This talk was given 8 June 2011

The text here may not be identical to the spoken text

COFUNDS INVESTMENT FORUM, HARROGATE

Thanks for asking me to talk to this gathering of – mainly – financial advisers.

You may wonder why a journalist is giving the keynote speech. I have been a

financial journalist for more than 25 years. I am not a trade journalist. I am a

consumer writer and my interest is in consumers of financial services not

providers. And consumers – and knowing what they want and need – is going to be

even more important in future. And it is that I hope to offer some insight into.

And

for every consumer there is a provider – or at least a way into the market. And

that is why I am talking to you today.

It’s been a difficult presentation to write. For ten years I have been talking

to meetings like this telling financial advisors – Polarised, depolarised,

independent and otherwise – about the evils of commission, about poor advice,

about mis-selling scandals, about the need to meet customers’ real needs. And I

will do a bit of that today – not just from habit. But I also want you to see

everything I say in the context of a wonderful real opportunity. Freed from

commission, freed from your past the world of real financial advice opens up.

I

was asked to talk about what you call ‘retirement solutions’. And, forgive me

if, as a writer – someone whose job is to explain highly complex things clearly,

unambiguously – if I quibble over the phrase ‘retirement solutions’. A solution

has to be the answer to a problem. And what problem do people have about

retirement?

Bill Deedes, at one time editor of The

Daily Telegraph and before that a Cabinet minister, born in 1913 who died at

the age of 94 in 2007 had a very neat solution to retirement – he didn’t do it.

During his final illness he wrote his Telegraph columns on his laptop in bed.

His final column was published just two weeks before he died – on Darfur being

as bad as Nazi Germany (he had been to both). His family reported that he was

writing another column as he died. And for myself that would be my wish – found

in bed with my laptop open and a half finished piece on the screen. To die doing

my job, earning my living. Not at the tedious end of a 30 year holiday paid for

by other people.

It’s a small example of how the industry uses words not to enlighten but

deceive. By calling it retirement

solutions you beg the question is there a problem in the first place? Maybe

there isn’t. And you may say well yes the problem is that most people don’t have

enough income in retirement. Which is true. But many of them won’t have had

enough income in their lives generally. And there is no reason to believe that

saving for a pension will solve that problem for them. Not having enough money

is the default state at any age for most of us.

CHANGE

We

are meeting at a time of immense, tremendous change in your industry. Three

things are on the horizon. The National Employment Savings Trust – yes its logo

is an egg and it is called NEST – the state sponsored pension scheme which

begins later this year. Automatic enrolment – not to be confused with NEST but

it frequently is, not least by journalists. And of course the Retail

Distribution Review – RDR – which will change fundamentally the way that

pensions are sold or at least the way the people who sell them – you – are paid.

And my thesis is it will also change the nature of your job fundamentally.

And

a fourth change is just below the horizon, the masts are sticking up and we’re

not quite sure what the vessel is beneath them, but it is sailing towards us and

if it avoids the rocks of politics and the dragons of the Treasury the good ship

high flat rate state pension may deliver its £140 a week cargo sometime in 2016.

Those four changes make this the biggest shake up in pensions for nearly a

quarter of a century.

Twenty five years ago the past was a foreign country. Margaret Thatcher was

Prime Minister, Nigel Lawson was Chancellor of the Exchequer, Norman Fowler was

S of S for Pensions. And in this foreign land called ‘the mid 1980s’ there were

no personal pensions. A few lucky professionals had a section 226 retirement

annuity plan and the even luckier ones did not put it with Equitable Life. But

there was no financial services industry as we understand it – there was the man

from the Pru and there were stockbrokers, and that was about it.

The

Thatcher Government came up with the idea that we should cast off the chains of

Government dependency. Official adverts showed a chained man setting himself

free. And the first thing he did, as you would after a long time in chains, he

bought himself a pension. One of the new personal pensions.

And there was a useful taxpayer subsidy

for those who took responsibility for themselves. Around 8% of your pay.

But

she also made another equally important change. Before 6 April 1988 if there was

a pension scheme at your job you had to join it – no choice. Margaret Thatcher

ended that and three weeks later (28 April) the first personal pensions went on

sale.

Commission

This history is important because it was the moment when the financial services

industry could have grown and developed into a popular, useful, worthwhile, and

much loved business. Instead it sent teams of poorly trained, commission driven

sales staff to descend on a hapless population who believed the adverts and

newspaper stories which said that for a few pounds a month everyone could buy

political and financial independence.

Altogether the industry systematically mis-sold the new personal pensions to

millions of people keen to embrace the new world of freedom from the state and

personal responsibility. They were persuaded to leave good company schemes and

put their money at risk in personal pension plans. More than a decade later the

industry admitted its mistake and forked out £11.5bn in compensation plus

another £2bn to find and deliver the money to the two million people known to

have been mis-sold.

There were all sorts of things that contributed to that systematic mis-selling –

Government adverts, political interference, phrases like ‘personal

responsibility’, and articles by compliant newspaper columnists with little

understanding of risk or indeed of pensions– but the fuel which drove it to the

heights it achieved was commission.

It

is commission – not solutions to financial problems – which has driven the

growth in your industry.

I

am sure some of you are thinking ‘what’s wrong with commission? It’s how we earn

our living!’

For

the last ten years I have been giving talks like this saying that commission was

the cancer at the heart of the financial services industry. I did discover that

was a bit of a false claim as the heart is the one organ in the human body that

is just about immune from cancer. But you get my drift. And over the years that

view has moved from being completely dismissed and derided – I’ve been jeered,

shouted at, people have walked out – to being mainstream as the FSA has slowly

come round to my view on this as on many other things – such as regulating

products not processes.

And

commission is wrong because when I sit opposite someone who is recommending me

to invest my money in a product I don’t really understand and which will cost me

money every year regardless of whether it does what it should do or not, I want

to know why is that person recommending that to me? Is it because it is best for

me? Or best for them?

And

that conflict of interest lies at the heart of the problems of the financial

services industry. A conflict of interest does not mean someone deliberately

sells a rubbish product just to earn the commission. Undoubtedly some have. But

most don’t.

My

uncle was an IFA and he is the kindest, fairest, and, if it matters, most

Christian man you could imagine. I don’t believe for one moment he sold me an

endowment mortgage because of the commission he earned on it. He genuinely

believed it was a good idea. He had been told so by those clever people at

Standard Life who manufactured it and surely knew what they were talking about.

They had actuaries and everything. So it was win/win – by selling me the right

thing, he earned money.

The

insurers who made that crazy product promoted it through high rates of

commission because it was so profitable. The fact it was and always would be a

mis-match – an uncertain investment to meet a fixed and certain debt – was

ignored. Not by good honest salesmen like my uncle. But by the people who

devised it and sold the idea to him and gave him a cash incentive to sell it.

Mortgage endowments sold from the 1980s right up to the late 1990s left up to

five million people up to £40 billion short of the money they need to repay

their mortgage. Nearly £3 billion of compensation has been paid.

I

could go on – AVCs, SERPS opt-outs, precipice bonds, split capital investment

trusts, structured products – no lawful industry has been rocked by such a

succession of scandals. And all of them can be traced back to commission.

And

this isn’t just historical stuff.

In

January this year Hector Sants, Chief Executive of the FSA, told MPs that mis-selling

still cost the public up to £600 million a year. Such as in the FSA’s 2008

pension switching review of IFAs, multi-ties and tied advisers, the FSA judged

that 16 per cent of sales were unsuitable, costing £43m in annual consumer

detriment.

So

whatever you think of yourselves that is how you have been seen. Commission

driven sales staff, mis-selling financial products to a hapless population. And

that is why the Financial Services Authority has decided that commission has to

go – at least so far as pensions and investments are concerned. Because it

biases the sales process and gives you a different interest from that of your

client.

And

that applies even to the majority of IFAs who genuinely want to help us take

personal responsibility and save for our future.

So

be glad it is going. Because now, 2011 to 2013, is your chance to undo that

quarter century of mis-selling, misguiding, driven by commission. And replace it

with the financial services industry as it should be. Finding real financial

need and offer real financial solutions to those needs. And being paid to do so.

Now

I am sure many of you are thinking – the big mis-sellers are the banks, the tied

agents whose very structure leads to mis-selling because they cannot recommend

the best product unless they happen to sell it – which is unlikely. And you are

right. Don’t think I am against independent financial advice. Every piece I

write or broadcast about getting advice on pensions or investments end with the

words ‘go to a good independent financial adviser.’ And I always say never,

ever, ever go to your bank for financial advice. Because it is rubbish. And even

more commission driven than it is in the IFA sector. And thank goodness that the

RDR is intended to deal with that problem as strongly as it will deal with

commission paid to IFAs.

So

at the risk of sounding like one of those awful books on business you see at

airports, I am here to say you should see this change not as a threat but as an

opportunity. The IFAs consumers want is one who will work for fees and build a

business around that.

Some IFAs who want to embrace the change say if we charge £100 or £200 an hour

then that will exclude the mass market. What about the guy who wants to start

saving £20 or £50 a month – he isn’t going to pay me £400 for advising him. And

I say ‘good’. He probably doesn’t need financial advice of the product-based

sort. The mass market should not be risking their small amounts on the stock

market. Should not paying fees of 1% or 1.5% or 2% of their money every year for

the hope of unachievable growth.

A

good IFA when asked about a pension or an investment will say do you have debts?

And if the answer is ‘yes’ will reply ‘then use any spare cash to pay them off

and come back and see me when that is done.’ Indeed a good IFA will reject as

many or more customers as he or she serves.

But

I am sure these changes are an opportunity for those who genuinely want to give

independent, financial, advice.

I

am sure many of you agree with me about commission but are still wondering how –

or indeed whether – you can make a living. Problem is that people who come to

meetings tend to be among the good guys. The ones who don’t think that Ethics is

a county to the east of London.

And

that is where another danger lurks. Because although commission is going for

investments and for pensions, it is not going for insurance or for mortgages, at

the moment anyway.

The

understandable temptation will be to seek the comfort blanket of selling those

commission-based products. Because as the FSA says it will not be ‘reading

across’ as it calls it, from the RDR to the insurance industry, though mortgages

are of course being reviewed.

The

view is that there may be product bias with investment products but not with

insurance. But that misses the point. There may not be significant product bias

between life policies or indeed car insurance policies. But there is a bias to

recommend insurance that is not needed in order to earn the commission.

I

mentioned some major mis-selling scandals of the past. And as I was moving

towards the present I am sure some of you were thinking – PPI. Because it is

looking likely that Payment Protection Insurance is going to be the second

biggest mis-selling scandal – I was going to say of all time, but I mean,

actually. PPI redress won’t cost the £13.5bn of pensions mis-selling. But we

already know that four High St banks and credit card provider MBNA have set

aside nearly £6 billion to pay compensation and admin costs. And industry

estimates suggest the final total could be £8bn to £10bn including

administration costs. And that was insurance. Commission driven insurance. And

not generally sold by IFAs. Mainly sold by lenders and particularly by the banks

and the commission driven staff that work there.

Now

I am not suggesting you might start selling PPI – there isn’t much of a market

for it now. But for insurance – or as the industry likes to call it now

‘protection’ – there is a big market.

I

am not a great fan of insurance. In many cases it buys you peace of mind – until

you claim. Then it is a nightmare. When Larry Silverstein bought the world Trade

Centre in New York in 2011 he insured the buildings with a cap of $3.5bn for

each claim. On September 11th the twin towers were destroyed and he

asked his insurer for the maximum $3.5bn for each of them – two towers, two

planes, two events, two $3.5bn caps – so

$7bn. Insurers said ‘no’ it was one event so the cap was $3.5bn. Now, the risk

was spread among several insurers so several lawsuits ensued and eventually the

courts decided it was one event for some insurers and two for others.

On

a smaller scale, 200 people are still waiting for payouts following the volcanic

ash cloud which closed down European airspace a year ago. Some insurers are

arguing that the ash cloud was ‘weather’ which the policies excluded. Others,

whose policies insure against weather, are arguing it was not weather but a

natural disaster which their small print excludes.

Far

too often insurance gives peace of mind to the vast majority of people who do

not claim, but anything but to the minority who do.

And

even good insurance can be mis-sold. Life insurance – yes. But only to someone

who has a financial dependant such as a child in education – in that case term

assurance is what is needed, insurance that runs out as the child gets older and

disappears when it reaches an age when it will – or should – be out of education

and independent.

A

spouse or partner might be financially dependent – and a key example of that is

a partner with whom you have a joint mortgage – always insure that debt. But

often not otherwise. Many couples are genuinely independent of each other

financially.

And

any policy should take account of life insurance that is available through work

– some jobs pay three times salary – or a pension arrangement. And always write

the policy in trust to avoid Inheritance Tax problems. So sometimes good advice

about life insurance is – don’t buy it. But commission can still drive those

inappropriate sales.

Don’t touch critical illness insurance with a bargepole. Consider income

replacement if you want – but ditto all of the above.

Car, house, and contents of course. Travel insurance when you travel or annual

if you travel a lot. And change your provider each year to keep costs down.

And, err, that’s it. Mobile phone insurance? It’s with the contents. ID theft

insurance? It doesn’t cost you anything, the bank picks up the bill. So why

spend money on it? And so on.

And

IFA should never tie themselves to one company for insurance. One of the most

confusing things for customers today is how IFAs move seamlessly from being

independent for investments or pensions but then suddenly not independent for

insurance. – choose the best deal for your client in that as you do with other

things.

Let’s get back to pensions. And what is wrong with how they are sold – even by

good financial advisers.

Persistency

Every Autumn the FSA publishes a little noticed report called

Survey of the Persistency of Life and

Pensions Policies. The series was due to be axed in 2007 but after the then

chairman Calum McCarthy said poor persistency was evidence for how the market

was not working it was reprieved.

There are a lot of figures in this report and I recommend it – you can download

it from the FSA website. Let me concentrate just on pensions

and

on two sets of figures.

The

first set show show how many personal pensions taken out are still live after 1,

2, 3, and 4 years. The latest year we have four year figures for are policies

sold in 2005 and how many were still in force in 2006, 2007, 2008, 2009.

Here is how they change year by year. After one year 81.5%, after 2 yrs 66%, two

out of three, after 3 years just over half and after four years 44%. In other

words after four years most personal pensions sold by IFAs 56% have been

abandoned.

The

only comfort from these figures for you IFAs is that they are slightly worse for

personal pensions sold by company representatives where only 41% in force – so

nearly 6/10 are abandoned.

And

there are two more damning things about theses figures. Over time the record of

persistency has got worse.

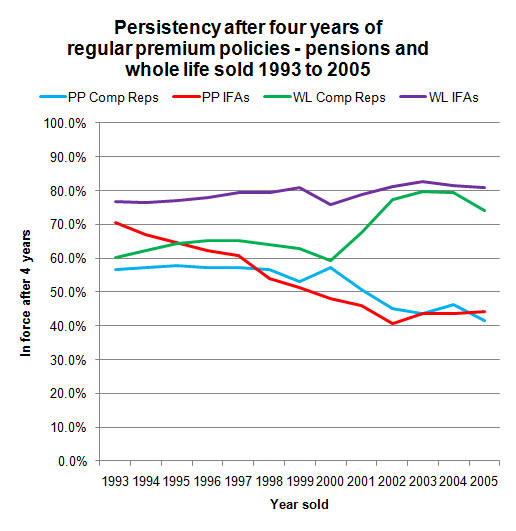

These figures show the persistency after four years of pensions sold each year

since 1993 to 2005. Pensions sold by company representatives have declined from

57% to about 41%. In the case of IFAs persistency has declined from 70% of 1993

pensions to 44% for those sold in 2005. And there was a slight improvement a

couple of years ago.

And

these figures look even worse if we look at persistency of whole of life

policies. Those show a rise in persistency over the years 1993 to 2005 both for

company reps in green and IFAs in purple.

And

here are the figures for regular premium personal pensions in force after four

years tracked from those sold in 1993 to 2005 so in force from 1997 to 2009.

The

report is not terribly helpful or insightful about why policies are abandoned.

But it does say

“If

investors buy policies on the basis of good advice, they would not normally be

expected to give them up.” (para 3.3).

So

if more than half are giving up these long term, life-time products within four

years we can conclude that something is going wrong. And that is something for

you to sort out. Mis-selling, mis-buying, misunderstanding?

Auto-enrolment

Some attempt to tackle the lack of persistency is behind envisaged by the new

system of auto-enrolment which will start now in July 2012 and which will come

in slowly starting with very large employers down through medium and small

employers in a process known as staging in which will be fully in place by 1

October 2016.

The

Government hopes that “Automatic enrolment into workplace pensions will see

millions of individuals newly saving for their retirement.” (press release

24/5/2011). So everyone earning enough to pay tax aged 22 or more and under 75

and in a job at least three months will have to be automatically enrolled by

their employer into a pension scheme. And those just outside those limits can

opt in if they choose.

People who are enrolled can opt out but after three years they will be

automatically opted back in and so on and it will be an offence for an employer

to encourage people to opt out.

Until staging-in is ended in October 2016, the contributions paid by employees

and employers will be a minimum of 1% each. Then a second process, known as

phasing in, will start increasing the minimum contributions to 2% and 3% from

October 2016 and then to their final level of what is being called 3% employer

and 5% employee from October 2017 – actually being called 3% employer and 4%

employee plus 1% tax relief. That is not true, as we shall see.

Even if it was these are pathetic amounts of money to put into a pension.

The

average amount going into a salary related pension – a defined benefit scheme –

is not 8% but 21.5% split 16.6% employer and 4.9% employee. The average amounts

put into money purchase pensions – defined contribution as the industry likes to

label them now – is much less but is still 9.1% split 6.1% employer to 3%

employee. So 2:1 employer and employee.

Source:

ONS, Pensions Trends, Chapter 8 April 2010; DWP data and Paul

Lewis calculations

Under auto-enrolment the amounts are a lot less than that. The 8% figure is

simply misleading. The percentage will only apply to a band of earnings. Those

bands have changed and as far as we know now will run from £5715 to about

£38,185 – though both may be different when they are announced in January 2012.

And

8% of that band equals at most a percentage of 6.8% of earnings. For someone on

average pay of about £25,000 it is around 6.2% and for someone on minimum wage –

about half average pay – it is around 4.4% of total pay. And that is when it is

fully phased in from October 2017. Before that – when auto-enrolment will be new

and it is important to persuade people of its value – it will be a lot less.

And

note that the auto-enrolment figures are biased to contributions from the

employee. While the employee will pay much what they pay on average into a DC

scheme – a bit less – the employer will pay well under half the average

contribution into a money purchase scheme. Instead of 2:1 employer employee it

is almost the opposite 2:1 employee to employer.

So

contribution levels are to be scandalously low especially among the very people

auto-enrolment was supposed to help – the low paid.

But

there is hope. Auto-enrolment percentages are a minimum. If the employer enrols

employee into a better scheme that is fine. There is no maximum. And even those

employers who are afraid of the big bad – and sometimes expensive – world of

pensions can stick with NEST and put up to £4200 per employee into that. For

someone on average pay that is about 17% of their wages which could provide a

decent pension – especially for younger people – at the low NEST charges 0.3% a

year (plus 2% upfront).

So

auto-enrolment brings immense opportunities for IFAs – millions of people with

no pension suddenly need advice – crucial advice like should I stay in? YES. How

much should I pay AS MUCH AS POSSIBLE. And yes you have to charge a fee – paid

by the employee or better still their employer – but this kind of

straightforward advice can be done quite easily – and if it can’t then the FSA

should ensure it can.

Financial advice

And

let me mention another great opportunity for you. How many of you are financial

advisers?

Forgive me but I doubt it. I doubt if many people here really are financial

advisers. Not in the sense of giving people advice about their finances.

Here is a list of ten common financial topics I get asked about.

1.

Income tax

2.

Benefits

3.

National Insurance

4.

State pension

5.

Credit cards

6.

Current accounts

7.

Foreign currency

8.

Inheritance Tax

9.

Care home fees

10.

Fuel bills

How

many feel comfortable giving advice on those topics?

Let

me help with ten common questions I might be asked.

1.

Income tax – is my tax code wrong?

2.

Benefits – what can a widow claim?

3.

National Insurance – Do I need to pay it on my earnings?

4.

State pension – how much will SERPS rise by this year?

5.

Credit cards – how do I cancel a regular payment I agreed to?

6.

Current accounts – which is the cheapest bank for an overdraft

7.

Foreign currency – where will I get the best rate for euros?

8.

Inheritance Tax – What allowance will my heirs get?

9.

Care home fees – does my daughter have to help with the cost?

10.

Fuel bills – how can I reduce the cost?

Those are all financial questions that need advice. Can anyone here answer them

with confidence? Or even tell people where to go to get the answers? And that is

without mentioning debt, or budgeting, or student loans, or tax credits, or cash

savings…I could go on. So in what sense are you financial advisers if you can’t

advise on basic financial questions?

The

trouble is financial advice is trammelled by its commission driven past. Now if

I had put this up

1.

Pensions

2.

Investment

and

perhaps

3.

Insurance

4.

Mortgages

there would have been a forest of hands. And what do they all have in common?

They all earn you commission. At the moment!

So

you have to be able to advise on those other things. And it is not very hard.

After all, journalists do it all the time. But it is what people want. And if

you are charging a fee, there just might be a model where you can make some

money – or at least break even or perhaps have a loss leader – advising on those

aspects of financial advice which the public really needs.

And

now you are – or will be free from commission other opportunities open up.

Equity release for example. A vital thing to explain. But often the best way of

releasing equity is downsizing – selling and buying somewhere smaller. It is

difficult and mistakes are easy. It can be costly. But freed from the need to

earn commission on a product, you can do that job too. Become an expert in the

problems – financial and psychological – and where the best choices are.

And

annuity choice. One of the most vital things there is – and for 95% of people an

annuity is still a much better choice than drawdown. And freed from the need to

balance the commission paid, sell the best annuity – ignore drawdown for most.

The advantages are an expensive profit generating illusion. For most people the

advice to get the best annuity would be a few hundred pounds in fees well spent.

A lot less than the commission in many cases. But money you have earned well.

So

25 years after the financial services industry began, auto-enrolment and

especially RDR are your chance to change and to turn your industry into one that

is valued, trusted and genuinely helps people meet their financial needs. Please

don’t mess it up again.