This piece first appeared in Saga Magazine in November 2009

The text here may not be identical to the published text

Money News

Tax fraud, Capital changes, King Kong, The worst banks, SERPS woes

TAX FRAUD

|

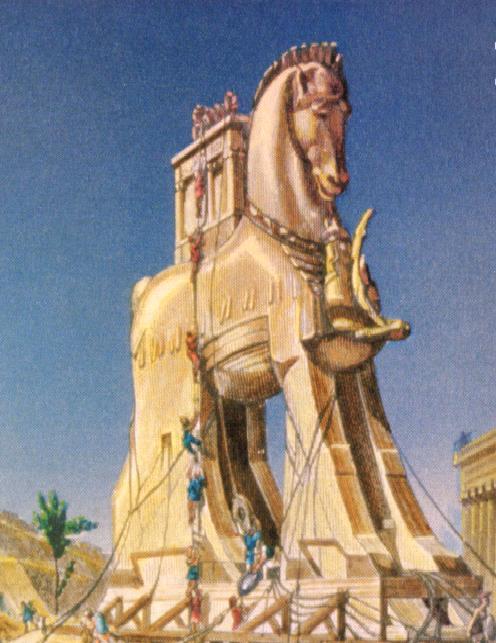

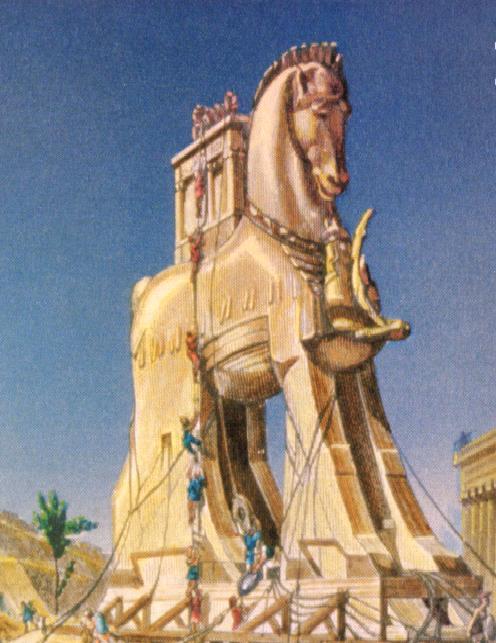

Millions of people are getting emails which say

they are due a tax refund. All they have to do is click on a link to

submit their request for the money. The amounts are modest – often just

a couple of hundred pounds – and no doubt many people are taking the

fateful step of clicking on the link.

Don’t. It is a fraud. If you hover your mouse

pointer over the link you will see that it takes you to a website

outside the UK – many are in South Korea – which is ends in .kr. This

address may well be a forwarding location to an untraceable and

temporary internet café account.

Other emails come with an attachment for you to

click on. The link or attachment may be used to download what is called

a Trojan Horse onto your computer. That is a small programme which

monitors your activity and steal passwords and financial information. Or

it may lead you to a website which asks for information from you and

slowly leads you into the sticky trap where you end up giving away

banking details or sending money in order to speed up the ‘refund’.

Which will of course never arrive.

|

HMRC never sends out emails asking people to click for a

refund. And if it does email you then it will always address you by your full

name. But the safest rule is never click on any link in an email which claims to

be from a bank or government department. If it contains information that you

think you want to follow up make a separate phone call to the bank using a

number on a paper document such as a statement.

Information:

hmrc.gov.uk/security/index.htm

CAPITAL CHANGE

More than half a million people who get pension credit will see their income

go up from the first week in November.

The people affected will all have savings above £6000. At

the moment any savings above that amount reduce the pension credit you get. But

from 2 November that threshold will rise to £10,000 and that will raise pension

credit by up to £8 a week, though most of those affected will get an extra £3.20

and some will get less. You do not have to claim the extra – it should just

appear with the first payment this month.

The new limit also applies to money off your council tax

(or rates in Northern Ireland) and, for tenants, to money off rent as well. All

of them should rise if they are currently reduced because your savings are above

£6000.

The higher savings limit will also mean that 70,000 people

who are currently excluded from pension credit because of their savings will now

be able to get it. Many more will be able to get council tax benefit or housing

benefit for the first time. However the Government has decided not to look for

them or encourage them to claim.

Anyone who has been refused any of these benefits in the

past should find out if they can claim now.

More information: Pension Credit helpline 0800 99 1234

(0808 100 6165 in Northern Ireland). Or put your details into the calculator at

entitledto.com

THE WORST BANKS

|

Lloyds bank, which is partly owned by taxpayers, is the worst in the

UK when it comes to customer complaints. In the first half of 2009

15,233 customers complained to the Financial Ombudsamn Service about it

and its related businesses, far more than the 9,056 who complained about

its closest rival Barclays |

Worse still, new figures from the Ombudsman show that 95%

of the complaints made by customers of Lloyds’s Black Horse subsidiary were

found to be correct. That is the worst performance among the 140 financial firms

in the tables. Third in the list was Lloyds’s Insurance services with 92%

upheld. Lloyds Bank itself was tenth with 81%of complaints upheld. Lloyds relied

on £17 billion of public funds to survive the recent banking crisis and is now

43% owned by us taxpayers.

Many of the worst offenders in the tables are those who

sell insurance with loans. Loans.co.uk was second. But even on pure banking and

credit the High Street banks do pretty badly. Abbey National had 71% of its

banking complaints upheld, Alliance & Leicester had 70%, and Barclays 67%.

Generally building societies did better – though most are small enough to have

too few complaints to be included.

Before a complaint reaches the Ombudsman it has to go to

the bank or insurance company itself which has the opportunity to sort it out.

Only when that fails can it go to the Ombudsman. So it is remarkable that many

big banks and insurers are not resolving more complaints themselves where the

customer is in the right.

One industry insider told Saga “everyone could do better of

course and publishing figures like this will keep everyone on their toes.” Let’s

hope so.

More information:

ombudsman-complaints-data.org.uk

SERPS WOES

The Government is making complex changes to a benefit no-one understood anyway.

But the result is – you’ve guessed it – millions of us will be worse off.

The State Earnings related Pension Scheme (SERPS) was

introduced by Barbara Castle in 1976 to give everyone a decent pension in

retirement. Over the years it has been cut back by every government. It is now

called State Second Pension (S2P) and is being cut again.

People earning more than £31,800 a year will earn less S2P

for their National Insurance Contributions. At its worst they could lose 16% of

the pension earned each year into the future. Over the next twenty years or so

the Government wants to turn S2P into a flat rate supplement to the basic

pension. And the latest cut is part of that process.

Another change reduces the amount of SERPS or S2P that a

widow or widower can inherit. In the past they used to inherit all the SERPS

earned by their late spouse. In 1986 the Thatcher Government decided to slash

this entitlement in half from 2000. But civil servants forgot to tell anyone. So

the present Government decided to phase the change in. A person widowed today

may inherit anything from 100% down to just half their late spouse’s SERPS

depending on the spouse’s age. It is 100% if the deceased reached pension age on

5 October 2000 or earlier. But it is only 50% if the deceased reached pension

age on 6 October 1945 or later. Between those dates the inherited SERPS is

between 60% and 90%. As time passes, more and more newly widowed spouses will be

affected by this cut.

KING KONG

|

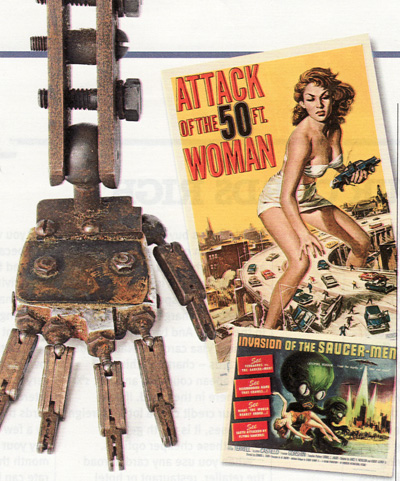

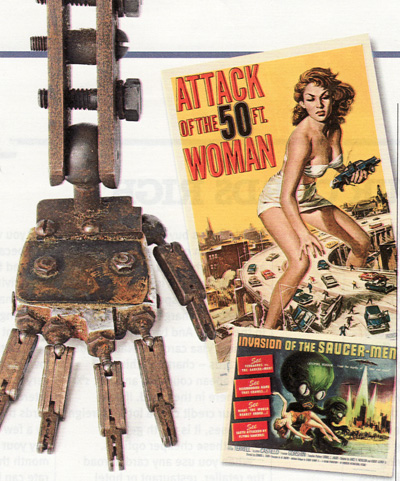

How did they do it? It may seem jerky and

unrealistic now but to cinema audiences in 1933 King Kong seemed almost

real. How did they get a giant ape to climb the Empire State building,

hold Fay Wray in his hand, and grab planes from the sky? The answer is

on sale at Christie’s South Kensington later this month. And if you have

a spare £100,000 or so it could soon be sitting on your mantelpiece.

The 22 inch tall metal armature was made from

interlocking ball and socket joints which were then covered in cotton,

rubber and latex before being finished with rabbit fur. The mechanism

was flexible enough to look like an ape but firm enough to hold still

while each frame was shot to give the illusion of movement.

The unique artefact is the star of a sale which

also has film posters and other memorabilia at far more affordable

prices. Some posters fetch a couple of hundred pounds. But if you used

to beg borrow or steal posters of your favourite science fiction film in

the 1950s now might be the time to bring them out.

Attack of the Fifty Foot Woman

(1958) is expected to fetch up to £3,500. And about half that for

Invasion of the Saucer-Men

(1957).

More information

christies.com

|

All material on these pages is © Paul Lewis 2009