This talk was given 12 May 2011

The text here may not be identical to the spoken text

THE

DEATH OF FINAL SALARY PENSIONS

Any

views I express are mine and mine alone.

The

death of final salary pension schemes and what caused it.

Because they are dead. Don’t take my word for it. I looked into this a couple of

weeks ago for Radio 4. And I tried to get – and expected – different views.

Dead, dying, on life support, not very healthy, soon be home with their family.

But no. Everyone I spoke to said – they are dead.

But

in their Twilight – as is fashionable – the undead zombies are all around us

making our lives difficult. But their life is limited and the more light you

shine on them the quicker they go.

The

programme did shine that light and you can hear it on iPlayer or download it or

read a transcript.

Let

me take you through the chronology of the death of final salary schemes. At one

time they seemed to be just what every one of us would want. At work we pay an

affordable, known contribution. And at a known age we retire on an adequate

pension for life.

So

what went wrong?

FAIRNESS

The

first thing that killed final salary schemes was fairness. It’s an odd thing to

say. But it is true.

The

mid 1970s to the end of the 20th century is seen as the Golden Age of

Pensions. Good company schemes were affordable, reliable and secure. But one key

part of how they worked had long been hidden – final salary pension schemes

stole money from people who left before they retired.

Remember that at the start of the Golden Age if there was a pension scheme you

had to join it. So everyone who worked in a company with a pension scheme was

automatically enrolled in it willy nilly, however long they planned to work

there and whatever their personal circumstances.

Until 1975 if you left the company you also left the pension scheme and you got

nothing. Or almost. The contributions you had made were refunded – minus tax

because you had made them out of tax-free income so the Revenue took that back.

But the fund kept the growth on those contributions. And it kept the

contributions paid in by your employer – which were more than you had put in.

And it kept the growth on those too. So those who stayed in the scheme took most

of the contributions and all of the growth from those early leavers.

Over the next three decades that unfairness was removed piece by piece.

From April 1975 if you left the job you could leave your contributions in the

pension fund and draw your pension when you finally reached the scheme’s pension

age.

From 1986 anyone who left with at least five years in a fund could take the

value of their pension rights with them and transfer that value into another

pension scheme. And that period was cut to two years and then six months.

Also from April 1988 the compulsion to join your company pension scheme was

ended, so those who were not committed to long term employment were no longer in

the scheme to be milked.

Ending that unfairness exposed another. In 1975 your pension would be based on

your salary in cash terms when you

left, so that was still a huge gain to the fund when you eventually retired and

you were given a pension based on, for example, a 20 year old salary. So

inflation was the next unfairness to be tackled.

That began in April 1978 when the bit relating to SERPS was inflation proofed –

like SERPS – with RPI

On

1 January 1986 all contributions made from that January 1985 had to be inflation

proofed

And

in 1991 inflation proofing of preserved rights was extended to the whole pension

whenever you paid in.

Then we get to a complicated bit – and all this is simplified – when pensions in

payment were also revalued.

Then on A Day, April 2006, the tide turned with the first example of reducing

the rights in a final salary pension scheme – the cap on inflation proofing was

cut from 5% to 2.5%.

And

from April 2011 that cap will remain at 2.5% but the chance of ever reaching it

will be reduced as the measure of inflation will be changed to the Consumer

Prices Index. And the maths of the CPI, the formula used, means it is about 1

ppt lower than the RPI given the same price data. So another cut in rights.

Your scheme may offer more than that – but many will change to CPI despite

Government chickening out on giving power to change trust deed.

So

these two sets of changes stopped schemes stealing off members who left. And

just as well because in many cases that meant men stealing from women. Because

final salary pensions used to be particularly unfair to women. In many companies

women could not join the scheme. Even when they were allowed to, a woman who

married often had to leave her job – and lose her pension. She became an early

leaver to be robbed.

So

ending the practice of stealing from early leavers – many of them women – has

played a major part in making salary related schemes unaffordable.

So,

yes there was a golden age – for some. If you were with the right employer,

worked there for 40 years, got promotion, and were a man. But not otherwise.

I’ll put some numbers on the cost of that quarter century of introducing

fairness later. But next Nigel Lawson. When he was Chancellor of the Exchequer

he was very concerned that pension schemes which had built up tax-free were

showing huge surpluses – they had more money than actuaries of the time said

they needed to pay the pensions they had promised. And firms wanted this money

back.

So

Nigel Lawson decided to regulate this process and introduced Lawson’s Law. Every

pension scheme had to cut its surplus to 105% of what the actuaries said it

needed to meet its pension promises – in other words they had a margin of just

5% above that cost.

The

firms could take the surplus back – but it would be taxed. Far more efficient

was to reduce the amount they paid in. What we now call a contributions holiday.

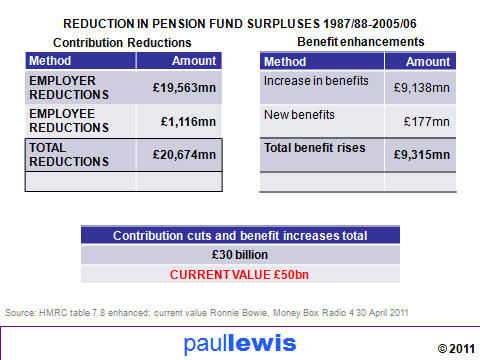

And most firms embraced that solution with glee. Here are the total amounts

employers took out – or stopped paying into – their pension funds from 1987 to

2006.

Over those 19 years employers took about £20 billion out of pension schemes,

employees benefited from cuts in their contributions worth about £1 billion and

were treated to enhanced benefits to the tune of around £9bn. So £21bn taken out

and £9bn of future commitments added. Though as you can see the benefits were

shared with two thirds in favour of employers, and almost all the contribution

cuts were by the employer.

And

here they are again split between contribution reductions and benefit

enhancements. The total is a fraction short of £30bn. But these are historic

cash figures. The cost today to funds of starving them of that money as long ago

as 1986 is a lot more.

And

for my Radio 4 programme Britain’s top actuary – Ronnie Bowie President of the

Institute and Faculty of Actuaries – put the value of that now at around £50bn.

And

Ronnie Bowie went further than just that figure. Here is how he referred to

contribution holidays and how they affect pension funds now

they’ve fallen behind also because of greed - because many companies plundered

the schemes for benefit augmentations - for contribution holidays, and so

they’ve really… put shackles round the assets that couldn’t grow because they

were being plundered in that way.”

Plundered. Top actuary Ronnie Bowie’s word for contribution holidays.

But

if you ask people which Chancellor is to blame for problems with pension schemes

it is not Nigel Lawson who crops up.

In

1997 the modernising Chancellor of the new Labour Government decided that the

way companies were taxed was so complex it reduced their incentives to invest.

So Gordon Brown changed the way dividends paid on shares were taxed. That had

the effect of taking away the tax refunds on dividends which pension funds and

others enjoyed. Brown insisted it was not the purpose of the change, and if

companies saved money as a result they could put it back into their pension

funds if they had to – perhaps end their contribution holidays! And some years

later when they didn’t do it he introduced the Pensions Regulator to make them

do just that.

The

total cost to pension funds and others of the change to the tax on dividends was

£5.4 billion in the first year. However, estimates by the Pensions Policy

Institute indicate that the true cost to pension funds was much less – between

£2.5 and £3.5 billion a year, and that figure reduces over time. So the cost

today?

Again Ronnie Bowie has put a figure on it and he said it was also about £50bn.

So between Lawson’s Law and Brown’s pension tax grab maybe £100bn off the

current value of pension funds.

After these perhaps surprising causes of pension scheme decline we have to add

on the more familiar things.

LONGEVITY

Longevity – when final salary pensions were at their height in the mid 60s

people could expect to live 12 years in retirement. Now that figure is almost

twice as big 22 years. And it is still growing. Indeed by the end of this talk

you will have gained about 4 minutes of extra life.

Actuaries, who had observed the rise in life expectancy for many years, used to

say it can’t last – there will be an end. But in October 2005 the Government

Actuary, Chris Daykin, announced that he had stopped assuming that the length of

life had some ultimate biological limit. In other words, the age we live to

really could go on increasing forever. Or as he put it in actuary-speak

‘Previous projections have assumed that rates of mortality would gradually

diminish in the long term… However… the previous long-term assumptions have been

too pessimistic. Thus… the rates of improvement after 2029 are now assumed to

remain constant.’

‘now assumed to remain constant.’

It

is one of the most important pronouncements of actuaries ever since their

profession began in the 18th century when men walked round graveyards and noted

down birth and death dates and worked out the maths of life expectancy.

INVESTMENT RETURNS

Investment returns have not been – and never will be – what they were in the

last quarter of the last century when the return on shares – after inflation –

was 8% a year for 25 years (Barclays Equity Gilt Study 2011).

REGULATION

And

then we have to add in of course changes to regulations – accounting policies

FRS17 which said companies have to declare their pension liabilities in their

annual accounts. Minimum Funding Requirement, and now Scheme Specific Funding

Requirement – those formulae which replace the best guesses which were used to

allow contribution holidays – and which are now enforced by the Pensions

Regulator. The total effect of those costs is not completely known. Here is what

I have got so far

The

Pensions Regulator tells me that over the last five financial years – up to

April 2010 – firms have paid in a total of £90bn specifically to reduce deficits

in agreement with the Regulator. In addition there is another £8bn paid in just

in two quarters at the end of 2009 and start of 2010 in ‘special contributions’.

So without even counting last year or some other contributions – and ignoring

all the normal contributions paid in which have grown by £16bn a year between

2008 and 2010 – without those things we know of a total of around £100bn being

put into schemes to cut the deficits. Which by coincidence is the total net

effect of Lawson’s Law and Brown’s Grab – I leave it at that!

And

the total effect of these changes was to turn final salary schemes from being

cheap for employers and certain for their employees to being very expensive for

employers and rather less certain for their employees.

Here is top actuary Ronnie Bowie’s analysis.

In

those golden days before fairness, inflation, Lawson, longevity, Brown and

regulation

The

cost began around 5% for the employee and 6% for the employer. Early leavers

added 2% Inflation protection added another 7% - that’s 9% for fairness -

Brown’s grab added another 2% us all living longer another 8% and finally

regulation added 10% - and that includes investment performance and contribution

holidays. So now it is still 5% for the employee but 35% - neaerly six times as

expensive – for the employer.

And

one final thought – I leave you with it because I am out of time and it may

point the way forward. There is another great unfairness at the heart of final

salary schemes. They reward high flyers and penalise low flyers. I won’t go into

the details – Lord Hutton does that and you can find other talks of mine that

summarise them.

But

because a final salary scheme pays a pension related to final salary and because

contributions are a percentage of your salary year by year it is inevitable that

someone who moves up the ranks and earns more year by year will get more per

contribution than someone who stays on the same grade throughout their career.

The admin assistant who becomes chief executive may be paying contributions

based on an admin assistant’s pay for a third of their career – but those

contributions will be buying a pension which is a percentage of chief exec’s

salary.

In

fact high flyers can quite easily get double the pension per pound paid in than

the low flyer. So this unfairness is built in. The way to avoid that of course

is to base the pension on average pay throughout the career. That deals with the

final unfairness of final salary schemes. But whether moving to that will be

enough to save what are called defined benefit schemes and the risks they impose

on employers is not at all clear.

Finally let me leave you with a quip – courtesy of Tom McPhail of Hargreaves

Lansdowne.

What’s the difference, he asked me, between final salary schemes and Bin Laden?

Some people still believe Bin Laden isn't dead.