This piece first appeared in Saga Magazine in October 2005

The text here may not be identical to the published text

Age discrimination to go

For those who want to work past the age of 65 – and there is a growing number

of them – the bad news is that the government has finally decided that it will

not force companies to keep on workers who want to stay. From October 1 next

year employers will not be able to force people to retire under the age of 65.

But once you reach that age, a company can fix a retirement age for staff. But

it will have to give six months notice of retirement and if the employee applies

to stay on will have to consider their application carefully – but no more.

The good news, though, for people who continue in work over 65 is that the

current ban on claims for unfair dismissal for anyone over 65 will be scrapped

and redundancy payments will be due to anyone who is made redundant over 65. At

the moment, redundancy pay is phased out from 64 and disappears altogether at

65.

Source: Labour Force Survey Spring 2003

Some forward looking companies have already scrapped upper age limits for

their workers, such as supermarkets Somerfield and Kwik-Save and directory

enquiries company The Number 118-118. Others, such as Nationwide building

society, have raised it to 70. The question of scrapping all retirement ages

will be looked at again in 2011.

More older people are working now than in the recent past,

though as the graph shows the number is still small. But with health and life

expectancy improving and pensions declining, that number is set to rise. A top

think-tank said this summer that the Government should raise the state pension

age to 67 by 2030. And from next October older people seeking work will have the

law on their side. Potential employers will not be able to discriminate against

applicants on grounds of age – unless they are over a company’s post 65

retirement age. But with unemployment rising and the total number of people in

work falling for the first time for many years, older people will have to

compete hard for the jobs there are.

Seen to be Green

From this month every new car sold in the UK will come with a

label to show how much carbon dioxide it emits per kilometre driven.

Carbon dioxide (CO2) is the worst of the ‘greenhouse gases’

that rise to the top of the atmosphere and cause global warming. Low CO2

emissions usually mean an efficient (and smaller) engine and that means you save

fuel too. But there is bigger saving from going green. The annual car tax due on

vehicles registered since March 1, 2001 depends on their CO2 rating. A dark

green class A car emitting less than 100g of CO2 per km driven costs £65 a year

to tax. But a car with a bright red class F label will cost £165. Diesels cost

£5 more in every category but there is a £5 discount for vehicles that run on

liquefied petroleum gas (LPG) or which combine gas or electric power with a

normal petrol engine. If you drive into London it is worth remembering that

these vehicles are also exempt from the £8 a day Congestion Charge. There are no

plans to extend the labels to the second-hand market. But if you are buying a

new car, why not go green? It can save you a packet.

| Band |

CO2 (g per km) |

Annual car tax |

| A |

100 and below |

£65 |

| B |

101 to 120 |

£85 |

| C |

121 to 150 |

£115 |

| D |

151 to 165 |

£135 |

| E |

166 to 185 |

£160 |

| F |

186 and above |

£170 |

Note: Add £5 for diesel, subtract £5 for alternative fuel

cars.

Buffett Lunch

How much would you pay to have lunch with the world’s most

successful investor? One person, still anonymous, has paid more than £200,000 to

take seven guests to dine with Warren Buffett, the boss of US investment firm

Berkshire Hathaway who has an almost evangelical following. Each share in

Berkshire Hathaway is currently trading at around $83,000. Had you given Mr

Buffett $1,000 in 1965, it would be worth more than $5m today.

So $351,000 may seem a small price to hear the ideas of the

world’s second-richest man. The money will benefit Glide, a charitable

foundation in San Francisco which helps homeless people and poor families.

Buffett has been auctioning a lunch for the charity for some

years. It used to fetch $25,000 to $50,000. But in 2003 he took the auction to

the internet using eBay, and the price has soared. Last year’s lunch was bought

for $201,000 by Jason Choo, a Canadian citizen who lives in Singapore.

Describing the meal at the Smith & Wollensky Steakhouse in New York, he said

"You want to meet him to understand him, his approach, his temperament and such.

So much of investing success, as in any job, requires a certain type of

personality as well as analytical skills. We didn’t talk much about investing,

so we really had a great time." Worth every penny then.

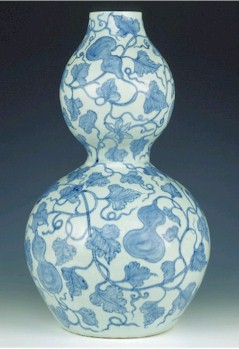

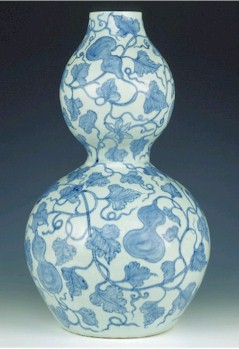

Pots break records

Alexander vase £3.06 million July 2005

For many years a small blue and white vase rested dirty and unnoticed on a low

shelf in a back room of a house near Salisbury. Although the owners thought it

might have some value, the room was used mainly by the family’s many dogs at

constant risk from a happy tail. But fortunately the vase remained intact and

when the owners got a routine insurance valuation, John Axford ceramic

specialist for Salisbury auctioneers Woolley & Wallis, realised that the vase,

bought for £10 in 1900 from was very much more valuable than that. His research

revealed it was the only complete example of its type and dated back to the Yuan

dynasty of Khubilai Khan, around 1350.

He estimated it might fetch £250,000. But the hammer

finally fell on it, so to speak, at £2.6 million which, after the buyer’s

premium was added, came to just over £3 million. It was the highest price for

any work of art in a provincial saleroom .Charlotte Hennage of Woolley & Wallis

told Saga Magazine "It was a unique experience for all of us. The owners

were in the saleroom. There were eight bidders on the phone, four of them still

bidding as it passed £1.5 million. The market is very strong now as Chinese

collectors buy back their heritage." Two days earlier Christie’s in London also

failed to predict the price of a Chinese blue and white pot from the same era.

They reckoned their jar, 11 inches tall and 13 inches round, would fetch more

than £1 million. But it was bought on behalf of an overseas collector for £13.5

million. The highest price ever paid for a ceramic.

Taxman looks abroad

The Government hopes to raise £80 million by taxing money held in bank

accounts outside the UK and not declared to HM Revenue & Customs. Any UK

resident who holds money in an account in another country is obliged to pay tax

on any interest it earns. But the Government suspects there are billions of

pounds lying in foreign bank accounts which is not declared and on which tax is

being lost. A new law, the European Union Savings Directive, will make it much

harder to hide this money from the taxman. It came into force on July 1st

and banks in EU countries and some others that have signed up to it now have to

do one of two things. In most countries, they will report annually to the tax

authorities in the country where the owner lives how much money is held and how

much interest it has earned. But in some countries the bank will instead deduct

a ‘withholding tax’ from any interest earned. That will start at 15 per cent but

will rise in two steps to 35 per cent in six years time. It can be offset

against any UK tax due. Alternatively, even in these countries you will be able

to choose to have the information passed on to HMRC instead of paying the

withholding tax. The countries with a withholding tax include Jersey, Guernsey,

and Switzerland. In most other EU countries, information will automatically be

passed to HMRC here. Find out more at

www.hmrc.gov.uk/esd

October 2005

All material on these pages is © Paul Lewis 2005