The pound is sinking. And taking with it the pensions of a million British people who live abroad. Saga reader Anne writes from Spain that the fall in Sterling over the last six months means that she and her husband "are over 100 Euros short each month". A quick look at the graph will show why. In September last year £100 of pension would get you €147. Today you will get just €132 for the same £100. That’s a cut in your Euro income of more than 10%. Pensioners who live in the USA are also suffering

. Although the pound is strong compared to the dollar it has fallen by 8% from its high in November. Even worse is the position of UK pensioners living in Australia. Their incomes have been slashed by nearly 14% in six months. They are doubly disadvantaged – Australia is outside the magic circle of 40 countries where the UK state pension is increased each April as it is back home. In Australia and most of the rest of the world the UK state retirement pension is frozen at the rate it is first paid abroad. Many UK pensioners living in Australia get a pension of just a few pounds a week – despite paying contributions for most of their working lives. Now even that small amount is worth much less than it was six months ago.

Apart from moving back to the UK there is little that can be done about these problems. People living in 37 countries, including Australia, Canada, the USA and much of Europe, can get their pension paid automatically into their foreign bank account in the local currency. The Government gets a good rate of exchange so that is usually the best way to receive a pension abroad. Pensioners in the rest of the world can have their pension sent as a payable order which they have to pay into their account abroad. Or have it paid into a UK account and transfer it themselves. Either way charges will be high charges and exchange rates worse.

Spot the Dog

Once a year the dog-catchers at financial advisers Bestinvest collar the

mutts of the investment world. They sniff out the funds that have been really

bad. The researchers compare the actual growth of managed share funds with the

average growth of shares in the same area. They do that by comparing them with

an index – so most UK funds are compared with the FTSE All Share index, Japanese

funds with the FTSE Japan, North American investments with Standard & Poor’s 500

index and so on.

To qualify as a dog the fund has to fall below the relevant index in every year for the last three years and end up at least 10% below the index at the end of those three years. It is a tough test. But 70 funds managed it – including many top names. Between them they look after – if that is the word – more than £10 billion of their clients’ money. In every case these investors did worse by 10% or more than if their money had simply been invested in a tracker fund which followed the index.

Some funds actually lost their customers money. The Newton Japan fund defied gravity, falling by 6% while the market rose by 7%. The managers of CF Canlife Smaller Companies selected the shares to invest in so well that the fund did indeed get smaller. It shrank by 12% even though the FTSE index of small companies grew by 32%.

Even dogs continue to charge their customers for the privilege of losing them money. The average annual fee of the 70 dogs was 1.65% of the money invested. Paid, of course, out of the declining fund.

If you have money in a dog fund it may be time to think of moving it. Research by the Financial Services Authority shows that while a fund that performs well may not do so next year, a fund that performs badly is likely to do badly in future. Read the whole report at www.bestinvest.co.uk.

The end of the cheque?

If you are going shopping at major retailers this month there is not much

point in taking your cheque book.

In March Tesco followed Sainsbury, Marks & Spencer, Boots, Currys, Debenhams,

Argos and many others and banned the cheque. All these stores now expect you to

pay in cash or use a debit or credit card. That means remembering your PIN. If

you find that difficult you can ask your bank to let you carry on signing – it

will issue you with a Chip and Signature card and the retailer will see that you

are allowed to sign rather than enter a PIN.

But it is not the end of the cheque. APACS – which runs the plumbing our money flows through – confirms that the number of cheques has fallen from its peak of nearly 4 billion in 1990 to around 1.6 billion in 2007 and will halve to 840 million by 2016. But on average each of us still writes almost 20 cheques a year and we receive 6. Although most major retailers do not accept them most smaller shops do with a cheque guarantee card.

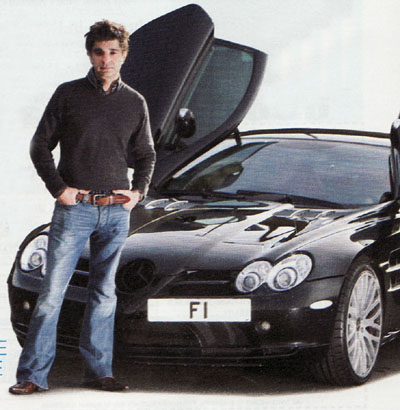

F 1 – Fine Investment?

It’s an old joke that in some parts of London people drive cars worth more

than an average house with a number plate worth more than the average car. Now a

number pate has been sold for twice the price of the average home. In January

Afzal Kahn, an automotive designer, paid a record £440,625 – including VAT – for

the plate F 1. It will grace his Mercedes Benz McLaren SLR.

With a list price of £333,000 the car is worth more than the average home

– but still rather less than the number plate!

F1 was issued in 1904 and is owned by Essex County Council. Until recently it was assigned to the Council chairman’s car. Essex will spend the money on a training scheme to improve the skills of young drivers.

You can buy a personalised plate from the Driver and Vehicle Licensing Agency or through the many small ads that appear in newspapers and on the internet. DVLA sells plates through its website at www.dvla-som.co.uk/home where they start at a couple of hundred pounds. It sells the rarer ones through auctions – the next is 16-18 April in Newport. DVLA made £74 million from them in 2006/07.

If you have a car with a plate issued before February 1963 when date letter suffixes began or one since then that makes a word or is an interesting combination you may well find it is worth more than your car! DVLA does not buy plates. For that you will have to go to a dealer or, if it is really unusual, put it into an auction.

Monday Monday

Why oh why do I reach pension age on Wednesday but have to wait until the

following Monday to get my pension? It is a question many Saga readers ask. And

although it has been explained here several times each generation comes afresh –

and aghast – to this unfairness of the pension system. The rules say that the

pension begins not on your 60th (women) or 65th

(men) birthday but on the next payday. At one time pensions were paid on

different days to manage the queues in the Post Office. But for decades now

payday has been Monday. The winners of this lottery of course are those whose

birthday that year happens to fall on a Monday.

The losers are those whose pension birthday falls on a Tuesday. They lose six

days pension which costs them nearly £80 on the basic pension of £90.70. The

rule saves the Government more than £25 million a year.

This problem will become even more apparent from April 2010. From that date women’s pension age rises from 60 to 65 in easy stages. Pension ages are all on the 6th of odd numbered months. A woman born on 10 May 1950 reaches 60 on 10 May 2010 but her pension age is actually 6 July 2010 when she is 60 years 1 month and 26 days. And while her birthday falls on a Monday – and in the past she would have got her pension that day – her new Government allocated pension age falls on a Tuesday. So she will not get her pension until Monday 12 July, six days later. You can find your pension age at www.thepensionservice.gov.uk/resourcecentre/statepensioncalc.asp But unless it falls on a Monday you will have to wait until the next one before you actually get any money!