This talk was given 20 April 2010

The text here may not be identical to the spoken text

Chartered Institute of Housing Cymru

Annual Conference 20 April 2010

I’m

Paul Lewis a freelance financial journalist, although best known I guess for my

work presenting Money Box on Radio 4. But I also write the money pages in Saga

Magazine and write for its website. Some of you may see that – I know at your

Mum’s or your granny’s in your case. And if you have trouble sleeping you can

read everything I have written since 1996 on my website or on one of theirs.

But

I am not here representing Saga, or Money Box or, god forbid, the BBC.

I

am very glad to be here in Cardiff. City of Vertical Drinking as I learned the

other day. And I suppose horizontal travelling home. I am sorry I am not staying

the night. My mother’s family name is Griffiths so at some point my family was

from Wales but I have never been able to find that point I have to confess.

So

let me be clear – if you hadn’t guessed – that I am from London and I am going

to be talking mainly about the UK rather than Wales – not least because we are

in the middle of an election campaign to elect the UK parliament – the

Westminster as some here call it which has three Plaid Cymru MPs. And of course

many more from Welsh constituencies.

Despite the powers given to the Welsh Assembly the economy, taxes, and still

after the recent deals done when parliament was dissolved some housing policy is

still decided by the Westminster parliament.

I

am going to talk to you today about debt. About the government’s debt and what

can be done about it.

There is nothing wrong with debt. Debt helps us manage our income, even it out

over the times and the things we want but can’t afford. So debt is fine.

Borrowing to even out a lumpy income was invented by

Edward I more than 700 years ago – (1272-1307). His royal income from wool and

hides was seasonal. But his expenditure was smooth – paying the royal retainers.

And

he wanted a provision for fighting wars – mainly, I’m sorry to say! – against

the Welsh. So he in effect sold his lumpy income to the Ricciardi family of

Lucca in Italy.

In

exchange they paid his bills and provided him with cash when he needed – it was

remarkably like a modern current account with an overdraft. There was no formal

interest charge – that was forbidden by Christian rules against usury – much as

Islam prohibits it today. But academics reckon that the charge was around 15%.

Which is about the return which today’s banks expect on their capital. I expect

the Ricciardi paid themselves large bonuses out of it as well. Though in 1294

they went bankrupt. Those were the days. When banks that got things wrong were

allowed to go bust.

So

borrowing money to smooth out your income is not bad. It has been going on for

more than 700 years. But Edward was very prudent. He made sure that he did pay

off the debt when times were good.

Now

before I embark on today’s government debt I should say at the start that I am

not an economist. I am journalist – though, unusually, a numerate journalist. I

often annoy my friends by saying you can only understand things you can measure

or count.

I am going to talk today about some very big numbers. Far too big for the human brain to comprehend. Let me show you something first.

How many blobs? 3. And now?

Yes. 5. And now?

Not

so easy is it. If you got nine that is very good. The human brain can see 7

normally without counting. And when things get bigger we try to reduce them to

groups so we can manage them. So here you might see three lots of three or nine.

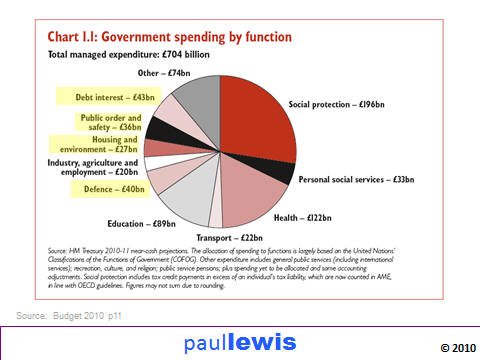

Billions, millions, trillions, very hard. But £163 billion is the amount that

the Government debt will grow this year. In other words in 2010/11 the UK

Government will spend £163 billion more than its income from taxes. So this

deficit as it is called is actually no more than an overspend. Income £541

billion, spending £704 billion, overspend £163 billion. And that overspend this

year is added to that of previous years and we have accumulated a debt of £952

billion, close on a trillion or 1000 billion or a million times a million.

Trying to bring this debt to some level those of us even with very large

overdrafts can comprehend a Conservative MP the other day said that to build up

a debt like that you would have to borrow £1.2 million pounds every day since

the birth of Jesus. Christ almighty.

In fact

it is slightly more – £1.3 million a day – got confused over leap years or

something.

But

he also got the figure completely wrong. That is the danger of simple

arithmetic. In fact if you started borrowing at that rate in the year zero,

which is 1 BC, and paid interest at 4% you would build up a debt of £952 billion

not by the year 2010 but in the early days of the year 112 when the Romans were

still here. And by now 2010 your debt would be unimaginably high.

In

fact if you borrowed as little as one penny every day since Christ was born at

4% interest per year it would have grown to the current debt by the year 765.

And 1p a day at 1% annual interest would by now have reached our current debt of

around £950 billion. So not such a great

propaganda point to say oh it’s like the Government borrowing a penny a day for

2000 years. But that is it – at even 1% a year interest.

But

even with simple arithmetic borrowing £1.3 million a day for 2000 years is

fairly meaningless. I find it hard to imagine a hundred years never mind more

than 2000. And I can’t imagine one and a quarter million pounds either – though

obviously some of my colleagues at the BBC don’t have to imagine that they can

just look at their bank statement. So two numbers that are too big for me to

imagine making a number that is doubly unintelligible.

So

let’s try something else. One popular measure for large amounts is the size of

Wales. An area of rainforest the size of Wales is destroyed every year or

sometimes people say every day. Let’s cover Wales in £10 notes how does that

compare to our debt? Well you only need to cover a twentieth of Wales in tenners

to get the £952 billion we owe. So maybe that’s like covering Conwy in £10

notes. So perhaps it’s not that much?

And

let’s bring that £952 billion down to the human scale – to you and me. There are

47 million adults in the UK. So our total debt is £952 billion divided by 47

million which is £20,255 per adult. Now I know people who owe that much on their

credit card. And the overspend this year is £3,436. So while it is not a good

idea to overspend £3,436 when you already owe £20,255 it need not be a disaster.

And

incidentally the average debt of people who go for help to the Consumer Credit

Counselling Service is £24,274. So we are close to that level and as a nation we

are in need of help. Of debt counselling.

But

you can look at our debt in another way. £20,255 is rather less than the average

income of a full time worker in the UK in 2009. Latest figures show that it is

about £25,412 – though rather less in Wales about £22,921.

And

stats from CCCS show that people tend to go for help when their debt equals

about 1.5 times their annual earnings.

But how does that compare to the UK’s income.

Here it is as a graph. The future is pink because they are just forecasts. Now

our national income is called Gross Domestic Product or GDP. And here is the

debt as a percentage of GDP. And you can see it rising from just over 40%in

208/09 to a forecast of almost 75% in 2014/15. You may recall of course Gordon

Brown’s Golden Rule that debt should not exceed 40% of GDP. Now it was a figure

plucked out of the air but while Chancellor he managed to achieve it. But now it

is taking off and will on these predictions be 75% of GDP by 2013/14. But that

is still only half as much as the debt level when individuals say enough at 1.5

times annual earnings.

And

internationally this isn’t bad either. Looking at the 27 nations in the EU in

2008 we are about the middle for debt – blue bars and ours is coloured green –

and in fact below average – those bars on the right there. But that was 2008 and

our deficit is big – the red bars and in our case the black one. And that will

make our debt grow strongly, worse than many others.

So

we need a plan. A plan to cut our debt. Just as someone going to CCCS with a

debt of 20,255 and planning to borrow another £3,436. And that is the message

from the people who we owe that money to – or their agents. We need a plan. Or

they will be reluctant to lend to us any more.

People often say to me the debt is a trillion pounds who do we owe that to? Who

has got a trillion pounds to lend us? In fact our debt is knocking on a trillion

pounds now - £952 billion – and by 2014/15 will be about 1.4 trillion – so we

need to borrow another half a trillion pounds in the next four years.

I

went to Canary Wharf a couple of weeks ago to Barclays Capital where they trade

in Government bonds and asked – how do I borrow half a trillion pounds, £500

billion, who will lend it to us?

About a third is from our own pension funds. They amount to far more than that

and they are keen to lend money to the Government in return for a secure income.

Another third is from abroad – foreign wealth, the so called sovereign wealth

funds of oil rich states and of course China. And the rest is from a mixed

variety – wealthy individuals, retail investors in the UK and elsewhere who buy

into government bonds.

Now

these bonds work in a simple way. You pay say £100 to the Government and in

exchange it promises to give you back your £100 after a fixed time – say 10

years or 15 years – and over that time it pays a guaranteed rate of interest. At

the moment for the UK that is about 4%.

Big

investors like these because (a) the return is fixed and safe – guaranteed by

the UK Government – and (b) the capital is returned at a set time and that is

also guaranteed by the UK government – a Government which has never ever

defaulted on its sovereign debt ever since 1272.

But

of course it is only as safe as the Government that guarantees it. And we have

seen recently with Greece that because people are very worried about its debt –

much bigger compared to its income than ours – it has to pay more than 6% to

borrow the money it needs. And recently the EU offered to lend Greece €30bn at

around 5% to help it out.

It

is just the same as individuals. If you take out a Bank of Scotland Easy Rate

Mastercard and your credit rating is excellent you will be charged interest of

8.9% APR. If it is not so good then the rate will be 12.9% APR. And if it is

average then it will be 14.9%. Or you might be offered a Plus Mastercard at

16.9% or if your rate is OK, one at 19.9% if it is bad or even 21.9% if it is

terrible. They call it pricing for risk.

It’s the same for countries. Though less extreme. At the moment the UK is paying

about 4% to borrow the money it needs and Greece is paying about 6.2%. Greece is

the riskiest of the Euro countries. And up here is Austria and Germany and then

down at the bottom Latvia and Hungary. So we are mid-table.

But

a year ago we were near the top. Over the last year we have moved from near the

top to the middle. And if the markets are not convinced that we are dealing with

our annual overspend then that rate will grow further.

Now

what does this mean? We owe a lot of money so even 4% or thereabouts costs a

great deal. Here is what the UK Government is planning to spend this year.

And

you can see that out of the £704 billion £43 billion or 6% is on debt interest.

Paying out those investors who have lent us the money we need to survive. That

is more than the £40 billion defence, more than the £36 billion on the police

and similar things, nearly double the £22 billion we spend on transport, and a

lot more than we spend on this – housing and the environment £27 billion. So

paying the interest on the debt we have is one of our biggest expenditures.

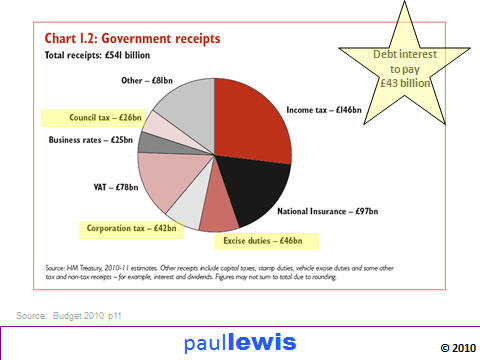

So

that is what we spend and this is what the Government gets in – principally from

taxes – is just £541 billion. So the Government will spend £163 billion this

year more than we take in. That is the deficit. And of course it is added to our

debt which is already huge to leave it at £952bn by the end of the year.

And

look at the debt interest we pay in relation to these income sources - £43

billion remember. It is as much as all the corporation tax paid by companies. It

is about as much as all the excise duties on alcohol, tobacco and petrol. So

next time you fill your car with petrol – or do a bit of vertical drinking – all

that tax is paying for the debt on our loan. Far more than council tax, and half

the amount from VAT – so that could 8% if we did not have this debt to pay. And

it’s about a third of what we get from income tax. Basic rate could be cut from

20% to about 10% if we didn’t have this debt to pay.

So

just servicing this growing debt is costing each of us a lot of money. That is

£900 a year that each adult is paying in tax so that investors can have their

interest.

If

someone went to consumer credit counselling service or national debtline with a

£21,000 consumer debt and said I am planning to spend another £3600 that I don’t

have the advice would be ‘whoa. You must cut your spending and boost your

income’. And for a Government that means spending cuts and tax rises.

Now

the present government has set out its plans to reduce the deficit. But here is

the debt as it will grow. Important to get these two clear. The debt will grow

but the overspend will reduce so we are adding less to the debt each year. Here

is the deficit each year in green. That is getting less but we are still

overspending more than our income by 2014/15 so the debt is still growing. In

fact our deficit will more than halve from £163 billion this year to £74 billion

in 2014/15. So our debt is slowly coming under control. But not yet falling.

And

although those figures are set out in the Budget the Government has not really

been upfront about what the numbers mean.

Because we know the totals. What the Government didn’t tell us are the

implications of that total – how you can achieve it. What we don’t know is how

that spending cuts will be allocated.

A couple of

weeks ago I went to the Institute for Fiscal Studies – one of our great

economics think tanks – and tried to cut this expenditure.

We

are planning to spend – by ‘we’ I mean the present Government and we have no

clear indication from the others how much less they would spend – we are

planning to spend £704 billion this year 2010/11. And over the next five years

that is planned to stay pretty much the same in real terms in other words when

you take account of price rises. So by 2014/15 it will be £703 billion. In fact

it will be £773 billion but in real terms that will be the same then as £703

billion is now. So in effect spending is frozen.

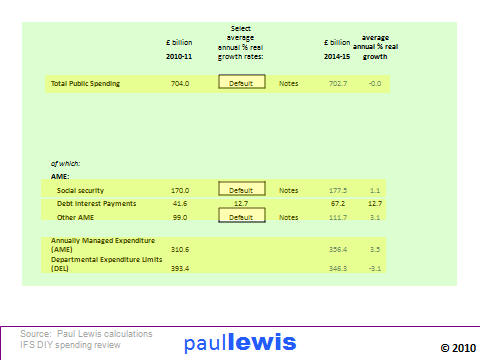

But that hides the big problem. Which is that a lot of spending ISN’T frozen. Social security for example which includes retirement pensions is set to rise by 1.4% a year in real terms according to Treasury forecasts. There will be more older people for example, and that will drive up the cost. Social security is part of what is called annually managed expenditure which is very hard to freeze – look at the fuss in the year 2000 when the state pension only rose by 75p a week – inflation was low then and that was in line with it but there were huge protests. So the pension will rise by at least 2.5% whatever inflation is. Despite that there was anger this year – although the basic pension rose by £2.40 the rest – including SERPS – was frozen. More older people and more expense from state pension when, from 2012 on the Labour plans and sometime soon after that on all plans – the state pension will go up in line with earnings so then it will start rising in real terms.

Then there is

that debt interest – sorry but that cannot be avoided and as the debt grows so

does the debt interest. That is expected to rise from £42 billion to more than

£67 billion over the next five years – which is a rise of

nearly 13% a year.

And if our attempts to keep borrowing down fails then that could rise further –

remember the rate we pay has already risen from 3% to 4% in a year. Another 1%

would add billions onto that bill.

And

then there are things like public sector pensions, contributions to Europe, and

so on. That comes to a staggering £99 billion a year. And that is expected to

rise by 3.1% a year. So this AME will rise from £311 billion to £356bn. Already

almost half of public expenditure is very hard to cut.

And

that means the other expenditure which can be cut will anyway have to fall from

£393 billion to £346 billion That is a cut of 3.1% a year. A cut over the

following three years of 12% £1 in every £8 we spend. But can we do that?

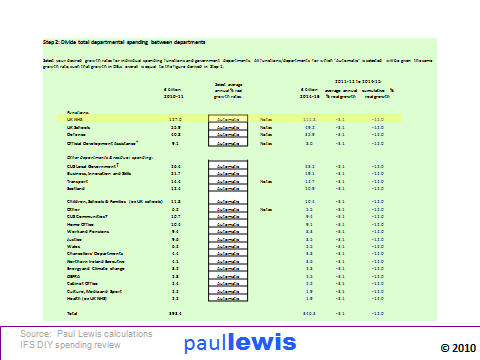

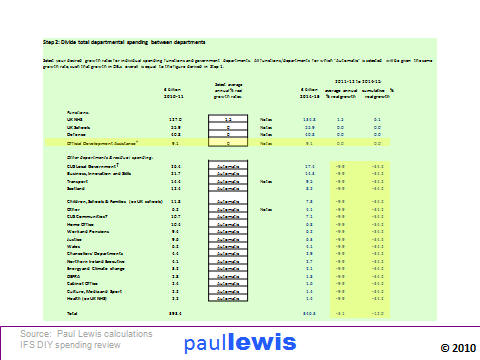

Let’s look at that spending in more detail.

Number 1 is the NHS £127 billion a year. Now this table assumes the NHS will

face the same 3.1% cut per year as everything else. But over the 13 years of

Labour government that has grown by 6% a year. The King’s Fund medical charity

estimates it has to grow by 1.6% a year just to stand still as wages rise, drug

costs rise and targets and expectations rise. So to keep it still even at 0%

would be a cut. So let’s put the 1.5% –

almost – King’s Fund rise in there. Now as soon as you do that the rest of the

world has to make that cost up. So immediately instead of cutting everything

else by 3.1% a year you have to cut by 5.6% a year. It’s just arithmetic.

Schools well we

want to protect them and that’s £55bn untouchable.

Labour is committed to preserving spending on schools – so let’s put that in no

growth but no cut. And remember spending on education has grown by 4.1% every

year by the present government. So if we put 0% in there again everything else

faces a bigger cut 7.2% a year.

Defence – very tricky. Now there are people who would like to see us out of

Afghanistan. They would like to see us not waste so much money on defence

projects which are billions over budget and years behind schedule delivering

weapons systems that are out of date when they finally arrive. Eurofighter being

one example. But if you are hoping to for example scrap renewing our Trident

nuclear fleet – £76 billion of costs – or cutting it to three rather than four

vessels, that won’t help in this period because the costs and hence the savings

will begin in 2015. Defence spending has grown by 1.8% a year under the

Government but let’s say that we freeze it. That’ll still mean cuts – wages,

equipment etc, but let’s freeze it. And then there is development aid – not a

huge amount but we are committed to raising it so we spend 0.7% of our GDP. Now

that should mean raising our help for other countries by 9.2% a year. But let’s

freeze that.

All

that’s left – police (which incidentally Labour is committed to preserving

intact but is not protected here), the courts, the prisons, all the civil

service in job centres, tax offices, culture, sport, social services, local

government, grants to Scotland and Wales to do what they do for national policy,

the Border Agency and so on all of those total about £160 billion.

Now if we cut

all of that out completely – close the courts, the universities, jobcentres,

social services, transport subsidies, roads – even if we stopped all those

tomorrow we would only just balance the budget. And of course we can’t do that.

And remember that so-called ‘frontline services’ are protected by the major

political parties. So job centres, Revenue tax collection, farmer’s subsidies,

business help all stay.

And

it is no coincidence that David Cameron has said he would cut Whitehall by a

third. But not just Whitehall, Cardiff, Edinburgh, Newcastle, every town in the

UK where people work for the state would have to be cut by a third.

And

this is keeping spending at the same level it is now roughly. But even freezing

overall spending implies big cuts in the things that are not protected. And by

keeping spending at the same level it is now you are relying on growth and

rising taxes to close this gap between income an spending.

But

if you look at the manifestos of the main parties – Labour, Conservative,

Liberal Democrat and Plaid Cymru – you will see very little about raising money

from tax rises. They all do a bit of it. But every rise in taxes actually pays

for a cut in tax somewhere else. And on spending they speak of

tough choices (Labour manifesto)

tough choices (Liberal Democrat manifesto)

Urgent action is needed (Conservative manifesto)

But

the details disappoint – they are a few billion here and there on efficiencies,

on getting rid of waste.

“with

£950m saved through

“cut

Even the Lib Dems who say

We have already identified over £15 billion of savings in government spending

£10

billion is a drop in a very big ocean of debt.

No

wonder the FT says there is a £30 billion hole at the heart of the political

parties’ plans.

So

what really radical ideas could we have?

Do

any of you here have a cash ISA? There’s about £158 billion in cash ISAs – if

the Government confiscated al that money – just took it – that wouldn’t quite

clear the deficit this year. And next year we would be back to borrowing £131

billion on current plans. So next year it could confiscate all the investment

ISAs as well £116bn that would almost clear next year’s deficit. After that? Not

much left.

We

could cut the state pension – say £10 a week off that and off pension credit too

of course – would save £6bn a year or so.

Or

we could cut all social security benefits and pensions by 10$ - that might save

£15 billion.

But

there is another choice.

David Cameron likes to give a homely example. When families face financial

troubles they cut back their spending. Yes. But they also try to earn more. Take

an extra part-time job, get a promotion, or do a bit of work on the side.

So

could we tax our way out of the hole? Each 1p on income tax brings in £4.75

billion next year. Labour has said it will not change the tax rates. And for

decades the only way income tax rates have gone is down.

However, it has said nothing about tax allowances – the tax-free bit of our

income that we have before we pay tax. It is already scrapping that for people

with an income over £100,000. If all tax allowances were cut by 10% – a few

hundred pounds – then that could bring in £8.5 billion.

And

each extra percent on VAT raises the same amount as 1p on income tax. So raising

it to 20% would be a simple way to bring in almost £12 billion a year.

And

raising stamp duty by 1% point on all rates would raise almost £2.5bn.

These are very tempting to any new government that wants to balance the books

more quickly.

The

Conservatives say they will move towards a balanced budget more quickly than

Labour plans.

But

whoever is in power Labour, Cons, Lib Dem – or even Plaid Cymru holding the

balance of power in a hung parliament – the deficit will have to be dealt with.

When I was young I had a poster in my room

Whoever you vote for the Government will get in.

In

fact whoever you vote for the Treasury will get in. Or as Eben Halford a 38 yr

old IT consultant told The Times “there’s not much to choose between

them. The head may change but the machine underneath doesn’t.” (The Times

14/4/10)

And

whoever becomes Chancellor after the election will face some pretty grim

choices. Cuts in jobs – and tax rises.

How

will this affect housing?

Now

one of the cuts that will be made is in housing support. Cuts to direct support.

Cuts to wales government. Cuts to local authorities.

1.

Easy to make

2.

Blame devolved government (assembly/local councils)

3.

Not much in the manifestos.

Lab:

we will enable more people to get on the housing ladder

LD:

providing more affordable homes

Con:

We will make it easier for everyone to get onto the housing ladder

Plaid Cymru understands the difficulties that first-time buyers face in getting

onto the first rung of the housing ladder

We

have become dependent on home ownership and its once inexorable growth.

That was partly because of the end of security and rent control for private

tenants.

But

now home ownership is declining in UK – below 70% (though not in Wales where

still 73%) as prices have been driven to artificial heights.

Prices are rising because of supply and demand.

Number of households is increasing but dwellings not being built to match. So

demand is increasing faster than supply. So prices will rise.

We

saw a temporary halt in demand because of lack of finance. But the home

ownership market is very resilient.

Young people being priced out of the market by higher deposits. That leaves some

rural areas unaffordable for those who were born there. That damages

communities.

You

can get 90% loans but only if you have a squeaky clean credit rating and a good

steady job – preferably two good steady jobs.

Changes: we need to increase supply of homes. Major house building for rent by

the state. That will take the pressure off prices and let them fall back down

again.

Long term: change tenure laws so that people do get security of tenure. With

lower prices landlords will come back into the market and will be able to make a

reasonable return from rents not capital growth.

Until that happens banks must play their part – especially those that are part

owned by taxpayers – the very people whose children can no longer get the loans

they need. Not with silly loans, not 125% loans nor even 100% loans but with

loans up to 90% on reasonable terms for the right people.

And

of course in Wales you have a particular problem of second homes. And it really

is unacceptable for people who already have a home to buy another and push

prices up to cut out local first time buyers. It is wrong. But I don’t know how

to solve it any more than you do.

So

the economy of the UK is in difficulties. Deep down it is very strong. We have a

large and hard-working population, an effective infrastructure, and a long

history of entrepreneurialism. But we have been spending more than our income

for years. And we have to stop.

And anyone who thinks that will be painless or easy is fooling themselves. And anyone who simply fails to talk about it at all is probably standing for election.

Thank you.