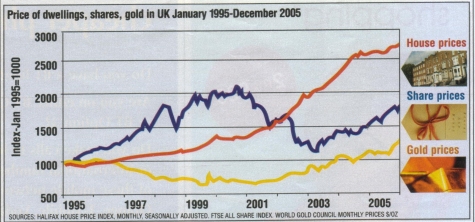

The New year began with headlines telling us that gold had hit a 25 year high and that for the first time for six years the price of shares had risen faster than the price of the homes we live in.

A more sober analysis of the last decade shows that although gold and shares have risen strongly – about 17% in 2005 – the consistent performer over that time has been domestic property - the houses flats bungalows and maisonettes we call home.

For a generation investment was concentrated in shares – it was even known as the cult of the equity. And for a long time it worked – the rise in shares was a one way bet. But even at their best shares are very volatile – they can soar but they can also plummet. As we saw most recently from January 2000 to March 2003 when they lost half their value.

But long term data shows that house prices are much less volatile than shares. In other words the price goes up and down by less. Share prices soar and plummet. But house prices tend just to rise and fall. Over the years they have shown the more consistent growth path. And with a population growing faster than the stock of homes for them to live in – and the number of people per home shrinking – the iron rule of supply and demand means that the price of homes is unlikely to fall in the future.

Until now it has been difficult for ordinary investors to put any of their money into the security of domestic property – apart from the home they live in. But from next year the Government will make that possible through a new sort of investment called a UK Real Estate Investment Trust or REIT. They are like a unit trust only instead of holding shares they hold property and you buy units (which confusingly will be called shares) in the REIT and gain from both the rental income and the rise in the capital value of the property. Tax breaks would ensure that the company did not pay tax on the capital gain of the properties or on the rental income. Though invesetors would be liable for tax on the return and gain on their shares.

REITs will be able to invest in any sort of property and a lot will no doubt

concentrate on the traditional offices, shopping malls, and warehouses. But some

will specialise in homes, enabling ordinary investors with a small monthly sum

or a few thousand pounds to have a small share in the advantages of being a

landlord. That will open up a new asset class to us all.

PIN or pen?

Did you remember to cement your relationship with the one you love on

Valentine’s Day? I mean of course your credit card. This year 14 February was

the deadline to learn the PIN for your plastic money. If you have tried using a

debit or credit card since then you will know that almost all retail outlets

will no longer accept new chip cards if you do not know your PIN. However

take heart if you don’t trust your memory you can change your PIN for one

you can easily remember at any cash machine and if that doesn’t work all

the card issuers will let you carry on signing if you have a medical reason why

you cannot enter a PIN. That could be a physical disability which prevents you

from seeing the key pad or pressing the buttons. Or it could be a memory problem

that stops you recalling the number. If you or a relative are in that position

ask your bank about getting what is called a CHIP and Signature card. No medical

evidence will be required. When the card is put into the terminal it will tell

the retailer you can sign rather than PIN, though some shops may still be

difficult.

Stamp down prices

The price of sending a letter will rise by 2p on 3 April. A first class stamp

will then cost 32p and a second class stamp 23p. The price is set to rise

another 4p for first and second class over the next four years. So now may be

the ideal time to buy a stock of 1st and 2nd class stamps at the old prices.

They will be on sale until the prices go up and you can use them whenever you

want. Buying early will cut the cost of posting a 1st class letter by 6% and

nearly 10% for second – and more in future years! The stamps can also be used to

make up the value on higher cost mail. From 3 April a 1st class stamp bought

earlier for 30p will ‘count’ as 32p when used with other stamps on heavier

items. In August more radical change happens when post will be priced by size as

well as weight.

Not all over yet

Football. Love it or hate it there is going to be a lot more of it as the World

Cup looms. If you have any old tickets and programmes – wasn’t one of them

signed? – stashed away in that box in the attic now is the time to dig them out

and see if they are worth anything.. Malcolm Davies who runs Mal’s Memorabilia

says that football items do fetch money but don’t set your hopes too high.

"What sells? World Cup items are picking up, especially 1966. The programme

sells for well over £100 [checking this is right] and if it is signed by Bobby

Moore then a lot more say £300-£400. Tickets are popular too."

When it comes to those the older the better. An original ticket for the 1923 FA Cup Final between Bolton Wanderers and West Ham recently sold at auction for more than £1700. Anything pre World War II is interesting. Even postcards of team photographs from the early 20th century can fetch around £100.

Malcolm, who admits to being "a bit of an anorak", now makes his living

selling football and cricket memorabilia. His team is Manchester United and he

loves the Busby Babes era before the 1958 Munich air crash which almost wiped

out the club.

"Programmes of matches leading up to the crash or just after fetch money.

Programmes are generally big business. But it’s the team and the name that puts

the value on them."

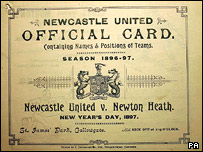

A programme for Newcastle United vs Newton Heath on 1 January 1897 recently

fetched nearly £7000 – in 1902 Newton Heath changed its name to Manchester

United. And in 1997 a programme for Chelsea vs Sheffiedl United FA Cup final of

1915 fetched more than £11,000.

But Malcolm warns of problems with modern photographs signed by players. "I

would say 75% of them are forgeries. And they can be hard to detect."

More at www.malsmemorabilia.co.uk

Parking beater

Motorists could be throwing millions of pounds down the drain because they

do not appeal against parking tickets. The latest figures from the National

Parking Adjudication Service show that only about one in three hundred people

who get a ticket outside London appeal against it. In London the figure is one

in every hundred. Nationally more than six out of ten of those who do appeal are

successful.

Councils generally do not inform motorists of their right to appeal a ticket and many drivers do not realise there is an impartial service staffed by independent lawyers to consider them. Councils also discourage appeals by allowing drivers to pay half the fine if they do so within 14 days. You can ask the council to review the ticket and generally keep that right. But if you then appeal to the adjudicator and lose you have to pay the full amount. With parking fines up to £60 outside London and up to £100 in the capital, that is a gamble many are not prepared to take.

In 2004/05 a total of 7.8 million parking tickets were issued in England and Wales, worth

at least £300 million – and potentially twice that – to the councils which issue them.

The National Parking Adjudication Service covers 117 out of around 300 councils in England and Wales. London and Scotland have their own Parking and Traffic Appeals Service. They all deal only with Penalty Charge Notices issued by councils which have decriminalized parking offences. In other areas tickets issued by the police or by traffic wardens are dealt with by the courts. But the message from these figures is clear – if you are sure the ticket is wrong, an appeal can avoid at least one cost of motoring.

England and Wales: 0161 242 5252 -

www.parking-appeals.gov.uk

London: tel: 020 7747 4700 - www.patas.org.uk

Scotland: 0131 221 0409

March 2006