...and postal changes, health tax, dolls' house prices

When I wrote about scams in April I did not expect to get so many letters from readers saying "I was conned". And they really are object lessons in how easy it is for people who are "not easily duped" – as one reader described herself – to be parted from their money.

J – she has asked to be anonymous – was invited to place bets for a group of racehorse owners. She was told that owners were not allowed to place bets on their own horses (which is not true as long as they back them to win. Others have been told that the syndicate is so good bookies ban them). She opened an account with William Hill, and fifteen minutes before the start of a race she was told to place a bet of up to £5000 on a particular horse. She was promised a regular fee, win or lose, and that any losses would be reimbursed. None of her horses won and she lost £8000 of her own money.

So who wins, apart from the bookmaker? In a race with a small field of say 6 horses, the conmen get J and five others – A, B, C, D, and E – to bet £5000 each on a different horse. Every horse is covered so one of them must win. Suppose it is D whose horse comes in at 4:1. The conmen contact D and claim their £20,000 profit, D keeps his £5000 stake and a small fee for his trouble. The crooks do not repay any of the £25,000 losses made by the other five victims, but they string them along saying the money is on its way. Next day they invite the victims to bet their own money on another race. And they keep going until victims with mounting losses and no reimbursement pulls out. J cut back the money she bet and pulled out after three losers. But on each of those races the conmen would have won through another victim who backed the winner. J admits she was foolish and perhaps a bit greedy. But she saw it as a simple way to help someone out and make some money for herself.

Other scams are simpler. Sarah wrote to say her mother ordered clothes from a reputable mail order company. But tucked in with the parcel was a notice saying she had won a prize and should call a number to claim it. The call was to a premium rate line and cost her more than £10. Of course there was no prize. Other readers have been told there is a parcel waiting for delivery and again are invited to call a number that turns out to be a premium rate line. Another £10 diverted from honest Saga readers to crooks. Premium rate services begin with 09. Calls can cost up to £1.50 a minute and the crooks are expert at keeping you hanging on with long messages and music until you have spent at least a tenner. Premium rate lines are regulated by ICSTIS. You can check numbers free on its website www.icstis.org.uk. However, there are also services from mobiles that have a short four or five digit code. You have to sign up for those. Never do that. In fact, never call a premium rate line from a company you do not know.

As I write an e-mail arrives saying I have won a prize in the Spanish Easter Bonanza International Lottery. I haven’t of course. But the people who send it are hoping I am going to make it their lucky day. If it seems too good to be true it probably is. Eleven words that can keep you and your money together.

Postal revolution

Post Office queues are set to lengthen this summer. Because from 21 August

every letter or packet will have to be measured as well as weighed to work out

the postage, and that will take more time. ‘Pricing in Proportion’ as it is

called, will replace the simple weight steps we have known for 166 years.

Currently a letter or small package weighing up to 60g (about 2oz) costs 23p

second class or 32p first, whatever its size. But from 21 August larger letters

will cost around half as much again and bigger packets will cost more than three

times as much.

To get the cheapest rate letters will have to be less than 5mm (1/5th of an inch) thick, 165mm (6½ inches) wide and 240mm (9½ inches) long. The only good news is that a letter within those sizes can weigh up to 100g (3½ oz) and will go for the same 32p or 23p of current mail weighing up to 60g. Royal Mail says that 85% of mail will cost the same or less and 15% will cost more. Prices for the next size up start at 37p or 44p for first class up to 100g with higher prices for heavier items. Anything more than an inch thick (25mm) or over 250mm (nearly 10in.) wide or 353mm (nearly 14in.) long will pay a real premium price, starting at £1 first class, and 84p second, for items up to 100g. Weightier packages will cost more..

Despite a £10 million publicity campaign queues are bound to grow as confused people get their letters and packages weighed and measured. A spokesman for Royal Mail agreed "There will be occasions when the queue is a little longer" but said no extra staff will be taken on. Click here for full details on pricing in proportion

Health cheque

People who get health insurance as part of their pension are facing a tax

bill of hundreds of pounds a year. Some companies – especially those in the

financial services industry – give their employees free health insurance and

some of those let it continue into retirement as part of the pension plan. But

the Government has decided that the premiums paid to health insurers such as

BUPA on behalf of pensioners is what it calls a ‘taxable benefit’ and pensioners

will have to pay tax on the amount of the premiums. One reader has worked out

that the extra tax he will pay will cost a whole month’s state pension. One

major High Street bank says the value of the premiums it pays cost around £1000

a year or £2000 for a spouse as well. That means extra tax of £440 on basic rate

or £800 on higher rate tax.

In the past, the premiums were tax-free once you retired. But as part of the A-Day changes to pensions which began in April all ‘non-cash’ pension benefits have become liable to tax. And with premiums rising by at least 10% a year, it is a burden that will only grow as you get older. The impact will not be felt at once. The tax will be collected by reducing tax codes. And that may not happen until next tax year when all the tax will be collected in a double whammy.

Small house, big price

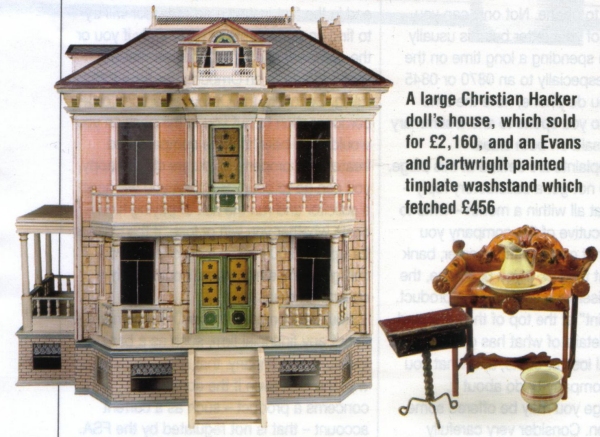

| Doll’s houses are big business. Especially if they were made in the 19th century or earlier, have original decoration and some original furniture. Daniel Agnew, doll and toy specialist at auctioneers Christie’s, says beware of miniature houses made more recently for the adult market. "Doll’s houses must be toys, made for children. Naivety is part of the charm – the cradle made from a matchbox or the chair that is too big for the table." The best houses can fetch tens of thousands of pounds. Christie’s sold a fifteen room doll’s house and contents for £124,000 a few years ago, not much less than the average price of a real house! Good points are original decoration, inside and out, some original furniture — and that ‘played with’ feel. |  |

"Victorian, 1850 to 1910, is the big period you are likely to come across. Some are just a foot tall; others are ten feet long. They can be worth anything from £100 to £100,000. But for a good Victorian house with original furniture reckon on £1000 to £3000. And it must look nice."

Although original furniture is desirable, the tables, sofas, figures, and pots and pans also fetch money by themselves. At a recent sale, early English tinplate furniture was fetching £500 or so an item.

So if there is a doll’s house in the loft, perhaps one you or your mum played with, it may be worth dusting off and getting it valued.

Christie's next doll’s house sale is on 3 October at its South Kensington saleroom.