On the buses

You will need determination, a pile of bus timetables, and an emergency

Thermos, but from April 2008 anyone aged 60 or more will be able to travel free

from Penzance to Penrith. The catch is you will have to use local buses. Because

from that date the local bus pass which gives you free bus travel in your own

area will also be honoured everywhere in England. The new scheme was announced

by the Chancellor in the Budget but it will not cover long distance coach travel

– only local services which have stops at least once very 15 miles.

The expansion of the service is intended to deal with the problems that are already becoming clear with the the free local bus passes that began in April. Someone who lives in one local authority area but needs to travel to another to reach the nearest shopping town may well find that there is no agreement to let them use their local bus pass outside their area. And people who travel to other parts of England on holiday or to visit friends or relatives cannot use their local bus pass there. The changes from 2008 are supposed to deal with those issues.

The new scheme will apply only in England as Scotland, Wales and Northern Ireland already have their own schemes. In Scotland free travel now includes long distance coaches. And in Northern Ireland local rail services are included as well. There are still lots of details to work out about how the new scheme will work in practice. And already local councils are warning that the money set aside – £250 million – may not be enough. Some claim they have already had to cut other services to pay for the present scheme.

Pension hopes dashed

The Government is refusing to compensate at least 85,000 people who lost

significantly when their company pension scheme was wound up leaving them with a

far smaller pension than had been promised. This is despite the verdict of the

Parliamentary Ombudsman, Anne Abraham, that the government misled the public

about the safety of company pensions by issuing inaccurate, incomplete, unclear,

and inconsistent information over a number of years. The Government is relying

on the scheme it set up last year to offer limited compensation to around 15,000

of the worst affected people who were closest to 65. This scheme has been widely

criticized as inadequate and the Government has now said it will be reviewed in

2007. That will be too late for many people who have lost money. Some have

already died.

Tax take

Over ten years of the Labour government the amount of money raised in income

tax has almost doubled from £69 billion to £131 billion; the amount raised from

people dying has more than doubled from £1.6 billion to £3.3 billion; and the

money paid when houses are sold has risen nine times from a tiny £675 million to

an estimated £6.2 billion in 2005/06. The reason is simple. Tax allowances rise

in line with inflation – 2 or 3% a year. But earnings rise faster at just over

4% a year, and property prices go up much faster than that. The result is that

more income is caught by income tax – especially at the higher rates, more

estates pay inheritance tax and much more money is raised whenever a house or

flat is sold. It has always happened and economists even have a name for it –

fiscal drag. Perhaps it should be called the Chancellor’s friend.

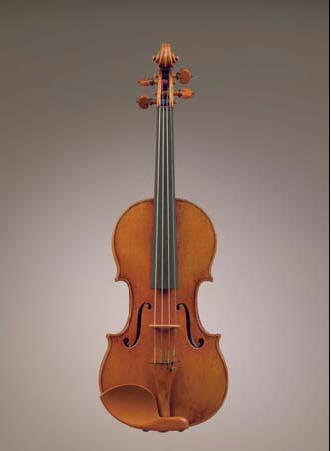

Hammer price

A 300-year-old violin could become the most expensive musical instrument

ever sold when it is auctioned by Christies in New York later this month. The

record was set barely a year ago when another violin by the famous Italian

Antonio Stradivari fetched $2 million (£1.16 million). But the violin on sale in

May was made in Stradivari’s so-called ‘Golden Period’ between 1700 and 1720 and

it may well top that astonishing price. It is traditional to name violins after

famous past owners and this instrument is known as the ‘Hammer Stradivari’ after

the Swedish collector Christian Hammer. When its cousin, known as the Lady

Tennant, was sold last April the new owner presented it to the Chinese violinist

Yang Liu who said "I have been given a soul mate for life." Kerry Keane, head of

musical instruments at Christie’s in New York, admits to hoping something

similar will happen to the Hammer "On a personal level, yes. These objects are

wonderful art, sculpture, and craftsmanship. But what is unique is that they are

static until they placed in the hands of another artist and then they come to

life."

Of course no-one can expect to find a Strad in their attic. But Kerry says remarkable finds to come to light. "Violins, violas, and cellos and their bows, some made as recently as the 20th century, 1880-1930, are selling for eight times what they would have fetched a few years ago. There were some magnificent English makers – Chanot, Fendt, Locke – a Hills violin from around 1900 might fetch £3000. Locke might make £20,000."

He warns though that many have the wrong labels applied internally and you should always take them to a qualified expert to get an opinion."

Grand child trust

The Chancellor has confirmed that all children born from 1 September 2002

will get a second Child Trust Fund payment of £250 at the age of seven. These

children have already had the first £250 payment and the Government is

considering whether to make a third payment when they are at secondary school.

The money becomes theirs at 18 and, if investment returns were 5% a year after

charges, that £750 would grow to around £1350. That will barely be enough for a

very old banger or a very good party by 2020 when the first funds are paid over

to their newly adult owners. So Grans and Grandads could be the key to young

people having a decent amount to put towards their university education or a

deposit on a home.

Anyone can pay into a Child Trust Fund, as long as the total extra going in does not exceed £1200 in any tax year. If that level of contribution is achieved then the lucky child can look forward to a total fund of more than £36,000, assuming 5% a year growth after charges. Quite an 18th birthday present! So instead of cuddly toys or designer clothes why not pay into your grandchild’s child trust fund?

|

Extra contribution per month from birth |

Total value of fund at age 18 |

|

£0 |

£1,106 |

|

£10 |

£4,574 |

|

£25 |

£9,891 |

|

£50 |

£18,753 |

|

£100 |

£36,476 |

| Assumptions: net growth of 5% per year after charges; £250 payment at birth and age 7. | |

May 2006