This talk was given 13 June 2011

The text here may not be identical to the spoken text

VOLUNTEER VISITORS OF THE ROYAL SOCIETY OF CHEMISTRY BENEVOLENT FUND.

Delighted

to be here to talk to you.

My

stepfather was a member of the Royal Society of Chemistry. He and my mother were

married for nearly 25 years and when he died in 2008 I was contacted by the RSC

asking if she needed help including financial help. She didn’t as it turned out

but I was very grateful and surprised at the offer.

I

don’t just do Money Box, I also write for

Saga Magazine. But I am here today representing not Saga Magazine, not Money

Box not Radio 4 and God forbid certainly not the BBC. I am here as me a

freelance financial journalist.

I

propose to talk to you about two things.

Care home fees

State pension changes

Care home fees

The

recent stories about Southern Cross care homes which is staving off bankruptcy

despite being the biggest care home provider in the UK has reignited the

concerns about care and who pays for it. Southern Cross has 31,000 residents in

750 homes looked after by 41,000 staff. Though last week it announced plans to

shed 3000 jobs. The real problem though is the complex structure devised by its

previous venture capital owners with rents fixed but having to be paid for 25

years. Now it is trying to pay 30% less rent. But what has really ignited the

debate is the suggestion that previous venture capital management has taken

£35mn out in personal profits and around £1bn in general profits for one time

owner Blackstone.

The

real problem with care homes is declining income as local authorities cut back

and growing costs of private self-funding care which can’t continue to fill the

gap. Heating costs and the cost of borrowing also a factor.

But

that is a sideshow really in the debate about care home fees and who should pay.

It was a major part of the election campaign last year – gosh that seems a long

time ago! – and next month Andrew Dilnot – broadcaster, economist, and now Chair

of the Commission on Funding of Care and Support which will report into how we

pay for care.

Everyone agrees that we need to reform the way that care is provided for people

as we all age but don’t die. We all agree that ageing without dying is a good

thing. We all agree that care should be provided for people in that phase of

life. And when it comes to who will pay – then again we all agree – someone

should. But ‘who’ is where the consensus breaks down.

The

tabloid press – and I am sorry to include

The Daily Telegraph in that definition – is obsessed with people being

‘forced to sell their home’ to pay for care.

Here is a Daily Mail article from last week about Dilnot’s commission.

It

contains this phrase

“Some 20,000 are forced to sell their homes every year.” but does concede that

Dilnot’s plans should mean “no

one is forced to sell their homes to pay for care”

We’ll come back to what Dilnot is expected to propose later. But I want first to

look at this idea of being forced to sell your home. Here is a more extreme set

of stories from before the last election.

The

Daily Mail joined in and both had

trenchant editorials and copy such as “Labour’s betrayal of the elderly was laid

bare yesterday as a hero Spitfire pilot faced having to sell his home to pay for

residential care”

Now

the rules are complicated and I suppose I shouldn’t blame fellow journalists for

getting them wrong.

I

am sure a lot of people you talk to are concerned about it here is what you have

to remember.

No-one, ever, can be forced to sell their home to pay for their care.

Now, if your capital resources are more than a certain amount then you do have

to pay your own fees. Those limits are slightly different in England, Wales,

Scotland, and Northern Ireland but are around £23,000. Above that you get no

help – below different limits you get all fees paid. And in between you have to

pay a contribution NB Wales.

And

in some cases the value of the house or flat you leave behind can count as part

of your capital. And that can rule you out of help from the local social

services department.

But

remember the rule. No-one, ever, can be forced to sell their home to pay for

their care.

And

this is why.

1.

If you leave behind a spouse or partner living there then the value of the home

is completely ignored.

This Express story fell at this first

hurdle as 88 year old Mr Mejor did leave behind a wife Cecile. That was

dismissed by the Express in para 13

as ‘a glimmer of hope’. Never let the facts get in the way of a good story!

2.

If a relative aged 60 or more lives there then the value of the home is

completely ignored. Mr Mejor’s daughter Sally aged 54 lives in the house as a

carer for her mother. So if the 94-year-old Cecile survives another six years,

the house will not count even when she dies.

3.

If someone who acts as a carer lives there then the local authority has the

discretion to ignore the value of the home.

So

the Express story could fail there

too – even if Cecile dies before Sally is 60.

But

suppose that doesn’t happen – no spouse, no relative over 60, no carer, an empty

house or flat?

It

still doesn’t have to be sold.

For

the first twelve weeks in the home the value of the home is ignored. And after

that there can be a deferred payment agreement. Introduced in October 2001 this

agreement allows the resident not to pay for their care at the time. Instead the

bill clocks up every week but nothing is paid. Instead the local authority takes

a legal charge on the home so that when the person dies or the home is sold the

care bill is paid.

The

care bill is added up each week without interest being charged. So it is an

interest free loan. No interest is charge until 56 days – 8 weeks – after the

person in the home dies.

And

of course while that is happening the property can be rented out or lived in by

a younger friend or relative to keep it in good order.

The income from that can be used to pay the care home fees.

In

this way the amount lost on death from the value of the home can be minimal.

Now

not all local authorities offer deferred payment agreements – though they

should. They were reminded in England in April 2009 that if a council did not

then “it is likely the courts would find this to be unlawful”. Similar rules

apply in Scotland and Wales.

[LAC(DH)(2009)3

para 15]

But

what if Cecile dies, daughter Sally is still under 60, discretion isn’t

authorised, and the council does not offer a deferred payment agreement will Mr

Mejor have to sell his home?

No.

Under the National Assistance Act 1948 the local authority has to provide

accommodation for elderly people who need care. And that obligation is not

extinguished if the person receiving the care refuses to pay for it. The

procedure in those cases is set out in s.22 of the Health and Social Services

and Social Security Adjudications Act 1983 – usually known as HASSASSA. It says

the local authority has to place a charge on the Land Registry against the value

of the property but cannot charge interest on the debt while the person is

alive. And the only real difference is that interest is charged from the day

after the person’s death rather than waiting for 56 days.

So

even without a deferred payment agreement the debt can build up interest free

until the resident in the care home dies.

You

just have to be firm. But if you are, no-one has to sell their home to pay for

their care.

I

find all this particularly frustrating because I wrote about it in an article in

Saga Magazine in November 1994 where

I set these rules out. I called it ‘Hold on to your home’. And here is what I

wrote then. – “They cannot force you to sell your home.” And the rules have not

changed since then

So.

No-one ever can be forced to sell their home to pay for their care.

During the time the home is empty it can be rented out and provide an income to

help pay the fees. So the eventual bill is less but of course the person in the

care home does sort of pay for it out of the value of their home.

Back to the Mail article from earlier and its main conclusions.

“Pensioners may have to consider selling up and moving to a smaller home to help

pay for their care…the elderly may also be called upon to raid pension funds to

meet the cost of home helps or care home fees…”

But

then it goes on to say

“The economist’s comments will enrage those who believe hard-working couples who

have paid taxes all their lives should not have to make extra contributions just

when they become frail.”

And

here is the problem at the heart of the tabloid view of this problem. We all

accept that the present situation is not great. Local authorities are not paying

enough. Perhaps 20,000 people a year may be selling their home to pay for care –

though as I said – they don’t have to. And remember that most people never go

into a home – perhaps one in five of us does, it may be less. And of those who

do about one in twenty sells their home to pay for it. One in a hundred of the

population.

People like my neighbour Margaret. She was in her eighties and had two hip

operations neither of which worked well. Using a zimmer frame, struggling up and

down stairs and then dementia began. She sold her house to pay for her own care

near friends, by the seaside and got a much higher standard of care for the

eight months she lived than if she had struggled to get the council to provide

her with something suitable in London. She is one of those 19,000 who sold their

home to pay for their care in 2009. I am very glad she did. And I am sure she

was too.

So

of those who do sell their home – and I won’t bore you with the calculation to

reach 20,000 which is a bit tendentious – many of them were not forced to do so

they chose to do so.

And

why shouldn’t they? It is not the person in the home who loses. They are in

there for life. It is their heirs who in fact pay through a lower inheritance.

And it is their heirs who are the readers of the

Daily Mail and

Daily Express who object to paying

out.

But

if we accept that we are not spending enough on care for the elderly – and many

care homes are not great and do cost up to £700 a week or more – then there are

not many sources for the money. We could all pay more tax. Perhaps 2p or 3p on

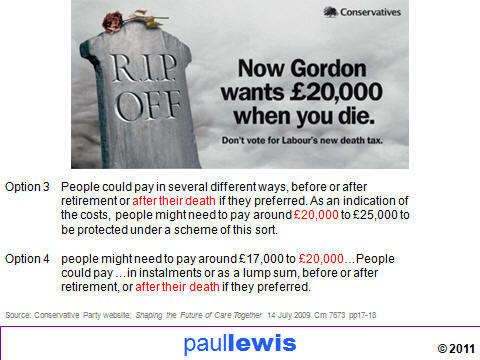

our income tax for example. There could be a special death tax as Labour

appeared to suggest before the election last year.

That was used against it by the Conservatives. And it is true that its White

Paper on care did just about make that suggestion as part of its options 3 and

4.

Because for reasons I have never understood Inheritance Tax is just about the

most hated tax – second only to council tax.

I

write guides to Inheritance Tax – how it works, how to reduce it and so on. But

I always start by saying something like this – It is one of the most hated

taxes. And that puzzles me. Because when it is due when you are dead. Someone

else pays it. (The ideal tax for me.) And very few pay it anyway.

One

reason for that is because in October 2007 Alistair Darling made the Inheritance

Tax allowance portable from one married or civil partner to another. Couples

with assets of less than £650,000 need not worry about Inheritance Tax today.

Here are the figures. Each year about 580,000 people die in the UK. And in

2010/11 16,000 estates paid Inheritance Tax. That is less than 3 estates in 100.

In fact it is one in every 36. In other words out of 36 funerals you see only

one of those families in black will have to worry about Inheritance Tax. It is a

minority concern.

Now

if there was a new death tax to pay for care then (a) and (b) would certainly

still be true – when you are dead and paid by someone else. Though (c) would not

be. It would apply in addition to any IHT to all estates. And as about 70% of

the retired population own their home and just about all of them have £20,000

much equity in it. Which is why Labour’s old pre-election idea of a flat-rate

death tax would work – it would raise about £8bn a year which is roughly what we

spend on care now.

The

election killed off the £20,000 death tax. Now it seems likely that Dilnot will

propose something different from that – we don’t know what. It will be a

combination of tax and spending from the value of our homes – perhaps with a cap

of £50,000 of the value of the home that can be taken – though that might be

£50,000 each partner to be taken when the home is eventually sold. And those who

do pay it shouldn’t care. This contribution is due not on money that is earned

or saved. It is due on a windfall gain on the home they live in.

If

you are 80 now and paid off your mortgage at 65 and bought that house at 50.

Suppose that home is now well into the IHT band. Suppose it is worth £500,000 –

now for most people who are or have been a couple no tax will be due on that.

But if you are single or haven’t arranged your affairs sensibly then tax may be

due. So let’s ignore that fact.

If

it is worth £500,000 now and you bought it 30 years ago it was then £67,750. Now

you may have struggled to pay that mortgage off over the next 15 years – average

pay then was around £4,100 a year. So it was about 16.5 times average earnings.

But you managed it. Today that house is worth about 20 times average earnings -

£500,000. So you have a windfall gain of £432,250. Money you haven’t earned in

any sense of the word. And even if you take account of the cost of borrowing

most of that money the windfall is still nearly £400,000.

That has been created by inflation, by wage rises, by the economy of the

country, by the state you live in. So why shouldn’t the state take some of it

back? £50,000 – even double that – is a fraction of that amount. In many

countries that capital gain on your home would be taxed while you were alive.

And

it is strange that the tabloid press opposes using this windfall gain to pay for

care. Because there are only two places to get the money – the value of

property, or imposing a new tax or adding to an existing one. Maybe 3p or 4p on

the basic rate of income tax would be needed. In fact Dilnot will propose a

combination of both – though where the tax will be levied is still a closely

guarded secret.

The

only alternative is to say we don’t care, let people carry on paying for

expensive and mediocre care homes.

One final thought on paying for care homes. Many people are in a home with

capital in excess of the limits and are paying for themselves. Self-funders.

Many people say why doesn’t the NHS pay.

Many people in a home have medical needs and their fees should in fact be met by

the NHS. Especially true – but not uniquely true – if discahrged from hospital.

The NHS will pay without a means-test and the whole fee so it is well worth

trying.

Advice from Carers UK is that you have to show the person has a high level of

primary health need – related to health not social care. Can be mental or

physical needs. So Alzheimer’s included. And as condition gets worse can ask for

re-assessment.

Step 1 is to use the checklist tool – a short questionnaire to give an idea if

you will be successful, downloaded from nhs.uk

Step

2 if you want to try it out is the decision support tool. That is what the

Primary Care Trust – who you apply to – will use. If it is refused then you can

appeal to an independent review panel.

Can be daunting.

Should you pay someone to do it for you?

No.

Money Box contacted by a listener, Stella from West Yorkshire. She had seen

adverts in national newspapers by firms offering to get refunds for people who

are paying their care home fees themselves.

The adverts say those people may have been wrongly assessed by the NHS and might

be able to get nursing care free. Stella was tempted as her mother was 96 and

had been funding her own care in a home for the past 3 years.

And there many companies offering to help with getting care home fees back –

advertising on the internet.

They charge a percentage of any fees recovered and some charge you upfront fees

as well.

We looked into Healthcare Fee Solutions based in West Yorkshire. There are no

prices on the website, but it says the firm makes no charge for assessing if

you’re eligible and takes on all the costs incurred to take your case forward.

But that is misleading. All that is free is the initial phonecall. If the firm

looks into your case, you have to pay £695 for an assessor, who isn’t medically

trained, to meet the family and take notes on the person’s condition.

Nurses then hired from an agency look at the notes and decide if you have a good

chance of a review if you apply to the NHS Primary Care Trust. If they don’t

think you do, you do get a refund of £500.

But if you do decide to go ahead with the review, there’s another £500 to pay

Healthcare Fee Solutions before the NHS Primary Care Trust makes its decision.

And if it does reassess the person and pays the fees, these can be backdated for

months or even years and Healthcare Fee Solutions also takes 25% of that refund.

Healthcare Fee Solutions. gave us four examples where the average settlement was

around £35,000. That would mean an average fee to Healthcare Fee Solutions of

just over £10,000 each.

We also discovered that the firm’s three directors [Richard Bennewitz, Elaine

Marshall and Steven Hume] were also directors of another claims firm business

called Individual Credit Solutions Limited. A year ago the Advertising Standards

Authority banned one of the company’s adverts on the grounds that it was

“misleading” because it said the firm didn’t charge a fee when they did. Iit

operated out of the same address as Healthcare Fee Solutions. until it went into

liquidation last October owing £100,000 to Revenue and Customs.

So my advice is do it yourself. No indication paying a firm will have any better

result and could cost you many thousands of pounds.

Self-funders in care

If all else fails and the person does end up paying for their own care, then

make sure they get the benefits they are entitled to.

1. Claim attendance allowance £49.30 day or night care or £73.60 a week day and

night care, both taxfree.

2. Claim winter fuel payment £100 born 5 January 1951 or earlier or £150 born 25

September 1931 or earlier. Also tax-free. These half rates paid in care homes

and only to self-funders.

PENSIONS

State pension

Women’s state pension age. Rising.

Original plan set out in 1995 and for women born 6 April 1950 to 5 April 1953 no

change beyond that passed more than 15 years ago. Currently women born in last

quarter of 1950 retired either on 6 May or will do so on 6 July (week of) aged

about 60y 7m.

But for women born from 6 April 1953 big changes. Table shows delay beyond that

of 2 months right up to 2 years and then back down to 1 year depending on your

date of birth.

Five million men and women face a change. About half each

500k women face delay of more than one year

300k more than 18 m

126k more than 22 months

33,000 more than 2 years in this dark grey band

where women born 6 March to 5 April 1954 will have to wait two more years.

Expected to retire at 64 in March 2018 will now have to wait until they are 66

in March 2020.

Is the government wobbling over plans to accelerate the rise in women’s State

Pension age?

Here are the straws in the wind which indicate a change in the weather. On 11

May Pensions Minister Steve Webb wound up a debate on the delays in the House of

Commons with these words “I will certainly reflect on the contributions of my

hon. Friends and other Members… Some of the points that have been put on record

today have been made forcefully and effectively.”(Hansard col 443WH)

On 18 May he used a similar phrase in answer to questions at a conference at the

British Library for pension professionals when he is reported by a lawyer

present to have said “We will reflect on the State Pension Age for those women

affected by more than two years.”

Ministers don’t normally reflect that hard on settled policy.

That same day, 18 May, Jenny Willott MP, who speaks on pension issues for all 39

backbench Liberal Democrat MPs, issued a press release saying there was a “real

and justified concern that the changes to state pension age are deeply unfair,

particularly to the 33,000 women who are being asked to work two years longer at

very short notice.” I understand that her backbenchers may well vote against the

plans when they are properly debated in a few weeks time; 14 have already signed

a motion condemning the changes. She took these concerns to Steve Webb at a

meeting in the evening of 18 May. Afterwards she would not tell me what was said

but confirmed she was “optimistic”.

Any change to the announced plans would be expensive. Scrapping the accelerated

programme completely and moving pension age up to 66 by 2022 rather than 2020

would cost an estimated £10bn. Even lesser changes are measured in the hundreds

of millions. Although Steve Webb is, of course, in charge of pension policy the

Treasury remains in charge of spending. If Steve Webb wants to spend money on

changing the announced timetable, past experience suggests he will have to pay

for it by making cuts elsewhere.

When I interviewed him he refused to indicate any change and once just refused

to answer – stayed silent.

State pension for 21st century

Will not start before April 2016 – after next General Election on 5 May 2015.

Will not apply to anyone who reaches state pension age before it begins

So it excludes men born before 6 April 1951, women born before 6 April 1953

Not flat rate – needs 30 years of National Insurance contributions. Reduced

April 2010 from 44/39.

Less than 7 years contributions will earn nothing. SAVING

Those who qualify by birth date will still get old rules pension if that is

more.

SERPS/S2P can still be paid partly through company pension.

Other savings –

Married woman’s 60% pension on husband’s contributions scrapped. Only just

extended to married men and civil partners. Inheriting state pension by

widows/employers may go. SAVING

Deferring and earning more pension may be made less generous SAVING

Guide figure of £140 a week. NB about 1.5mn already get a pension more than

this. Long term that will be a saving.

Whole of it will rise with Earnings or CPI or 2.5% - basic now by that but

SERPS/S2P by CPI only.

Will probably be between £160 and £175 a week when it starts.

Pension credit savings credit will be scrapped for new claims

At the moment 1.6 million people with an income between £103 and £188 a week who

are single (between £166 and £207 for a couple) get some savings credit. For

those aged 65 or more and can add £20 a week to income.

Pension credit guarantee credit may also be changed and set lower

National Insurance contributions will rise as contracting out ends. Already

pesonal penson contracting out ends April 2012 rise by 1.6% and 0.2% for those

in company schemes and then a further 1.4% to 12% from April 2016 or when this

new scheme starts.

Consultation until 24 June. White Paper maybe early next year. Bill after that.