012/07/paying-for-care-deja-vu-vu-vu.html

Because the real shocker to me was that the Government response said there would

be a Deferred Payment Scheme

“so that no-one is forced to sell their

home in their lifetime to pay for care”

Those of us with memories longer than a goldfish will recall that in the year

2000 the last Government announced a deferred payment scheme

“to ensure that people… are not forced

to sell their homes...in their lifetimes.”

So

12 years on the Coalition Government did exactly what the New Labour Government

had done – and pretended it was new.

There already is a deferred payment scheme. The only difference between the

existing scheme and the new one is that the new one will cost more to the family

of the person in care. At the moment a deferred payment clocks up interest free

while they are alive and for 56 days after they die. Under the new plans future

interest will be charged throughout costing the heirs a few thousand pounds more

than the present deferred payments scheme which a lawyer who deals with these

cases says anyone can get if they ask and persist when they are turned down.

Something the Government did not mention. I did of course.

As

for the £35,000 cap – it never was a £35,000 cap. Often quoted as no-one would

have to pay more than £35,000 towards their care – once they had paid that much

the state would step in.

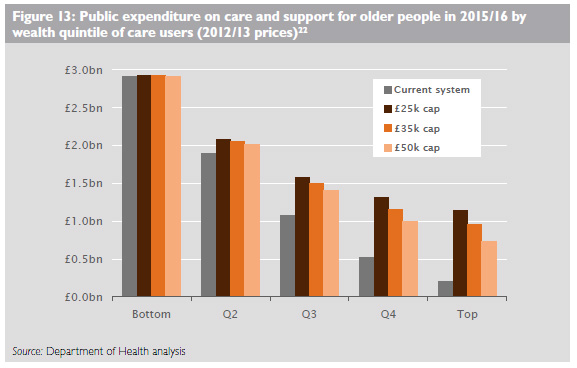

Except it wouldn’t. For two reasons. First the cap was not £35,000 but the

amount of care that could be bought for £35,000 at standard local authority

rates. Suppose the local authority charged £350 a week for care – and just the

care element – and suppose you paid for your own care but were billed at £500 a

week. Then after 70 weeks you have spent £35,000. But at local authority rates

you could buy 100 weeks. So the cap would not be reached until you had bought

100 weeks – at whatever cost it was – in this case you would have spent £50,000.

Second, the cap was only on care costs – not hotel costs, food, drink laundry,

room rent etc. And Dilnot said that lot could be charged at up to £10,000 a

year.

So

the cap is not set in money – and is not a cap.

Dilnot was asked to deal with a difficult problem. We all agree that the present

system of paying for care in our old age is confusing and unfair. We all agree

it should be changed. We all agree that more money is needed. We all agree that

someone should pay. And we all agree that it should not be us.

Dilnot made it clear that the main beneficiaries of the plans would be the

better off – because they are the ones who might have £50,000 and £10,000 a year

to spend.

Dilnot Commission, Fairer Care Funding, July 2011, p.67

And

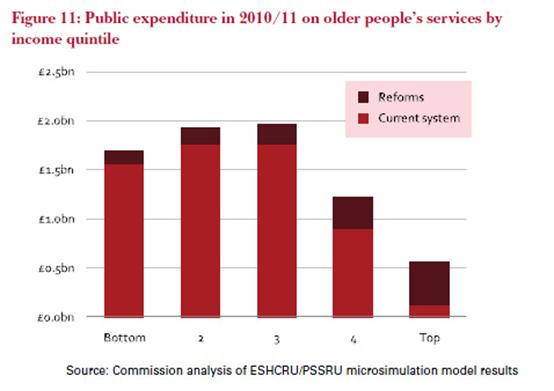

that was confirmed by the Government in its analysis this July. Most of the £2

billion a year cost would go to the people in the top 40% of the income

distribution.

Caring for our Future: progress report on funding reform,

Dept of Health, July 2012, p.35

Or

rather their heirs. It is not the person in the home that benefits but their

families when they die.

But

has Dilnot got it entirely wrong to propose shifting the cost away from

individuals towards taxpayers? There is another source of money that could

certainly be used to pay for care for most people for at least the next

generation – the estimated £2.5 trillion locked up in owner occupied housing .

This wealth is mainly owned by the baby boomers who bought their homes cheap and

have seen them change from a place to live to a lottery win in little more than

the time their children have taken to become adults.

There are very strong arguments to say that those who own this wealth should use

it to pay for their own care. But in reality it is simply a windfall derived

from the economy they have been fortunate enough to live in. And it only seems

fair that they should be expected to pay some of this windfall gain to pay for

their own care.

At

the moment they generally will not have to do so. If they are the first to go

into care leaving their partner behind, then the value of their home will be

ignored. It will also be ignored when the second goes into care if there is a

relative aged 60 or more living there and, at the local authority’s discretion,

if a younger person who has been a carer is living there. Figures from care

specialists Laing & Buisson and the Department for Work and Pensions indicate

that only about one in eight of the elderly people living in a care home have

sold their home to pay the fees.

The

average time in a care home is about 2.5 years . The average fee is around

£30,000 a year. That puts the average cost of care for an individual at around

£75,000 – or £150,000 for a couple. That is below the average value of a home –

which is just over £160,000 . So a simple mechanism to take a charge against the

value of a home to pay for care would see the costs covered in most cases.

Of

course many older people will ask why those carefully nurtured assets should be

taken when others get care free? But the people who would lose from this policy

are not those in care but their heirs who would no longer inherit the windfall

their parents have made from the economic times they lived through. And why

should taxpayers as a whole foot the bill so that middle aged adults can inherit

more?

But

one thing is clear the Government has no intention at all of implementing Dilnot

this side of an election. Expect it to be the subject of manifesto promises,

more reports, and no action in the next parliament either.

Thank you.