This piece first appeared in Saga Magazine in September 2008

The text here may not be identical to the published text

Saga Money

How safe are your savings, So 20th century, Take up scandal, Taxing

issues

The Government is considering raising the amount of savings in a

bank or building society that is fully protected from £35,000 to £50,000. A

consultation paper will be issued later this year. It will also look at how the

limit will be applied where people have money in several different banks. At the

moment the limit applies to accounts in each bank which is separately authorised

by the Financial Services Authority. So if you have £35,000 in Barclays and

£35,000 in NatWest both are 100% protected. But if you have two accounts in

Barclays your protection is limited to £35,000 between them. The problem arises

when you have two accounts in different banks but they are both owned by the

same company. In that case you normally get one lot of protection

.

But it is almost impossible to find out which banks are linked in this way and

which are not. The consultation will consider whether each ‘brand’ should be

separately covered by the new limit.

Since I wrote about this complex system in May many readers have

asked for a definitive list of which banks count as separate institutions so

they can split their money and be sure it is fully protected. The table below

shows the connections between some of the better known banks. Note that Royal

Bank of Scotland owns NatWest and Ulster Bank and runs Tesco’s savings accounts.

But the brands are all separately authorised and so money in each is counted

separately for compensation. Most other banks not on the list and all building

societies are separately authorised

.

If a bank or building society merges or is taken over then it may lose its

separate authorisation. That will happen when Santander completes its purchase

of Alliance & Leicester and merges it with Abbey.

Connected banks

- Abbey, Cahoot, Alliance & Leicester (separate until merger happens)

- Bank of Ireland, Post Office

- Bank of Scotland, Birmingham Midshires, Halifax, Intelligent Finance,

Saga, The AA

- Cheltenham & Gloucester, Lloyds TSB

- Clydesdale Bank, Yorkshire Bank

- Co-operative Bank, Smile

- Direct Line, Royal Bank of Scotland

- First Direct, HSBC

This list is not definitive. Check with your bank if you

are concerned.

Foreign banks which are based outside the European Economic Area

(EEA) but trade in the UK must be registered here and are covered fully by the

compensation scheme. However, banks registered in one of the 30 EEA countries

can trade here without separate registration. That would mean you are covered

only by the compensation scheme in the country where they are registered.

However, most major EEA banks belong to a ‘top-up’ scheme so the local

compensation scheme pays the first part of the protection – usually €20,000

(about £16,000) – and the UK scheme pays the rest. Bank of Ireland – which runs

the Post Office savings accounts – is a top-up bank.

Banks based in EEA countries which are part of the top-up scheme

- Anglo-Irish Bank

- Bank of Ireland

- ING Direct

- Landsbanki

- Triodos Bank

For a complete list

http://fscs.org.uk/consumer/How_to_Claim/Deposits/EEA_firms_that_have_topped_up/

If you are really concerned about the safety of your money then

you should put it in National Savings or Northern Rock where any amount is

currently fully protected by the Government. In fact the Government has made it

clear that it will step in if any UK bank gets into the mess which Northern Rock

found itself in. But that is not true for banks which are foreign owned. If any

of them gets into financial difficulties – which is highly unlikely – you will

have to rely on the compensation scheme or the government in the country where

it is based.

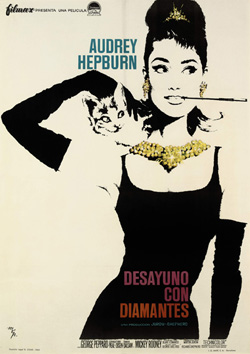

So twentieth century…

|

It is enough to make you

feel old. The twentieth century is less than a decade behind us but already

it is being celebrated as history – and of course art. Later this month the

London auctioneer Christie’s is holding a 20th century week.

Posters, lamps, furniture, art, handbags, shoes and frocks all come under

the hammer. And some at reasonable prices. So what makes the twentieth

century what it is – or was? And is there really anything in common between

the Edwardians at the start and the late Elizabeth II’ians at the end? Yes,

says Monica Turcich fashion specialist at Christie’s. |

|

"What makes the 20th century different is the emergence of

the designer as star. In the 19th century very few ‘names’. In

the 20th Dior, St Laurent. We have boots from Yves St Laurent’s Russian

collection. He took 19th century peasant wear and made it into a

fashion statement." And she says Dior and St Laurent were following in the

footsteps of the French fashion designer Paul Poiret "he drew on influences

all over the world. He did perfumes in little bottles, works of art

themselves, and clothes. His high point was the 1920s."

With the 20th century becoming strong collecting

territory some of that old stuff in the loft may well be worth far more than

you thought. Especially those things you just couldn’t bear to throw away.

One the other hand, if you are in collecting mood a lot of these items can

be bought for fairly reasonable prices.

|

More at

www.christies.com and Monica is glad to advise on

mturcich@christies.com

INHERITANCE TAX

Nil-rate band

There are growing concerns that a major inheritance tax concession is

proving unworkable for many older widows who fear their heirs may not be able to

take advantage of it when they die. Last October the Government announced that

the £312,000 tax-free allowance for Inheritance Tax would be doubled when a

widow or widower died as long as their spouse had left everything to them. Even

if some other bequests had been made whatever proportion of the tax-free

allowance was unused could then be used by the widow or widower on their death.

For example if the first to die left money to his children which used up half

the tax-free limit then when his widow died the heirs would get her tax free

limit – currently £312,000 – and half her late husband’s which would be worked

out as a proportion of the current limit. So they would get an extra £312,000 x

50% = £156,000 making a total of £468,000 before any IHT was due.

So far so (relatively) simple. But the scheme depends on knowing

what the first spouse left to whom and being able to prove it. That may be

difficult. If there was a will and the estate was large then a copy can be

obtained from public records. But if the estate was small and most of it was in

a jointly-owned house then probate would not be needed and the will would not be

registered or publicly available. If it has disappeared that could cause

problems. Even if a solicitor was used and can be traced the firm may have

destroyed any documents more than seven years old. So the very people who

inherited everything from their spouse and who should have a full transferable

allowance may find they are the very ones who have no proof of that fact.

The Revenue says it will accept all reasonable claims and

operate what it calls a ‘light-touch regime’. But it is sensible to get the

widow and any other living relatives or friends who remember what happened to

set the facts down in writing. If you are particularly concerned you could get

that statement sworn as an affidavit by a solicitor.

Older widows

Another problem with the new scheme is that before 22 March 1972 there was

no specific amount that could be left to a spouse without estate duty (as it

then was) being charged. That means that any amount left to a wife (or husband)

used up some or even all of the tax-free allowance. For example in 1970 the

maximum tax free amount that could be left was £10,000. If a spouse was left a

share of a house then a big chunk, perhaps all, of that allowance would be used

up. So there may be little or no allowance left to transfer when the widow dies.

More details of the new Inheritance Tax rules in Paul Lewis’s

free guide at

www.saga.co.uk/images/content/money/inheritance_tax_guide_2007.pdf

Take up disaster

For the first time the amount of state benefits which pensioners fail to

claim could have topped £5 billion in a year. The 2006/07 figures published

recently show that up to £2.8 billion Pension Credit is unclaimed by up to 1.8

million over 60s. To that we have to add up to £770 million of housing benefit

and up to a staggering £1.5 billion in council tax benefit waiting to be claimed

by nearly 2.5 million people over 60.

The number not claiming and the amounts unclaimed are all up on

the year before. Despite that the Government has now abandoned its commitment to

increase the take-up of pension credit claiming that pursuing those who do not

claim "is no longer…value for money."

But new research indicates there is a simple way to boost

take-up. Every pound spent on benefit advice in doctors’ surgeries and hospitals

generates a return of £10 benefit gained. Age Concern England found that that

each full time adviser raised £260,000 for the clients they advised and each

client who was helped, gained £1,549 they would not otherwise have had.

So why doesn’t the government do it?

September 2008

All material on these pages is © Paul Lewis 2008