These seminars were given 6th and 8th September 2009

The text here may not be identical to the spoken text. It is based on a

presentation and my seem brief or abbreviated in parts.

C4 YOURSELF! ARGOS DISTRIBUTION CONFERENCE 8 & 10

September 2009

HERITAGE MOTOR CENTRE

I

was asked to do a seminar on Managing Domestic Costs which I thought sounded a

bit boring. So I changed it to Money Magic. Now I discover that I am billed as

Up Close and Personal. So if you are expecting a massage or an agony aunt you’re

in the wrong place. We’re here to talk about money.

But

of course in some ways this is about our most intimate relationship – with our

money. No relationship lasts so long, causes so much pain and indeed joy. Or

maybe that’s just me.

Because money is my life – or my working life. I am a financial journalist. And

have been writing for 25 years about managing money and how we can make sure we

get the better of banks, insurance companies, credit cards, advisers, in fact

the whole of the financial services industry.

My

main job now is to present Money Box on Radio 4. And you may see me on Breakfast

on BBC1 or on the BBC News Channel.

I

also write for Saga Magazine – which some of you may see – at your mum’s of

course. Or the doctor’s. And I write for other magazines and organisations.

We’ve got about half an hour here. I am happy to take questions or interruptions at any time. And I thought I’d start by finding out your concerns about money. And this presentation reflects the top items which Argos members have raised with me.

One

thing I didn’t say in case it put people off coming along is that we will be

doing some arithmetic. But don't be concerned about that. Money is arithmetic.

And the banks make money because they are so much better at arithmetic than the

rest of us. And don’t think they are not

making money. It is true that some have made thumping great losses. But if you

just look at retail banking – that’s current accounts, credit cards, savings,

mortgages, dealing with our money – they are all still very profitable.

Now

of course it is good that UK retail banking is profitable. If it wasn’t then we

wouldn’t have banks and all the convenience that brings. You all work for a

company and it makes a profit. So we have the convenience for shopping at Argos

and you all have work. Which is good. But just look at how they have performed.

|

UK BANK PROFITS

|

||||

|

2009 H1

|

% ch

|

2008

|

2007

|

|

|

RBS/NatWest

|

-514% |

-£40,667m |

£9,832m |

|

|

UK Retail only |

£877m |

-12% |

£1,764m |

£2,007m |

|

Lloyds BG

|

£807m |

£4,000m |

||

|

UK Retail only |

£360m |

+4% |

£1,793m |

1,720m |

|

HBOS

|

-- |

-298% |

-£10,825m |

£5,474m |

|

UK Retail only |

-- |

-38% |

£1,265m |

£2,026m |

|

Barclays |

-14% |

£6,067m |

£7,076m |

|

|

UK Retail only* |

£659m |

+15% |

£2,158m |

£1,878m |

|

HSBC

|

-58% |

£5,072m |

£12,106m |

|

|

UK Retail only |

£222m |

+24% |

£918m |

£740m |

|

TOTAL UK

RETAIL*

*includes Barclaycard

|

£2,118m

|

-6%

|

£7,898m

|

£8,371m

|

In

2008 – during the worst banking crisis in living memory – Barclays made £6

billion profit and of that £1.4 billion was from retail customers. You and me.

And Barclaycard made £789 million – up 31%.

And if you look at the first half of this year while all banks retail profits have fallen Barclays and Barclaycard £659mn, RBS/NatWest £877mn, Lloyds (including HBOS) £360mn. HSBC £222mn. So still very profitable. More than £2.1 billion in one of the most challenging half years for banking ever.

Because when it comes to you and me, taking money off us is easy. So don't feel

sorry for the banks if we take a bit back. They won’t feel it.

SPENDING

When you go to work is there one thing you buy – a paper, a coffee, a train fare

– what does it cost?

Say

you spend £1 on something. How much do you have to earn to pay for that treat on

the way to work?

If

you work full time after taking off statutory holidays and typical sick leave

(6.4 days in the private sector) there are 225 working days in a year.

So

if you spend £1 a day what does it cost over the year? £225? But to have £225 to

spend you have to earn a lot more than that because tax and National Insurance

is taken off.

|

You spend each day |

£1.00 |

|

5 days x 52 weeks |

260 |

|

less

paid leave (inc. Bank Hs.) |

-28 |

|

232 |

|

|

less

sick |

-7 |

|

Net days at work |

225 |

|

You spend £1 for 225 days |

£225.00 |

|

Have to earn |

£326.09 |

|

CHECK THAT'S RIGHT |

|

|

Gross earnings |

£326.09 |

|

less

tax 20% |

-£65.22 |

|

less

NI 11% |

-£35.87 |

|

NET PAY |

£225.00 |

In

fact to afford a regular payment of £1 every work day you need to earn about

£325. So if you spend £2 a day it is

like a pay cut of £650. So cutting out that regular treat – and don’t say ‘I

deserve it’ you don’t we all go to work – is like a pay rise.

So

giving up your morning cappuccino would be like a pay rise of £650 a year. And

not giving it up is like turning one down.

“No

thanks, boss. I’m OK really. I don’t want another six hundred and fifty quid a

year. I’m happy as I am thanks.”

Little savings every day mean big savings in a year. And the rest of the savings

I am going to talk about are not treats – like your newspaper and cup of tea on

the way to work. They are things you don’t want to spend anyway. Money the banks

take off us without us even noticing.

CREDIT CARDS

Credit cards. What is the difference between a credit card and a debit card?

DEBIT CARD = SPENDING

CREDIT CARD = BORROWING

You’d be surprised how many people see them as interchangeable.

Credit

cards can be a good thing. They help us manage short-term cash flow, buy

something you need now without waiting. But they can easily get out of hand. And

they can be expensive even if you manage them well.

I

have a golden rule

GOLDEN RULE

Always pay off the debt for what you’ve bought before what you’ve bought wears

out. So pay for Christmas within 12 months. Pay for a holiday before you take

the next one. And pay for that pair of shoes – well before they’re out of

fashion. Say a couple of weeks.

Take a typical credit card, one charging 18.9% APR.

If

you keep a debt of £1000 on that card over a year it costs you £189 in interest

– that is £3.63 a week – just to pay the interest. And at the end of the year

you still owe £1000!

And

suppose you decide to be good, cut up the card and pay off the £1000 debt, how

long will it take you? Take this typical card, APR 18.9%, minimum payment of

2.25% of what you owe with a minimum of £5. How long does it take to pay it off?

In

fact it is 21years 2 months. And in that time you have paid £1512 interest – for

borrowing £1000!

But

here’s a trick. In month one you are paying the minimum payment of £22.83. If

you can afford it this month you can afford it next month too and the month

after. So make a regular payment of that much and you pay off debt in

And

only pay £609 interest.

Even better double your payment to £45.66 and pay off debt in

And

only pay £218 interest,

Some people say cut back on credit cards. I say take out more. Because the banks want to tempt us in with special offers. The way to use them is to take the offer but don’t be tempted in. Here is my...

...Five Card Trick.

Card 1 – zero percent balance transfer card.

If you have credit card debt that worries you then the answer may be a card

which charges zero percent on the transferred balance for a year or so. You will

be charged a one off transfer fee – normally about 3%. That is still a good deal

if you keep the transferred balance there for a year. During that twelve months

you can pay off the debt or keep it there out of harm’s way and pay off more

expensive debts. Cut up the card on arrival.

Card 2 – low life of balance transfer card.

If you have a worrying debt but really cannot sort it out within a year then a

low life of balance card is an alternative. They let you transfer a balance and

pay a low interest rate – around 6% or 7% – on that balance until it is repaid

however long that may take. You may be charged a fee. Beware that some cards

only guarantee the low rate for a fixed period. Cut up the card on arrival.

Card 3 – zero percent purchase card.

If

you know you are going to use a card to buy something expensive why not take out

a card that charges you zero percent on your purchases for up to a year. It is a

cheap way to borrow – but always make sure you repay the amount within the

interest free period and cut up the card at the end.

Card 4 – cashback card.

If

you pay off your credit card bill in full every month without fail a cashback

card can make you money. They give you back between 0.5% and 1% of everything

you spend on the card. Only worth it if you never go into debt on the card as

even one month’s interest can wipe out a year’s reward. Not to be confused with

‘rewards cards’ that are generally not worth having.

Card 5 – foreign use card.

If

you spend money abroad – or over the internet in foreign currency

– most credit cards add a surcharge of up to 3%. Avoid that by picking a

card which charges nothing or no more than 1% for foreign usage.

All these special deals are getting rarer. Find them through

www.moneyfacts.co.uk

the

standard comparison site

www.moneysupermarket.com a similar

www.moneysavingexpert.com

And

talking of foreign use –

Use

a debit card to get cash out of foreign ATMs. Debit cards are always cheaper for

cash than using a credit card which will charge a higher rate of interest and

the interest starts at once. Sometimes it hard to ever pay off completely.

Whenever you use your card abroad you may be asked if you want to pay in

Sterling or in the local currency ALWAYS say the local currency. This may seem

counter-intuitive but you will get a better rate from Visa or Mastercard than

you will by letting the local agent do the conversion. It is called Dynamic

Currency Conversion and it is a way of getting more money off tourists.

And

never ever ever use your credit card to get out cash in the UK either.

SAVINGS

There are good deals out there on savings. But before I talk about savings if

you have debts pay them off first. There is no point in having a debt that costs

you 9% or 19% a year and savings earning you 2% a year or less – before tax. So

spare money should be used to pay off debts first. The only two possible

exceptions are student loans were interest rates are set at the rate of RPI

inflation and are currently either zero or negative. And some tracker mortgages

which are close to zero.

If

you have money to save what is the best way to do it?

Savings have never been so complicated. And I can't go into all the choices but

here’s a couple of thoughts.

Fixed period – one year, two year, five year bonds. Savings

bonds with a bank or building society.

You have to tie it up for that period.

If you don’t you can lose some or all of the interest it has earned.

The interest will normally be taxed at 20%.

Currently there are some good value bonds out there paying up to 4%.

Instant access – you can take your money out or put more in at

any time. But beware. They use lots of tricks to get our money. Two favourite

tricks to lure us in.

1.

Bonus

– the rate looks great but is rubbish after a year.

•

For

example

ING Direct offers 3.16% but that includes a 2.66% bonus for 12 months. So after

a year it falls to 0.5%. Takes it from 4th in best buy tables to 85th.

2.

Withdrawal penalty

– called instant access but if you take your own money out you are penalised.

For example

•

West Bromwich No Notice Saver Direct 12th best buy in the best buy

tables paying 2.8%. But if you take money out more than twice in the year the

rate slashed to 0.05% on the money left for the rest of the year (1 May – 30

April).

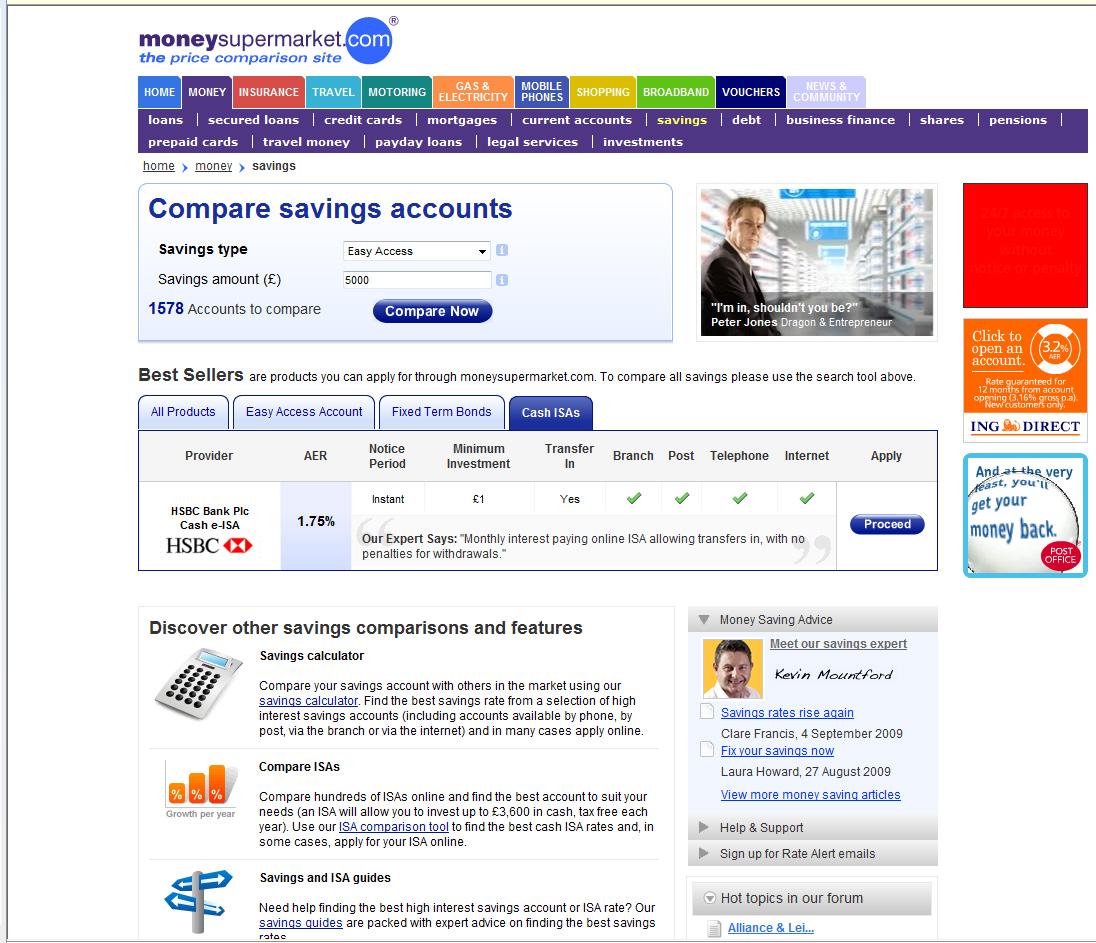

Using comparison sites

How

do you choose? Use the comparison sites such as MoneyFacts.co.uk, or

Moneysupermarket.com

But

again you have to be aware of the tricks.

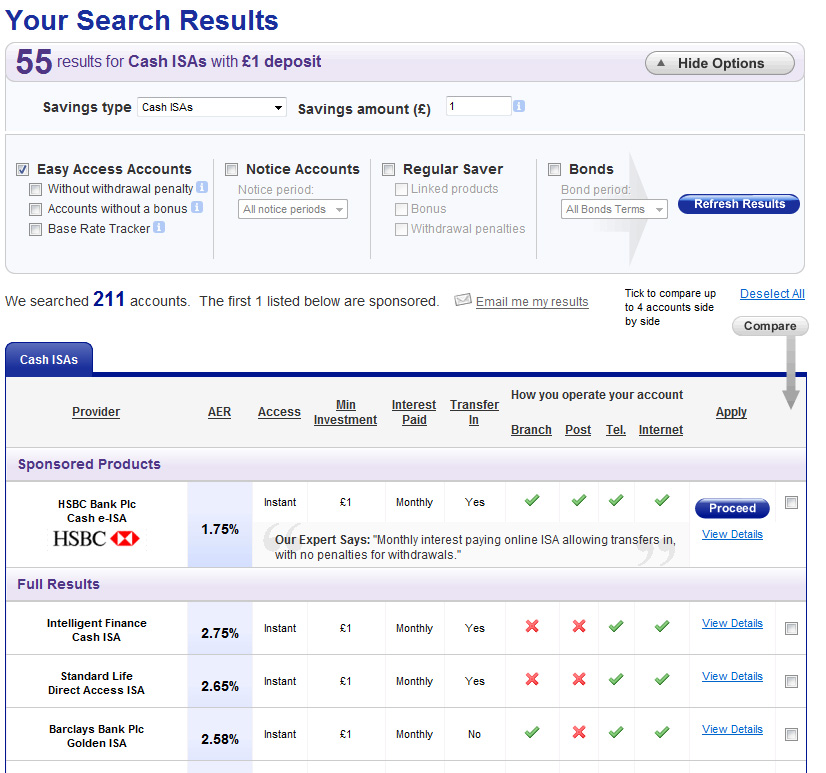

1.

The sponsored link.

Many sites let firms buy their way to the top of the list. Normally these

products are shown separately and the full list is given below the entries that

pay for their position. But the sponsored links can fill a whole screen. So it

is always worth scrolling down to make sure you are finding the real best buys.

And

MoneySupermarket also has what it calls Best Sellers. They are just sponsored

links. Here is the ISA search page and on it is the HSBC ISA.

2.

The missing firms.

Not every product provider is listed. Some choose not to be. Others do not

provide the information regularly enough or in the right format. And some are

just missed out. Some of the absent products might be the best deal. So try two

or three comparison sites and compare them.

3.

Paid for adverts.

The advertisements are normally separate and clear to see, as in the top

illustration above. But beware. The claims made in the ads may not be as clear

or objective as the deals in the best buy tables. Always cross-compare.

4.

Click-through payments.

Every time you click on a link to a financial firm or product the website will

get a payment. And if the click leads to a sale the website will get more. The

amounts of these payments are kept secret. So you can never be sure if the way a

product is shown or the prominence it is given depends on a good click-through

rate. But the temptation must be there.

5.

Deals and offers.

Finally, the product providers study the way the best buy tables are compiled

and try to find ways of getting into the top five by tweaking their product.

That is why savings accounts offer those ‘bonus’ rates for six or twelve months.

That can propel them to the top only to plummet down towards the bottom when the

bonus runs out. If you buy one make a note in your diary and switch in good

time. Insurers will pare their premium to the bone by cutting back on the

service or the extras or imposing a very high excess. You may not realise this

trick until you make a claim.

DEBTS

Always pay off the debt for what you’ve bought before what you’ve bought wears

out. So pay for Christmas within 12 months. Pay for a holiday before you take

the next one. And pay for that pair of shoes – before you give them to Oxfam.

There is nothing wrong with debt. Debt helps us manage our income, even it out

over the times and the things we want but can’t afford. So debt is fine.

So

what is bad?

Ø

Debt we cannot afford

Ø

Debt at extortionate interest rates

Debt we cannot afford

The

average debt taken to one of the major debt charities is over £30,000 – and that

is consumer debt not mortgages.

Lots of people say to me 'Isn’t it their fault?' if they have too much debt. They are grown ups, they take it on knowing the consequences.'

I don't really agree with that. Often

it

happens because of lax checks by the banks. If you have a clean credit record it

is easy enough to get £25,000 of credit card debt. Your monthly repayment is

£500. A lot of money but people do afford that. Sometimes by taking out further

debt. It is literally a slippery slope.

Debt can also get very serious because of life changes.

Here is the latest research from the FSA - published this month - on how life events can change our financial health.

|

Life event |

Financial problems |

Financial capability |

|

Have a baby |

+19% |

DOWN |

|

Become unemployed |

+63% |

DOWN |

|

Divorce or separate |

+17% |

DOWN especially women |

|

Retire |

+31% |

|

|

Enter work |

-27% |

UP |

|

Have employed partner |

-15% |

UP |

|

Get married |

|

DOUBLES |

Source: The impact of life events on financial capability,

Consumer research paper 79, FSA, September 2009

So the banks have to take at least some of the blame for extreme debt. And stuff that happens takes a bit more.

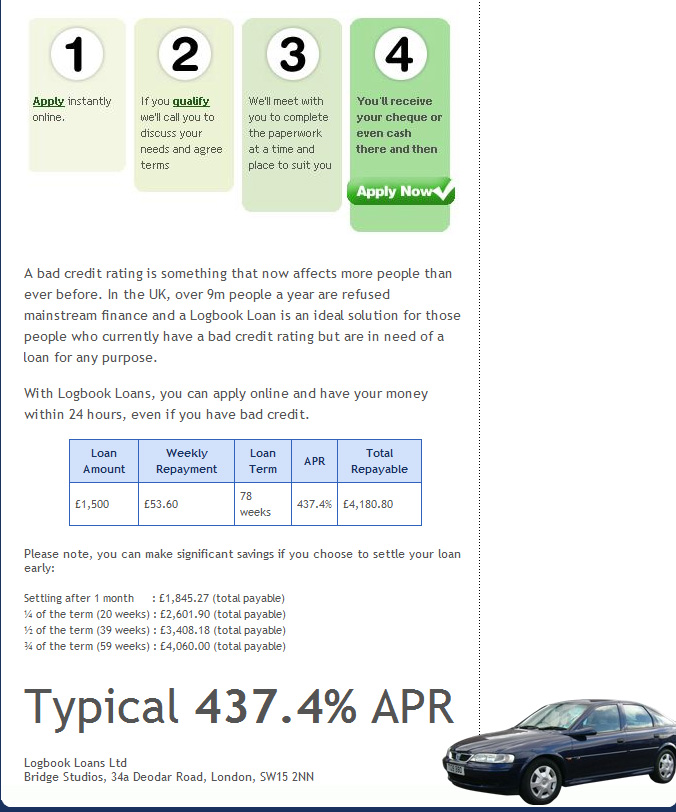

Debt at extortionate interest rates.

There is no law about a maximum interest rate in the UK - unlike Germany and

some states in America. So the offers described below are legal and the firms

themselves are perfectly respectable and licensed by the Office of Fair

Trading. But the rates they charge are - well, if not extortionate, quite

extraordinary.

Log

book loans are secured on a car or motorcycle. The APR on this site is quoted as

437.4%.

|

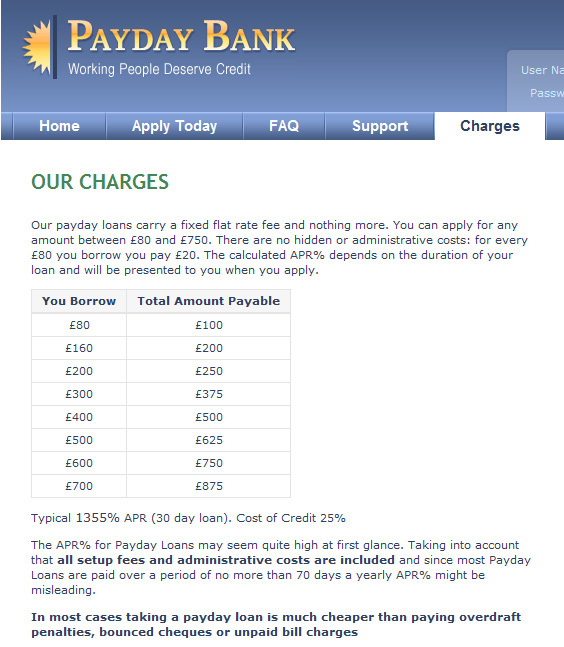

Pay

Day loans are a fairly new phenomenon to the UK. The idea is that you borrow a

small amount when you run short and pay it back when your monthly pay day

arrives.

|

|

Companies that make short term loans like to say that APRs are misleading. And

they often give the example of the £20 loan and half pint of beer shown above.

Which they say shows how silly APRs are. But in fact it is our instinct which is

misleading. The arithmetic tells us the real cost of short term borrowing.

Another tempting offer is to consolidate debt. Wrap it all up, take out a new

loan (and the temptation is plus a bit more), and then spread those payments out

further.

paying off debt by borrowing more is not paying off debt.

It

seems cheaper. That’s because it is spread over more years – maybe up to 20. And

although it cost less per month you will pay far more in interest over the whole

term of the loan.

My

rule is that if you wake up worrying about your debt. Or you lose sleep over it

then you must get help.

PENSIONS

Ø

Rule 1 – start as young as you can

Ø

Rule 2 – put in as much as you can afford.

Ø

Rule 3 – if you can’t put in enough don’t put in anything.

Ø Rule 4 – no-one knows how much ‘enough’ is.

The problem is means-tested benefits. In this country we don’t let people

starve. If you have nothing – literally nothing – then at 60 state gives you

£130 a week. If you have less than that you get the difference. So if you have

£90 you get £40. So there is no point in saving up if it is only going to take

your income up to £130 a week. You will be no better off.

And

once you reach 65 it gets more complicated. Up to £96 a week – £1 above basic

state pension – the state makes your income up to £130. For every pound above

£96 you not only get your income made up to £130 but you get a bit more what is

called ‘savings credit’ on top. For every pound on top of £96 you are allowed to

keep 60p. So you are being taxed at 40p in the pound on your extra money. So it

is barely worth it. Only when your income is £181 or above are you above the

means test and every £1 you get you keep.

Well sort of. Apart from pension credit there is council tax benefit if you pay

council tax. And there is housing benefit if you pay rent. They can help you

with an income right up to more than £250 a week single and much more if you are

a couple.

So

if you pay into a pension and it puts you in these zones you don’t get to keep

all of it and it is less worthwhile.

Now

no-one knows what the means-test will be when today’s workers retire. The

present one has been around less than 10 years. It may not survive another ten

years. We just don’t know. And that is why we have rule 4.

But

from April 2012 everyone in work will have to be put into a pension by their

employer. Companies which have a pension – like Argos – will have to enrol

everyone. From 2012 you will automatically be put into a pension scheme – either

the company’s own or a new state sponsored scheme called, confusingly, ‘personal

accounts’. You will be able to opt out. But joining in the first place will be

automatic.

If

your employer does not have a pension they will have to put you into a personal

account pension. Contributions into personal accounts will be low. And there

will be many people – certainly 10% - who will not be any better off by putting

money into the pension. The problem is we don’t know who they are. That will

depend on their circumstances for the rest of their working life and in

retirement. Older, renters, low paid will be most at risk.

There are two sorts of pension:

All other pensions - stakeholder, personal and so on are all the pension pot sort.

And

look at how much goes into these two sorts in the average company scheme.

So salary related pensions tend to have much higher contributions than pension

pot schemes.

The table below shows the best annuity you can buy for £100,000. Women get less than men because they live longer and the money has to be stretched further. The flat annuity will stay the same however long you live. In twenty years it may seem a lot less than it does now. So you can choose to have less at the start but it will be raised each year either by 3% or by the Retail Prices Index. Although these may not seem big pensions, most people have far less in their pension pot than £100,000. The average is a bit under £25,000. That would buy a quarter of these amounts. Annuity rates vary from day to day.

|

BEST ANNUITY ON 9/9/09 FOR £100,000 AT AGE 65 |

||

|

|

Female aged 65 |

Male aged 65 |

|

Flat |

£6,696 (£558 mnth) |

£7,020 (£595 mnth) |

|

3% a year |

£4,764 (£397 mnth) |

£5,220 (£435 mnth) |

|

RPI prices index |

£3,996 (£333 mnth) |

£4,404 (£367 mnth) |

Source: www.fsa.gov.uk/tables 9 September 2009

Two final points on pensions. You can always transfer a pension from one employer or scheme to another. It may not always be a good idea - especially from a salary related scheme to a pension pot scheme. But you can do it.

And remember that pension contributions are paid before tax is worked out. So you are getting a subsidy from the Treasury. The higher the rate of tax you pay the better this subsidy is - higher rate taxpayers take about half of the total subsidy paid - but is worth having for everyone.

CREDIT REFERENCE

If you’ve ever

wondered what the phrase credit crunch really means try applying for a loan. It

means that it is very very hard to get one. At any price.

Don’t get me

wrong, some people will still get credit. Indeed the numbers getting a mortgage

are now rising slowly – though still half what they were a year ago. How do

these class swats do it? They have a perfect credit score.

Every time you

are late with your credit card or mobile phone contract payment you get a big

amber stamp on your credit record saying ‘warning casual about paying on time’.

And if you have three or more late you get an illuminated red sign which says

‘lend if you like but you may be taking a b i g risk’. And if you miss a payment

or go overdrawn without permission – your current account is now on your credit

file – you get a klaxon going off saying ‘danger danger, reject if you’ve got

any sense’. And all this information hangs around for six years!

Of course, you

might still get credit. But if you do, instead of an APR at 8.9% it will be more

like 29.9%. The lenders call it pricing for risk. The ads tempt you in with a

really low rate (and which they have to give to two out of three people). But

when they see your credit record has more holes in it than an Emmental cheese

they hold their nose and double, treble, or even quadruple the cost.

So always pay

your credit card on time. Never miss or delay an installment on your car loan. If

you cannot guarantee to pay your monthly mobile phone bill every time then bin

it and get a pay as you go. It is more expensive but it cannot damage your

credit rating. And keep up your mortgage payments. If you do not you may never

get another.

Some bills that

do not involve credit are not on your credit record. Of course they have to be

paid too. Not least because if you put them off too long you will be taken to

court. And to say that is bad for your credit rating is like saying your heart

stopping is bad for your health. But do make sure that the bills you always pay

on the dot – or preferably a few days before the dot – are the ones that go on

your credit record.

With a good credit record you can get the best credit deals.

Updated: 10 September 2009

If you want to know more then my internet writing archive - link below - contains a lot of Money Magic ideas for saving money.