The Red Queen’s Pension

'Now, HERE, you see, it takes all the running YOU can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!' (Lewis Carroll Alice Through the Looking Glass Chapter II)

Just when the Government is urging us all to save more for our retirement the problems of doing so have been starkly illustrated by actuaries Watson Wyatt. Its analysis shows that a man retiring ten years ago who had saved £200 a month for twenty years could buy a decent pension. But someone retiring today who had saved exactly the same amount each month would get barely a quarter as much.

Take two brothers. George and Michael Phipps. George was born in January 1937 and started saving £200 in a with profits pension fund when he was 40. In January 1997 he reached 60. His fund was worth £265,507 and for each £1000 he got £77.40 a year pension – a total of £20,513. He considered that a fair deal. His brother Michael was born ten years later, in January 1947. He started saving at the same age and put the same £200 a month into the same pension fund. This year he reached 60. But his fund was less than half as much as George’s – just £112,100. The insurance company blamed falling investment returns. And because everyone is now known to live longer he only got a pension of £41.50 for each £1000. That double whammy of less money and less pension for each pound of it meant his pension was just £4613 a year, less than a quarter of George’s. He thinks he has been done. Both brothers saved the same amount for the same length of time in the same pension fund. But George’s pension is nearly four and a half times as much as brother Mike’s. Their twin sisters do even worse - £17,847 for Georgina and a paltry £4209 for Michelle.

Now who labelled those pensions ‘DRINK ME’?

Bank bosses humbled

The chief executives of two of Britain’s major High Street banks have had to

sign personal undertakings to look after their customers’ data. Barclays Group

Chief Executive John Varley and his rival Chief Executive John Hornby of HBOS

both "acknowledge" the problem and "undertake to comply" with a two page

agreement setting out how they will improve security of personal data at their

branches. The two bosses were not alone. Royal Bank of Scotland, Alliance &

Leicester, Clydesdale Bank, NatWest, Co-operative Bank, HFC, and United National

Bank all signed similar agreements as did Nationwide and Scarborough building

societies and the Post Office.

The banks’ offence was to leave sensitive personal data about their customers outside their branches with the ordinary rubbish. The items included paying in slips, Visa and debit cards, account details including some PINs, insurance and mortgage application forms, bank statements, lists of direct debits and standing orders, names, addresses and dates of birth. The breaches came to light last Autumn and the Information Commissioner, whose job it is to protect our privacy and our data, decided to investigate. Six months on he found that the twelve financial companies had broken the Data Protection Act. The signed undertakings mean that any future breach could lead to enforcement action and large fines. Let’s hope they have learned their lesson.

Direct debit downside

Most companies offer a discount if you pay regular bills by direct debit.

And BT even fines you £4.50 a quarter if you choose to pay by cheque. But in the

Looking Glass world of financial services, insurers charge motorists a hefty

premium if they spread their payments over a year by direct debit.

Research by www.MoneyExpert.com shows that the average charge for spreading your insurance is 22.7 per cent of the premium. A typical car policy of £806 a year would cost an extra £182 if it is paid in monthly instalments. It is cheaper to take the money out of your savings and pay upfront or even borrow the money to spread the cost. Some insurers allow their customers to spread the cost without making a charge – they include Virgin Money, insure.co.uk, and Saga.

Budget losers

Hundreds of thousands of older people were the big losers in Gordon Brown’s

last (probably) Budget. The people who will lose out when the main tax changes

begin in April 2008 have an income less than about £18,500, have no children and

are less than 65. Many – perhaps most – of them will be in their fifties and

early 60s.

The Chancellor introduced two major tax changes for earned income and pensions.

The bad news:— the lower 10 per cent rate of tax will be doubled from 10p in the pound to 20p. The lower rate applies on the first £2230 income above the personal allowance. So the tax on that band of income will double from £223 a year to £446.

The good news:— the basic rate of tax will be cut from 22p in the pound to 20p. That rate applies to a band of income of £32,370 so the potential saving is £648. But that is only realised by those with the highest income. The break even point is an income of £18,605 – the extra lower rate tax is exactly balanced by savings on the reduced basic rate. People with an income lower than that may pay extra tax from April 2008.

The Chancellor decided to protect some low income groups from this loss. First, people aged 65 or more will be able to have an extra £1180 income before they pay any tax. That will ensure that those over 65 will not pay more tax. Second, he is raising the amounts paid with tax credits – that will help those with children particularly. Third, the lower rate will still apply to income from savings if that is your only taxed income. But that leaves all the rest – people with small pensions or low earnings who are under 65 and cannot claim the benefits paid to some people who work. Most of them will be in their fifties and early. For example, a woman aged 62 with a state pension of £4000 a year and a private pension from her job of £6000 will pay £172.10 a year more tax from April 2008 under these proposals. Some will lose as much as £223. Hardly a vote winner for someone trying to be popular.

Pension fig leaf

The Government has bowed to pressure from the courts in the UK and Europe by

improving the Financial Assistance Scheme for people whose pension has been

partly or wholly lost after the employer went out of business before April 2005.

But the scheme is still worse than the help offered by the Pension Protection

Fund for those whose scheme got into trouble after that date. And it falls well

short of the full compensation demanded by campaigners after the Parliamentary

Ombudsman – now supported by the High Court – found the Government guilty of

maladministration after it issued misleading information about the safety of

company pensions.

The revised scheme will now help all 125,000 of the people affected from 1 January 1997 to 5 April 2005 – previously it would have helped only around a third of them. It will still only offer compensation of 80% of the ‘core pension’ they were expecting but the cap of £12,000 has been more than doubled to £26,000 and there will be no minimum pension – originally the Government was not going to pay out to anyone who was due less than £10 a week. But there will still be no inflation proofing – once the pension is in payment it will be frozen for life. And pensions will only be paid from the age of 65, even where the scheme pension age was less. The Government claims the change will raise the cost of the scheme from £830 million to £1.9 billion in today’s terms. But that cost is spread over 60 years and the Treasury has told Saga Magazine that any extra money will come from the existing budget of the Department for Work and Pensions.

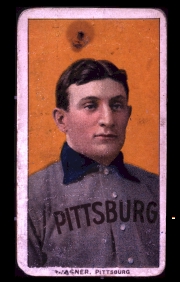

Fag card packet

A small piece of cheaply printed cardboard that was once given away with a

packet of cigarettes was sold recently for $2.35 million (about £1.25m). It bore

the face of US baseball star Honus Wagner and is the rarest – and most valuable

– cigarette card in the world. Honus – who played in the early 1900s – demanded

the card was withdrawn either because he was not paid enough or because, rather

ahead of his time, he did not want to encourage children to smoke. Either way

only a few examples are known.

Cigarette cards began in the 1880s and collecting them is now a worldwide business. Common sets – and modern reproductions – can be bought for a few pounds or even pence, rare and older sets can fetch hundreds. The London Cigarette Card Company celebrates its 80th birthday this year and Ian Laker has been Managing Director since 1971.

"In Britain we have nothing like the Honus Wagner card. The closest is the set of 20 clowns and circus performers due to be issued by the small cigarette company Taddy after World War II. But Taddy went out of business and they were never issued. In good condition they could fetch £15,000 now."

But he warns such values are very rare. "Between the wars cards were very common, issued in their millions. Smaller makers and rarer sets especially before World War I can fetch a bit of money. But condition is vital, they must be near perfect to fetch top prices."

Even then we are talking tens or low hundreds of pounds rather than thousands. Cricket has always been a popular theme and football is now growing. Ogdens Football Caricatures from 1935 is available at £130. Vehicles are also popular. WD and HO Wills’s Railway Engines 1924 can be bought for £60. If you have a set tucked away in a box or bookcase you can get an idea of values from the website londoncigcard.co.uk or its catalogue which lists 6500 different series with their values.

May 2007