Tips on tipping

A new law begins this month which will stop restaurant owners using the

service charge to contribute towards the minimum wage they pay the staff.

Until now restaurant owners could use the service charge to pay part of the staff’s minimum wage. From 1 October that will no longer be legal. But the Department for Business, which is introducing the change, has confirmed to Saga that owners will still be under no obligation to pass the service charge on to staff. They will be free to use it to pay for other things such as rent, ingredients, or just profit. So the staff could be left on the minimum wage – however good their service and however generous you are.

The Department is relying instead on a new Code of Practice on tips which also begins this month. But restaurants will not be obliged to adopt it or even tell you clearly their policy or the choices you have. If you add the tip to the amount you pay by card – or just pay the bill including the standard service charge which many restaurants now add on automatically – the money will still belong to the proprietor.

The only safe way to make sure the waiter or other staff get the tip is to leave it separately in cash. The law says that belongs to the waiter. And the owner must still pay all staff at least the minimum wage which goes up this month to £5.80 an hour for people aged 22 or more.

So next time you are presented with a bill including service charge, or you are asked to add it to your card payment, why not just pay the basic amount before the service charge – and then leave a completely separate cash tip? That way the waiter will get it on top of their minimum wage.

ISA limit rises for

over 50s REVISED

All Saga readers should be able to put more into their tax-free

ISA from 6 October. Before then the limit for this year’s contribution is £7,200

of which £3,600 can be in cash. From 6 October that rises to £10,200 of which

£5,100 can be in cash. That means you can top up your existing cash ISA by

£1,500 on that date. Not all ISAs will let you do that and strictly speaking you will not be

allowed to take out a new ISA until the next tax year begins in April, though

the Revenue has indicated it will interpret this rule with common sense. The new

higher limit applies to anyone who is aged 50 or more by the end of the tax

year. So even if you reach 50 between

now and April 2010 it will apply to you from 6 October. From 6 April 2010 the limit

rises to these amounts for everyone. Contact your ISA provider to see how you

can take advantage of the new rule.

If you had money in a cash ISA with Icesave your compensation came with a certificate which allows you to put the money into another ISA without losing its tax-free status. The deadline stated on the certificate for putting it into another ISA is 5 April 2009. But that has been extended to 5 October 2009. So if you got money back from an Icesave cash ISA and have not put it into a new ISA you have until 5 October to do that. Not all ISA providers will accept transfers in. Check out the best deals at moneyfacts.co.uk and click ‘ISA transfers’.

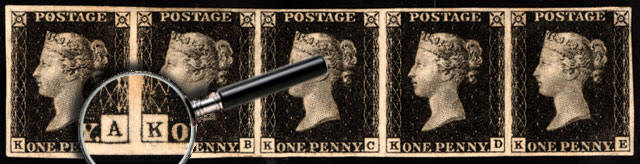

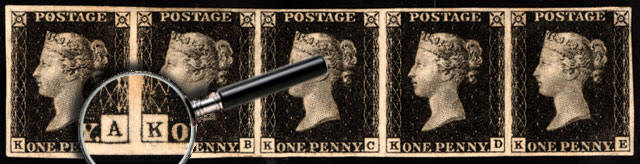

Initial sales of Penny Blacks

We are all used to people spending money on personalised car number plates. But how about a personalised stamp? And not a modern one but an original Penny Black almost 170 years old. That is the extraordinary offer from stamp dealer Stanley Gibbons.

Penny Blacks went on sale in May 1840 and were the first adhesive postage stamp in the world. Within a year the black colour was replaced by a red-brown version. But in that first year more than 68 million Penny Blacks were printed. They all have a letter in each of the bottom corners showing the row and column on the printed sheet. There were twelve stamps across – making a shillingsworth – and twenty down so each sheet was worth 240d or £1. The first row ran from AA to AL and the last row from TA to TL.

Stanley Gibbons marketing manager Alex Hanrahan came up with the bright idea of selling the stamps to people on the basis of the initials. I was recently offer the Paul Lewis stamp with a ‘P’ in one corner and an ‘L’ in the other. He says the initiative has been a great success. Although there is no premium put on the price it does open up a new market. “People might like the idea of the stamp being returned to its rightful owner even if they don’t collect that particular stamp. Everyone knows the Penny Black. And we offer a free framing service.” But remember the resale value of stamps is far less than the price dealers charge.

Pension success

One reader has already gained from the information in my August column about

bereavement. Sheila writes ‘Thank you for your article "Alone - and out of

pocket" in the August issue of Saga magazine. I rang the Pension Service and

have now received the Bereavement Payment and have an extra £47.51 per week on

my state pension (backdated to 15th December 2008) because of my late husband's

NI contributions.’

In all she got more than £3,500. Not everyone will be as lucky. The bereavement payment of £2000 is not paid if the deceased was getting a state pension and the widow (or widower or civil partner) is over pension age. And in many cases the widow’s state pension will already have been increased. But if you have recently lost a husband or wife and feel you are not getting the right payment why not do what Sheila did and call the pension service on 0845 6060265?

Scrappage

Since I wrote about the scrappage scheme for vehicles registered on 31 August

1999 or earlier it has emerged that vehicles which are legally off the road

under the SORN system do not qualify. The vehicle must be taxed, insured and

have a valid MOT to get the £2000 rebate.

October 2009