Hello. Well after that introduction you’re probably thinking who? What luminary of the financial services industry is before us. Good grief it’s a journalist! That bloke who presents Money Box on Radio 4.

Formal bit now. My Initial Disclosure Document. I am a freelance. I do present Money Box on Radio 4 but I don’t represent Money Box still less God forbid the BBC. I also write for Saga Magazine, Reader’s Digest, and various other outlets. So what is say is mine and mine alone. No-one takes responsibility for it but me. No-one would take responsibility for it but me!

Anyway. I’m honoured and flattered to be here today kicking off your Conference.

I chose the title Too Much Finance and Not Enough Service some time ago. And when I did I could not have known the golden opportunity that was about to be handed to you.

Because, Building Societies, this is your big opportunity. Your best chance to differentiate yourself from The Banks. More and more people don’t trust banks. They are seen as a necessary evil. Now you can’t do much about their nature. But Building Societies can make banks unnecessary.

Let me give you one small example which I came across by chance the other day. I was appearing on Radio 2, a first for me, and on the programme one of the DJ’s posse – how different it is from Radio 4 – Janey asked me about earning a decent rate of interest on her current account where she keeps quite a lot of money to pay VAT and tax and so on. I didn’t know the answer but I thought I’d find out. Because I knew that some current accounts did pay a bit more than the standard bank interest.

Let’s just remind ourselves of the banks’ offers.

Here we are dealing with just the big five. And they all have the same underlying rate of interest – 0.1%. Though to call that ‘interest’ is stretching things a bit. If you keep £1000 balance in there you make just £1 by the end of the year – and that’s before they take off 20p tax. And remember they are lending this money out overnight at about 5.6%.

Some of them do offer higher rates – up to 6%. But typically these all involve either paying a fee or paying in a certain amount of money each month or both. And most of them carry an upper limit above which interest reverts to 0.1%. So the actual amount you can earn in a year is limited.

And some of these higher interest accounts carry a fee – quoted monthly by the bank but here it is over the year. So you can see that if you do pay the fee you won’t even earn that back from your interest.

Barclays and NatWest don’t have a maximum. So here I’ve put in the balance you would need to keep to pay off the maximum fee in each case. £44,400 with NatWest and a whopping £174,000 with Barclays. But at least you’d have free banking.

Then I looked at building society current accounts. Again there are five – these aren’t the big five – I could only actually find five in MoneyFacts. Here they are.

Now the first thing you notice is the variety. They are different. Not that I’m suggesting the banks all agree to pay the same — that would be illegal. The second thing is that in many cases there aren’t limits. Coventry for example lets you put up to £250,000 in your current account and pays 5% - in fact 5.85% for the first year. Now that answered the question from Janey on Radio 2. Coventry’s your best bet. OK you could earn a bit more by transferring the balance from time into Icesave but if you don’t want the trouble here is the answer. Cumberland lets you keep up to £1 million in your current account and pays you 3.75%. Leeds even pays you a tiered rate – the more you have the more interest it pays – up to 3.4% on £250,000. Not a brilliant rate but hey this is a current account. And none of them charges a fee. Though some do require a minimum amount going in and as you can see two do have those silly caps so that they pay you one rate – not a bad rate – on the first few thousand pounds then it reverts to, well at least not 0.1% but something pretty negligible.

And this is what customers want. Half decent rates, few restrictions, and simple rules. That’s what I mean by service. But the best accounts are offered by relatively small societies – Cumberland really only wants current account customers in the Cumbria area unless they have a mortgage with them – when they could clean up nationally. So come on Nationwide your current account charges are the most like a bank’s. Go down the no restrictions route and give the Building Society movement a boost.

But, and it’s a big but even the building societies are not immune from the current campaign to reclaim bank overdraft charges. In fact as I shall show they are very much in the firing line, unless they seize their chance.

This campaign is an extraordinary phenomenon.

Here is just one week’s bank press cuttings in February this year.

This of course is about overdraft penalties charges and claiming them back. About 5 million form letters to claim a refund have been downloaded. And moneysavingexpert.com reckons a million people could be in the process of reclaiming. We know that around 10,000 have reclaimed about £15 million. And the Ombudsman, an alternative to the courts, says that he is dealing with a 1000 claims a week.

This major legal battle between the banks on one side and customers and consumer groups on the other develops almost daily. Let me just remind you what is at its heart — the Unfair Terms in Consumer Contracts Regulations 1999.

These regulations are long and dull but in principle are very simple. They recognise that when a consumer and a company sign a contract there is a great imbalance of power. The company has the power – the consumer doesn’t. And because the imbalance is so great the company can only put into consumer contracts terms that recognise that imbalance. Terms that do not recognise it or make it worse are unfair.

5. - (1) A contractual term…shall be regarded as unfair if…it causes a significant imbalance in the parties' rights and obligations arising under the contract, to the detriment of the consumer.

So banks and building societies have to treat customers fairly. Not just because the FSA says so now, but because of the law. If the terms in a consumer contract are not fair under the regulations they are of no effect. And taking money using one of those unfair clauses is not just unfair – it is illegal.

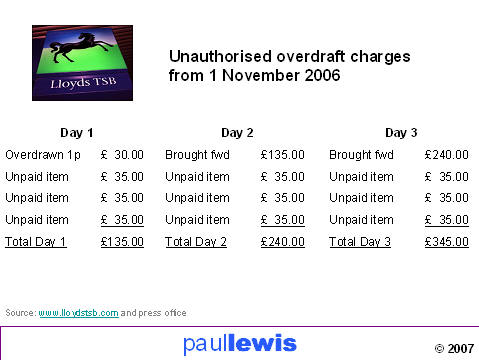

The claim is that the charges made by the banks when we go overdrawn are penalties for breaching our contract and are thus subject to these regulations. Let me remind you how much these costs can be. Take Lloyds TSB. From the first of November last year if a customer of its Classic account – and there are several million – goes a penny overdrawn without permission, the bank charges £30. And if the bank decides to bounce a direct debit or cheque it charges £35 a time with a maximum of £105 a day.

So a payment is late coming in. A standing order is paid, the account goes one penny into overdraft — £30. Another payment is due. It is bounced. £35. Another £35, ditto £35. At the end of day one £135 in charges for being a penny overdrawn.

Day two dawns. Still overdrawn. Another payment is due. Another £35. Ditto. Ditto. A total of £240 pounds in charges. Next day, another three payments due another £105 added on, total of £345 in charges. So the cost of being a penny overdrawn on Tuesday is £345 by the end of Thursday.

Now this person has been careless, perhaps foolish. Three days late with money going into her account just at the time when her standing orders and direct debits are due.

Three days. By coincidence the same time it takes the banks to move money around the banking system. So if the bank is three days late with a payment, it’s a shrug and that’s how the system works. If we are three days late with a payment it’s £345 in fines taken from our money without a by your leave.

Now that seems unfair to me. But is it illegal? Here is the UTCCR 1999 again.

5. - (1) A contractual term…shall be regarded as unfair if…it causes a significant imbalance in the parties' rights and obligations arising under the contract, to the detriment of the consumer.

Schedule 2(1e) of the Regulations gives examples of an unfair term under Regulation 5(5)

"requiring any consumer who fails to fulfil his obligation to pay a disproportionately high sum in compensation"

In other words the charge made for breaking the contract can only reflect the cost of the breach of the rules and cannot have a penalty added on as well.

So the whole question of whether penalty charges are legal or not comes down to the question of what it costs the bank to bounce a payment or simply report you overdrawn. Like what is the meaning of life it is very simple question to ask. But a very hard one to get an answer to. Though generally the banks would like the answer to be 42 - pounds!

On this topic the banks won’t be interviewed. They always put up the British Banker’s Association which speaks for the industry but cannot answer questions about individual policies.

But when Lloyds TSB announced those new penalty charges on its Classic current account last November, it put up Gerard Schmid head of current accounts to come on Money Box to explain these new charges. Here is how it went.

LEWIS: And let me ask you about the charges - £30 if you’re a penny overdrawn; £35 to bounce a payment. Does it actually cost you that much because if it doesn’t the OFT could tell you those charges have to come down?

SCHMID: Well as the earlier discussion alluded to, the OFT has not had a view in terms of whether these charges are …

LEWIS: No, but I’m asking you does it cost you £35 to bounce a payment?

SCHMID: There are a number of decisions that the bank has to undertake in terms of choosing whether to decide to extend credit when a customer doesn’t have an overdraft facility with us or whether to choose to bounce the cheque, so there are a number of complicating cost factors that are embedded in this decision that we do have to make.

LEWIS: So yes or no, does it cost you £35?

SCHMID: I think the way to think about it is a lot of these charges are completely avoidable for customers.

LEWIS: Is it yes or no?

And then a very strange thing happened. The head of current accounts at LloydsTSB just sat there in silence. As the transcript indicates

(Silence)

So I tried again

LEWIS: You’re not saying?

Once more, silence.

I thanked him and he left, in silence.

So on this one central question – when a payment is bounced, does it actually cost the £35 you charge your customers – the Head of Current Accounts at Lloyds TSB sat in silence.

Of course if you are interviewed on live radio "You do not have to say anything, but it may harm your defence if you do not mention when questioned something which you later rely on in court."

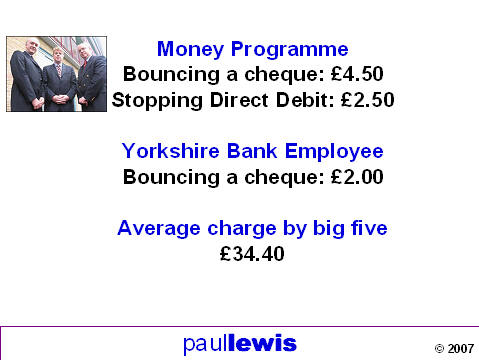

To estimate the real cost the Money Programme on BBC1 brought together two professors and a former senior executive of NatWest.

They estimated that the highest cost that could be justified for bouncing a cheque was £4.50, while stopping a direct debit or dealing with an unauthorised overdraft could cost no more than £2.50. And a Yorkshire Bank employee claimed it was even less - £2. The average amount charged by the banks is £34.40.

For many months the campaign languished there. No bank ever defended itself in court. Just about all claims were met. And judges were getting very cross with the banks for taking matters to court but then paying up.

Then week last Mr Justice Cooke, sitting in Birmingham, took the unusual step of hearing a case even though the bank – and it was Lloyds TSB – didn’t bother to turn up. Normally when that happens the customer wins. But not in this case. Kevin Berwick asked for £2545 in charges and interest from the bank. Judge David Cooke decided to hear the case without the bank and consider the legal arguments.

A month later his judgement was that the contract with Lloyds TSB did not prohibit anyone going overdrawn so the charges were not penalties. So they were not covered by the Unfair Contract Terms rules. Rather they were just a fee for a service. So if it cost a couple of quid to bounce a payment and the bank charged £35 that was not illegal – it was just a bank’s profit margin.

Now this is in sharp contract with the views of lawyers and, indeed, we believe, other judges. But Judge Cooke was relying not on the original contract which Kevin Berwick had with his bank – no-one had a copy – but with the conditions as he found them on the internet. But I am told that the banks have been busy rewriting their terms and conditions, cutting out the word ‘penalty’ and anything which implied overdrafts without permission were prohibited.

HSBC’s terms and conditions for example now state that if you go overdrawn without permission that will be treated as what it calls an ‘informal request’ for an overdraft.

Having considered that ‘informal request’ it will charge you £25 to either go overdrawn or to bounce that payment. They are fees not penalties.

Lawyers I have spoken too insist that companies cannot rewrite contracts in this way to make what is in fact a penalty appear to be a fee. They tell me there are decided cases which mean that line is unsustainable. An appeal is being considered and no doubt we will get an answer from the House of Lords in a few years time.

Now the banks realise that they are targets and are defending themselves. But are the building societies prepared? No. First, the current accounts that I looked at did charge £20 or £25 to bounce a payment or to pay one which led to an unagreed overdraft. Slightly cheaper than most of the banks – though not cheaper than HSBC – but still a very great deal more than the £2 or so it has been found to cost.

But worse than that terms and conditions I looked at make it very clear that overdrafts are not allowed unless approved.

For example Leeds Premier Current account

2.1 Your account must always be kept in credit

Cumberland Building Society

15.1 You must not make any transactions on the account which could make the account go overdrawn.

And Nationwide

51. If withdrawals or payments made from your FlexAccount create an unauthorised overdraft, your account must be brought back into credit immediately.

So an unauthorised overdraft in these cases is a breach of contract. And that means the charges levied are penalties. And that means they must not exceed the cost of bouncing a payment. So if customers ask for their money back – pay up, you’ve no defence.

And I notice Nationwide has put a provision of £50.3 million in the accounts just published – up by £10 million from last year for "various customer claims". That figure I was told by the press office "contains a number of elements, four or five, and is not dominated by any one thing. But yes a certain element is given over to refunding bank charges."

But like any threat here is your opportunity. Don’t go retrospectively fiddling about with the terms and conditions and fudging the issue like the banks do. Make it clear these are breaches of contract. Make it clear that it costs – well whatever it does cost, but please don’t tell us that’s £20 – to send a letter or bounce a payment. And charge us that. A lawful amount.

Go for the service not the finance. In that way you can distance yourself from the banks by behaving openly and fairly. Calling them penalties – but charging what they cost.

Now I’ve spent some time on that and perhaps too long. But honest simple and competitive pricing, especially of things that are normally hidden and secret, is part of a move that the building societies could take. I call it retailisation. What I mean is perhaps best illustrated by imagining how building societies – would sell groceries as if they were mortgages.

It is 2010. After many years of sniping against the growing Tesco-isation of our towns, and using new planning controls smuggled in by backbenchers to the Planning Act 2008 the local Tesco in the county town of Essex is now run by the Colchester Building Society. A triumph for local activism.

I arrive to see how it will work.

At the entrance I am charged £10 to come in. When I ask why I am told that the charge was £5. But Tescolchester has increased it because the cost to leave the shop is now guaranteed to be no more than £3. There is a notice up in the shop

‘Cost to leave - £3. We guarantee that this charge will not be raised during your stay at Tescolchester.’

In the past the leaving charge was set out in a very small notice at the entrance and if anyone bothered to look it was said to be just £1. That was the cost of maintaining the doors that so conveniently opened as you left with your trolley and keeping the mats clean. But when you reached the till the exit charge was often a £5. It had been put up while you were in the shop. After a long investigation by the Office of Fair Trading Tescolchester has decided not to do that. So its entrance charge has been raised from £5 to £10. After all, you wouldn’t really want to open the door yourself or bring your own trolley would you?

As you walk round you’re pleased to see that the best buy tables you consulted before you arrived are accurate. Beans are 10p a tin, much better than the 10.1p in Saints Bury and the 11.5p in Waitrochester. And eggs were at least a halfpenny cheaper for a dozen than anywhere else. Why do people pay such prices you wonder? Though you have heard that Waitrochester only charges £3.50 to enter the shop. But you reckon if you buy enough at best buy prices that will more than pay for the £10 entrance fee – even at a tenner.

Finally you get to the till. As your beans are rung through you notice that you have been charged double the 10p price on the shelf. ‘Hang on a minute’ you say ‘why is that tin of beans 20p?’

The cashier tells me ‘Opening a tin with a tin opener is one of the most dangerous acts we perform in the kitchen. And to protect you and your family we add on our exclusive insurance – Protection from Piercing Injuries.’ She gave me a leaflet on this PPI.

Have you ever wondered, it said, what you would do if you had a cut on your hand that prevented you from providing for your family? More people cut their hand when opening a tin than in almost any other

kitchen activity. Don’t let your children face the choice of starvation or having blood in their sandwiches. PPI costs just 10p a time. Not a lot for peace of mind.

Your neighbour George is the only person you know who actually has cut his hand when opening a tin — and he was drunk. A fact he failed to mention when claiming. But that didn’t stop the claim. What stopped it was that his medical records showed that he had in fact cut his hand twenty years earlier while slicing bread and failed to mention it on his application.

So you refuse PPI and you’re given a leaflet confirming you have refused it. You check your bill and there is the exit charge £3 as promised but hang on what’s this, a guard is putting cling film all over your trolley – to protect your food from the weather he says – and yes there on the bill is the final charge – a fiver, a sealing fee.

Now if grocery shopping really was like that it wouldn’t be long before someone came along and shook it up. Shops did used to sell a few products at uncompetitive prices, they opened at 9, shut at five, took a lunch hour, and half a day on Wednesday – apparently so the shopkeeper could do her shopping – don’t quite see how that worked. And in living memory – I mean my memory – shops in London’s Oxford Street used to shut at lunchtime on Saturdays. Then we got supermarkets, 24 hour opening, Sunday trading, and Tesco metro. Retail has advanced. But why is it that while shop retail advance are in our interests – or at least in the interests of enabling us to shop when we want – advances in mortgages are designed to bamboozle us.

Now in some areas of finance competition does work and work very well. For straightforward savings accounts for example the market is highly competitive and newcomers come in like ING and Icici and now Icesave offering 5.95% with no strings attached and money moves between them. When ING decided to ignore two of the last four rate rises £3 billion flowed out of it into its competitors. Of course there are still rubbish savings accounts and some are paying 2% or 3% or even less and presumably have some customers. Inertia is a wonderful profit centre.

But for many customers the internet has turned everyone’s back room into a highly competitive High Street.

Except with mortgages – your core product – it doesn’t work quite like that. Indeed the internet and best buy tables have been accused of acting against fair competition. There is one easy thing to compare on a mortgage – the headline rate 7% or 5% – they are easy to compare and most people will go with the lower one. And in the desperate search to drive down that rate competitive levels become unprofitable levels. So to keep that rate down you charge us in other ways.

I joked last year that mortgage lenders have a small group of staff employed in the taking-money-off-people-without-them-noticing department. And I repeated this joke on television and I had an email from a viewer who said – It’s true. My Dad worked for many years in a bank — in the Retail Innovations Unit.

One wheeze which came straight out of one of the retail innovations unit is the fee to leave the deal. When a customer comes to the end of the deal, and has performed their side of the contract month by month over 25 years, there is a fee which can have many names but lets call it an exit fee. And the wheeze was that you put the charge up during the course of the loan. When MoneyFacts looked into this last year it found that in 1996 the average was £56. A year ago it had grown to £218. Quadrupled in ten years.

Then of course the FSA stepped in and said it was unfair to raise the fee during the course of the contract. And you all agreed yes it was unfair and froze your exit fee and promised it would be the same at the end as the beginning.

But since the fees at the end were controlled the fees at the start have gone through the roof. Arrangement fees can now be thousands of pounds. And indeed they have become part of the choice. Would you rather pay £495 with a rate of 5.85% for two years or £695 with a rate of 4.99% for three years? That courtesy of Furness B Soc. Tough isn’t it? And with some societies it’s even tougher as they have different fees depending whether it is a remortgage, a house purchase and whether you are an existing customer or a new one.

MoneyFacts tells me that three years ago arrangement fees averaged £281. A year ago they averaged £441. Three weeks ago they averaged £634. And yesterday that had gone up to £676. And that excludes the mortgages with no fees – and step forward here Dudley BS and Shepshed BS and Stafford Rlwy BS who charge no fees. It also excludes percentage fees, also rising 2% or even 2.5% not uncommon. On a half million deal – and that is not uncommon either now – that will bring in £12,500. Does it really cost twice as much to arrange a mortgage for £500k as one for £250k? What do you do, draw it out in tenners and count them?

And although these are fees you don’t send a bill do you? Arrangement fee £695 payable in 30 days. No. It’s payable in 25 years. Because you just add it to the loan. So £695 at 7% a year becomes £3772 just for allowing the customer to walk through the door.

And although these are fees even that wouldn’t matter if you explained that’s what you did.

Adding fees on to the loan without telling anyone is finance not service. And not something which building societies should be doing if you are to differentiate yourselves from the banks.

All this variety means it is impossible to answer the simple question ‘What is the cheapest mortgage to buy this house?’ First you have to sort your way through fixed, variable, discount, capped, tracker – and that’s before we get to offset, current account, and credit impaired. And way before we reach LIBOR linked or dollar denominated. And even if you get to grips with those, there are arrangement fees – flatrate or percentage – higher lending charges, legal fees, survey fees. Amounts which it is impossible to factor in to the total cost without a computer. And then of course release fees. Which, just as you’re walking away from the deal, leap after you and bite you in the bum. At least you know now how big their teeth will be.

No-one can rationally choose between all this. It’s not choice and competition – it’s complexification. The deliberate act of making products so complicated that no-one can understand them. Can never be sure if they have been sold the right product or not. Find it hard to tell when the product goes wrong. And if it does, can never find the evidence to sustain a complaint. So we employ a mortgage broker. Adding another cost to the price of buying a home.

A year ago I complained about this in a speech to the Council of Mortgage Lenders. Did anyone listen? Then the MoneyFacts database had 6437 residential mortgage products. Three months ago I asked again and it was 9508. Yesterday it was 10,665. So clearly I did have an effect. You thought ‘hey, confusion. That’s a good idea.’ And increased your product.

But here is another golden opportunity to differentiate yourselves from the banks. Keep it simple. Keep it transparent. Service not finance. MoneyFacts now offer the public the chance to compare the true cost of mortgages on its website. Why not put the true cost of your deals by the side of them so people can genuinely make the choice. And you know what? Once you started doing that the choices would get fewer because you would be fooling fewer people into spending more than they need to.

Now I’m going to end with a radical suggestion about the future of building societies.

In January Ed Balls, economic secretary to the Treasury and the man who has advised Gordon Brown as long as anyone, asked Otto Thoresen Chief Executive of Aegon to head a review of Generic Financial Advice – accurate and reliable information about their money separate from the sales process. Something of course which journalists like me have been doing for years. And the fact that the newspaper personal finance supplements on Saturdays and Wednesdays are still so bulky, and the fact that Money Box reaches about 2.5 million people a week on the radio and another 400,000 a month on the web shows the demand for impartial, accurate and practical advice.

The banks have turned their back even on independent financial advice. You know if a bank tries to sell you a product it’s not because it’s the best for you. It’s because it is the one that they have an agreement to sell. And that is why the best advice is never buy a product from your own bank. But building societies are not much better. Sure you might refer someone to an IFA chain but often you will act as an introducer to an insurance or life company you have a deal with. So again, no independent financial advice through your branch network.

But building societies are trusted more than banks. Your mortgages dominate the best buy tables. As we saw your current accounts shame the banks. And the atmosphere in the local branch is more friendly than the sales cauldron of personal bankers. And I bet some of your staff do offer generic financial advice. Where do I claim pension credit? How do I pay off my credit card? How do I budget.

Thoresen’s job is not to see whether generic financial advice can be put in place but to see how it can be put in place nationally. One way or another we are going to have it.

With the trust that you have. And the branches that you have. And the mindset your customers have when they visit you – money; sorting out my problems. It is a short step for the building societies to use those advantages and play a major part in providing non-sales, unregulated, clear and accurate money advice.

Now you start with one disadvantage against your competitors. Size.

The Post office has more than 14,000 branches and will probably end up with about 12,200 after closures and replacements with mobiles. They want it. The banks have about 11,000 branches. They want it. But the building societies have just 2148.

But you have trust. And that is where you can certainly beat the banks. And perhaps complement the Post Office. And it is possible that the Government will even pay you to do it.