This piece first appeared in Saga Magazine in May 2008

The text here may not be identical to the published text

How safe is my money?

Car tax, gift aid, winter fuel, pension at 100, tax losers

As the worlds economy or at least our bit of it goes

through turmoil and uncertainty more and more people are putting their money

into cash. Rates are good and it seems safe. But some are asking what if? What

if a major bank did go bust and was not rescued as Northern Rock was?

Under the current guarantee the first £35,000 saved in cash in a

UK authorised bank is protected 100%. The rest is not protected at all. If the

bank goes bust you will get back a maximum of £35,000 from the Financial

Services Compensation Scheme, an independent body paid for by the financial

services industry. So an ultra cautious approach is to keep all savings accounts

below £35,000. Husbands and wives are of course two people. So they can have

£35,000 each. And if they have a joint account it is guaranteed up to £70,000.

The guarantee covers the savings owned by individuals in each

separately authorised financial institution. So there is no point opening five

accounts in the same bank with £35,000 in each. Your compensation will still be

£35,000 in total. Even opening an account in another bank is not necessarily

going to protect more cash. An account with HSBC and another with its subsidiary

First Direct would be treated as being in the same bank. However, accounts in

NatWest and Royal Bank of Scotland which owns it are treated separately

because the banks are separately authorised. So if you had £35,000 in each then

both accounts would be fully protected. It is not easy or even possible to find

out from the Financial Services Authority website which banks are separate. So

always ask each bank if you are intending to separate your savings.

Some banks based in the European Economic Area are not

separately authorised in the UK. Although you are normally entitled to the full

£35,000 you may have to get the first part from the local scheme which could

be as little as 20,000 (£16,000) and the balance from the FSCS. That could take

time. Again, ask the bank.

More at

www.moneysavingexpert.com/savings/safe-savings

Centenary of the state pension

|

|

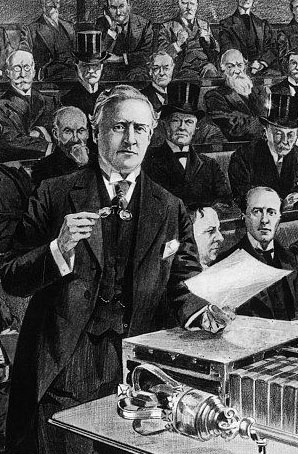

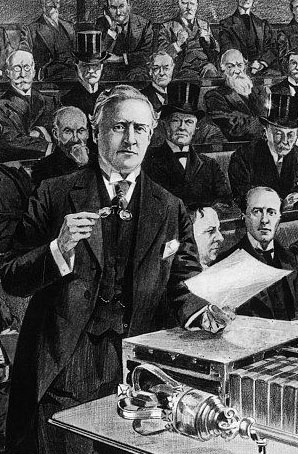

One hundred years ago this month the plans for the UKs

first state pension were unveiled by the Liberal Prime Minister Herbert

Asquith in his Budget speech on 7 May. Three weeks later on 29 May the

Old-Age Pensions Bill was published.

The pension of 5 shillings (25p) a week was worth about

£21.45 in todays money less than a quarter of the current £90.70

retirement pension. But it was a lifesaver for many people when the first

payments were made on 1 January 1909. Until then people who were too old or

infirm to work had to rely on their families or on poor relief provided by

the parish. Often they died from cold and hunger. Getting old was a

desperate time indeed for many people.

To qualify you had to be aged at least 70, a British subject

and resident in the UK for the last twenty years. It was also means-tested

people with an income over £21 a year (£1800 at todays prices) got the full

amount and it was paid on a sliding scale down to 1 shilling for those with

incomes up to £31-10s a year (£2700 at present prices).

It is ironic that it was a Liberal Government which

introduced this first means-test. Now the Liberal Democrats are passionately

against means-testing and want a universal non-means-tested pension for

everyone over pension age.

|

Winter Fuel Payments

The winter fuel payment will be bigger this winter. It will be £250 an

increase of £50 for people aged at least 60 and £400 which is £100 higher

for those aged 80 or more. The qualifying date to reach those ages is 21

September 2008. The payment is per household and based on the age of the oldest

resident. It is tax-free and not means-tested. Many men aged 60 to 64 do not get

it because the Department for Work and Pensions does not know about them. So if

you will be 60 on or before 21 September get your claim in. The Winter Fuel

Payment can be paid if you live in any other country in the European Union plus

Iceland, Liechtenstein, Norway or Switzerland as long as you have received it at

least once in the UK it. Although the higher payment is just for this year, an

imminent General Election will make it hard to take away in Winter 2009.

www.thepensionservice.gov.uk/winterfuel/home.asp

or call 08459 15 15 15

Gift aid spreads

The hospice and homecare charity Sue Ryder Care has pioneered an innovative

way to reclaim tax on the value of the books, clothes, and bric-ΰ-brac people

take into its 370 shops. Until now Gift Aid only applied to donations of cash.

When a taxpayer gives money to a charity the Treasury refunds the income tax

that has already been paid on it boosting the donation by 28p in the pound.

Donations of goods were not covered by the scheme. But Sue Ryder has found a way

to include them.

When someone goes into one of its shops with their goods they

are asked to fill in a Gift Aid form. They are then assigned a unique six digit

number. That is put on the price tag of every item they bring in. When that item

is sold the amount charged is recorded at the till. In that way the cash

realised from every gift can be traced back to the individual taxpayer who gave

it. Each month donors are sent a statement setting out what their goods have

raised and how much Gift Aid tax has been reclaimed. If the donor is a higher

rate taxpayer they can then use that information to reclaim the higher rate tax

when they fill in their self-assessment form.

Sue Ryder Care says it has raised an extra £1 million from Gift

Aid in the first year of operation and reckons if all charities with shops

adopted the scheme they could boost their annual income by £30 million in tax

relief.

Car tax

Vehicle Excise Duty to give the car tax its proper name is being recast

for 2009/10. And some people with family cars in the current bands D and E will

see their annual payment rise by more than 20% - even 50% in some cases. The

tax will still vary by how much CO2 the car emits per kilometre

driven. All vehicles registered from 1 March 2001 have a CO2 emission

level fixed at manufacture. Currently tax varies by seven bands of emissions

from A which is less than 100g per kilometre to G which is more than 226g. From

April 2009 those bands will be split into 13. Some vehicles currently in D will

move to H and pay £30 a year more a 21% rise. Some in band E currently paying

£170 will be put in J and pay £260 a rise of £90 or 53%. On the other hand

every car emitting 140g per km or less will see prices fall. Those in the bottom

half of the current B band will see their tax drop from £35 a year to £20 a

43% cut. The biggest rise will be big vehicles registered before 23 March 2006.

They will lose their exemption from the highest band and if they end up in M

they will pay £440 instead of £210.

The changes apply only to vehicles that were registered from 1

March 2001. That includes all new style numbers and those with the prefix Y.

Older vehicle are in two bands

.

Engines of 1549cc or less which will pay £120 in 2009/10 and those with 1550cc

or more which will pay £200 from next year a rise of £15. In either band a

vehicle may pay more or less than an identical model registered under the new

system. Historic vehicles made before 1 January 1973 will continue to pay a

zero rate of tax.

Altogether the higher tax will raise £465 million in 2009/10 and

£735 million in 2010/11 when vehicles emitting more than 160g will be charged

extra in the first year they are registered £950 for the worst polluters.

Budget footnote

There was no reprieve in the Budget for the 5 million low income taxpayers

who are now paying more tax in 2008/09 than they were last tax year. Anyone who

pays no National Insurance contributions and who is under 65 will pay more tax

if there income is between £5645 and £16,505 a year. The maximum loss on an

income of £7,455 is £181 or £3.48 a week. By contrast those with a pension of

£41,345 or above will gain by £788 a year. People in low paid work who pay

National Insurance contributions will pay more tax and National Insurance if

their income is between £5931 and £15,075 a year. Some will be able to claw some

or all of this back by claiming tax credits. But most will not. By contrast,

those earning over £41,435 will gain by £297. The over 65s are protected from

the losses but will still enjoy gains of up to £788 a year. Again the better off

will gain the most.

May 2008

All material on these pages is © Paul Lewis 2008