Pensions barometer

On a scale of 1 (best) to 25 (worst) where would you put pensions in the UK?

The surprising answer from business consultants Aon is 6th. At least

it is when the 25 are the countries of the European Union – not counting new

entrants Bulgaria and Romania. Aon assessed both state and company pensions in

each country in the light of pension age and life expectancy.

|

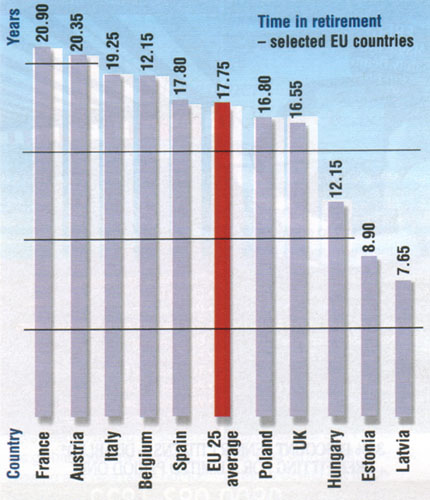

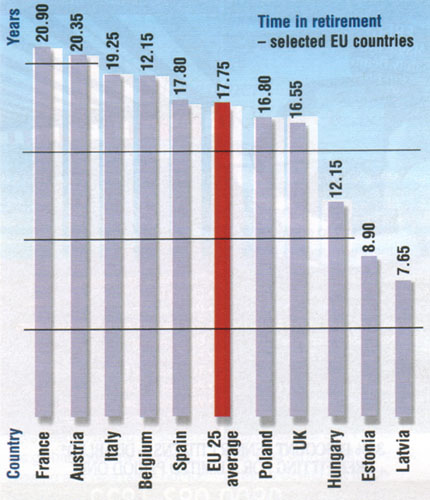

The UK’s overall position at 6 is due mainly to the company and personal pensions which many people have. Aon looked at two measures – how adequate pensions are and how affordable they are. Our state pension was – you’ve guessed it! – 25 out of 25 for adequacy but 3rd for affordability. In other words it was so cheap there was no problem finding the money for it. Our company pensions were the fifth best in the EU – beaten by Netherlands, Denmark, Sweden, and Ireland. Those four joined us in the top seven with newcomers Latvia at 4th and Estonia 2nd. Their high places were due not so much to the generosity of their pensions as to the short life expectancy in those countries. Locals can expect to draw their pension for well under 10 years which makes affording them much easier. In the UK we can look forward to 16½ years on the pension. In France, Luxembourg and Austria it is more than 20 years. |

T

hat is one reason why France, with a generous state pension and the longest life expectancy in the union, came near the bottom of the overall rankings at 22. Aon considers France’s generous public pensions and its early retirement age to be unsustainable in the long term. Belgium was bottom. Only a third of those aged 55 to 64 are employed and company pension provision is low.Top of the table was Denmark. It has an "acceptable" state pension, a high proportion of older people in work, and 95% of employees are paying into a company pension scheme, the highest in Europe. To Aon, that is a good balance. But it warns that "all EU countries face significant pension challenges because of ageing populations" and it says governments should address that problem by raising the retirement age and encouraging more people to save for their own retirement.

Personal inflation

What is your personal rate of inflation? In other words how much are the

prices of the things you buy going up? For the first time the Office for

National Statistics – which produces the official figures on the rate of

inflation – has found a way for us to work out own rate of inflation. You need

access to the internet to do it but there is now a page on its website where you

can put in what you spend each month on food, travel, clothing, heating,

telephone, housing and so on, out of your total monthly spending. It then shows

you the rate at which prices are going up for you. It is all a bit rough and

ready so is probably more fun than serious but you can try it out at

www.statistics.gov.uk/pic

At the same time National Statistics has come up with an explanation for why inflation seems higher than the statisticians say it actually is. The things we buy every week or month are rising in price more than the things we buy less often. The rate of inflation on these regular purchases is one percentage point higher than the overall rate. So inflation ‘feels’ higher.

The real worry for most people is that inflation really does seem to be getting worse. Figures for the end of 2006 showed that the Retail Prices Index, the traditional measure of inflation, was higher than it had been since Norman Lamont was Chancellor in December 1991. If it stays at this level of 4.4% prices will be rising faster than pensions – they go up by 3.7% in April.

Of course this is still a long way from the record 26.9% annual rise recorded in August 1975. But even at 4.4% prices double every 16 years. After a long period when inflation was not a worry, as we warned in December, it is firmly back on the agenda.

Banking on the family

They call them BOMADs. People in their 20s, 30s, or even 40s who still rely

on their parents for financial support. Research done by the YouGov polling

organisation on a sample of 2000 parents with children aged over 25 found the

more than four out of ten had given them financial support in the last six

months. It ranged from paying for child care to providing a deposit for a home;

from paying off a student loan to making mortgage payments; from taking over a

credit card debt, to paying for a divorce.

More than a quarter had paid off a debt, or helped to. And nearly as many had helped with the cost of their children’s housing – hardly surprising now the average home costs eight times average full time pay. One in ten had paid for childcare costs. The research shows that the dependency of young people does not end at 18, 21, or even 25. It goes on until they do not need it anymore – or their parents run out of money!

The result is that many parents do not gain financial freedom from their offspring until they are well into retirement. More than four out of ten of those polled said they expected that golden age to arrive around the age of 67. And the average British parent expects to be providing some financial help to their progeny until they reach 59.

And why BOMAD? Bank Of Mum And Dad of course!

Least favourite tax

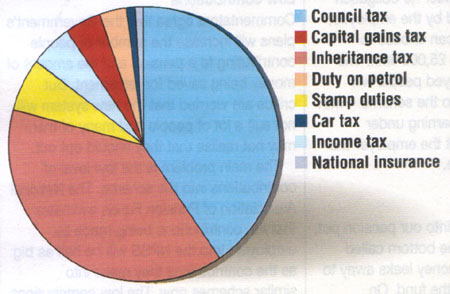

|

As the Chancellor puts the finishing touches to his Budget,

two taxes should be top of his list to be scrapped, according to a poll of

readers on Saga magazine’s money website. They had two clear hates –

Inheritance Tax and Council Tax. Nearly 40% of you voted for each as your

most hated tax. At the other end no-one disliked duty on tobacco or alcohol,

only 5% picked income tax and 6% wanted to get rid of Stamp Duty on homes

and shares. You can vote in our latest poll here www.saga.co.uk/magazine/money |

Pens and pencils

Pelikan, Parker, Shaeffer – names that bring back the iron smell of ink and the fear of blotting your best handwritten homework. Nowadays, if we handwrite at all it is with a cheap biro that is thrown away or lost before it runs out. As we abandon the art of penmanship, the precision writing instruments we used to cherish are moving into the collector’s market. Many are still surprisingly cheap given their age and the care with which they were made. There is even a show devoted to them – the next is the Northern Pen Show in Lytham. Simon Gray of Battersea Pen Home who has been selling and repairing pens for 15 years says collectors look for two things. "First make. Parker, Shaeffer, Conway Stuart, Swan. Second coloured rather than plain and big rather than small." Collectible pens come mainly from before World War II. Then the individual manufacturing process allowed colourful patterns in the celluloid they were made from. "But after the war manufacturers discovered injection moulding so the colours were plain." He offers a Parker pen in marbled celluloid from 1933 for £125. Pens from the 1950s are around £80. But Simon’s dream is to find a Japanese Namiki in maki-e lacquer. One fetched a record price of £183,000 at auction in London in 2000.

|

|

More from Battersea Pen Home www.penhome.co.uk tel: 01992-578 885 www.bloomsbury-book-auct.com tel: 020 7495 9494 Writing Equipment Society www.wesonline.org.uk www.northernpenshow.com

|

Money from your home

Have you ever wondered how to use the value of your home to raise some

much-needed cash? Saga Magazine has produced a new independent guide to what is

called ‘equity release’. Written by financial journalist Jennifer Bailey it

looks at the pros and cons of selling up and buying a smaller place, taking out

a lifetime mortgage, or selling part of your home to an insurance company. You

can read it online at

www.saga.co.uk/magazine/money or download it and print it off on your

printer.

March 2007